lis 217 stemming the tide - LISC

lis 217 stemming the tide - LISC

lis 217 stemming the tide - LISC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

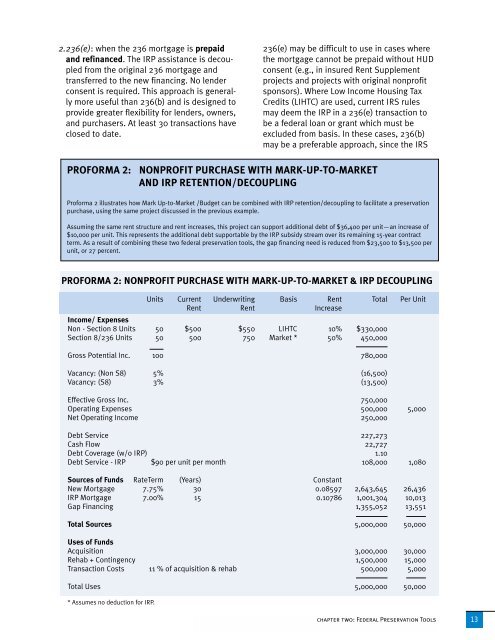

2.236(e): when <strong>the</strong> 236 mortgage is prepaidand refinanced. The IRP assistance is decoupledfrom <strong>the</strong> original 236 mortgage andtransferred to <strong>the</strong> new financing. No lenderconsent is required. This approach is generallymore useful than 236(b) and is designed toprovide greater flexibility for lenders, owners,and purchasers. At least 30 transactions haveclosed to date.236(e) may be difficult to use in cases where<strong>the</strong> mortgage cannot be prepaid without HUDconsent (e.g., in insured Rent Supplementprojects and projects with original nonprofitsponsors). Where Low Income Housing TaxCredits (LIHTC) are used, current IRS rulesmay deem <strong>the</strong> IRP in a 236(e) transaction tobe a federal loan or grant which must beexcluded from basis. In <strong>the</strong>se cases, 236(b)may be a preferable approach, since <strong>the</strong> IRSPROFORMA 2: NONPROFIT PURCHASE WITH MARK-UP-TO-MARKETAND IRP RETENTION/DECOUPLINGProforma 2 illustrates how Mark Up-to-Market /Budget can be combined with IRP retention/decoupling to facilitate a preservationpurchase, using <strong>the</strong> same project discussed in <strong>the</strong> previous example.Assuming <strong>the</strong> same rent structure and rent increases, this project can support additional debt of $36,400 per unit—an increase of$10,000 per unit. This represents <strong>the</strong> additional debt supportable by <strong>the</strong> IRP subsidy stream over its remaining 15-year contractterm. As a result of combining <strong>the</strong>se two federal preservation tools, <strong>the</strong> gap financing need is reduced from $23,500 to $13,500 perunit, or 27 percent.PROFORMA 2: NONPROFIT PURCHASE WITH MARK-UP-TO-MARKET & IRP DECOUPLINGUnits Current Underwriting Basis Rent Total Per UnitRent Rent IncreaseIncome/ ExpensesNon - Section 8 Units 50 $500 $550 LIHTC10% $330,000Section 8/236 Units 50 500 750 Market * 50% 450,000Gross Potential Inc. 100 780,000Vacancy: (Non S8) 5% (16,500)Vacancy: (S8) 3% (13,500)Effective Gross Inc. 750,000Operating Expenses 500,000 5,000Net Operating Income 250,000Debt Service 227,273Cash Flow 22,727Debt Coverage (w/o IRP) 1.10Debt Service - IRP $90 per unit per month 108,000 1,080Sources of Funds RateTerm (Years) ConstantNew Mortgage 7.75% 30 0.08597 2,643,645 26,436IRP Mortgage 7.00% 15 0.10786 1,001,304 10,013Gap Financing 1,355,052 13,551Total Sources 5,000,000 50,000Uses ofFundsAcquisition 3,000,000 30,000Rehab + Contingency 1,500,000 15,000Transaction Costs 11 % of acquisition & rehab 500,000 5,000Total Uses 5,000,000 50,000* Assumes no deduction for IRP.13chapter two: Federal Preservation Tools 13