Bringing forest carbon projects to the market

Bringing forest carbon projects to the market

Bringing forest carbon projects to the market

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

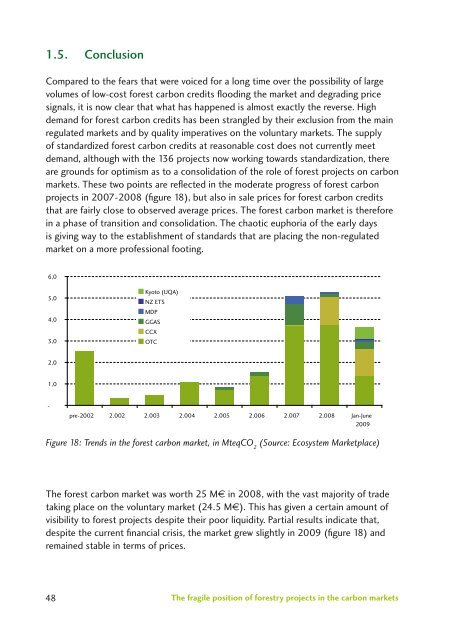

1.5. ConclusionCompared <strong>to</strong> <strong>the</strong> fears that were voiced for a long time over <strong>the</strong> possibility of largevolumes of low-cost <strong>forest</strong> <strong>carbon</strong> credits flooding <strong>the</strong> <strong>market</strong> and degrading pricesignals, it is now clear that what has happened is almost exactly <strong>the</strong> reverse. Highdemand for <strong>forest</strong> <strong>carbon</strong> credits has been strangled by <strong>the</strong>ir exclusion from <strong>the</strong> mainregulated <strong>market</strong>s and by quality imperatives on <strong>the</strong> voluntary <strong>market</strong>s. The supplyof standardized <strong>forest</strong> <strong>carbon</strong> credits at reasonable cost does not currently meetdemand, although with <strong>the</strong> 136 <strong>projects</strong> now working <strong>to</strong>wards standardization, <strong>the</strong>reare grounds for optimism as <strong>to</strong> a consolidation of <strong>the</strong> role of <strong>forest</strong> <strong>projects</strong> on <strong>carbon</strong><strong>market</strong>s. These two points are reflected in <strong>the</strong> moderate progress of <strong>forest</strong> <strong>carbon</strong><strong>projects</strong> in 2007-2008 (figure 18), but also in sale prices for <strong>forest</strong> <strong>carbon</strong> creditsthat are fairly close <strong>to</strong> observed average prices. The <strong>forest</strong> <strong>carbon</strong> <strong>market</strong> is <strong>the</strong>reforein a phase of transition and consolidation. The chaotic euphoria of <strong>the</strong> early daysis giving way <strong>to</strong> <strong>the</strong> establishment of standards that are placing <strong>the</strong> non-regulated<strong>market</strong> on a more professional footing.6,05,04,03,0Kyo<strong>to</strong> (UQA)NZ ETSMDPGGASCCXOTC2,01,0-pre-2002 2.002 2.003 2.004 2.005 2.006 2.007 2.008 Jan-June2009Figure 18: Trends in <strong>the</strong> <strong>forest</strong> <strong>carbon</strong> <strong>market</strong>, in MteqCO 2(Source: Ecosystem Marketplace)The <strong>forest</strong> <strong>carbon</strong> <strong>market</strong> was worth 25 M€ in 2008, with <strong>the</strong> vast majority of tradetaking place on <strong>the</strong> voluntary <strong>market</strong> (24.5 M€). This has given a certain amount ofvisibility <strong>to</strong> <strong>forest</strong> <strong>projects</strong> despite <strong>the</strong>ir poor liquidity. Partial results indicate that,despite <strong>the</strong> current financial crisis, <strong>the</strong> <strong>market</strong> grew slightly in 2009 (figure 18) andremained stable in terms of prices.48The fragile position of <strong>forest</strong>ry <strong>projects</strong> in <strong>the</strong> <strong>carbon</strong> <strong>market</strong>s