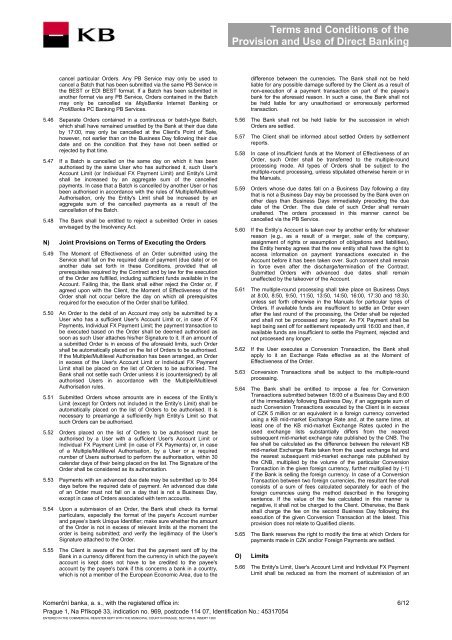

Terms and Conditions of the Provision and Use of ... - Komerční banka

Terms and Conditions of the Provision and Use of ... - Komerční banka

Terms and Conditions of the Provision and Use of ... - Komerční banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Terms</strong> <strong>and</strong> <strong>Conditions</strong> <strong>of</strong> <strong>the</strong><strong>Provision</strong> <strong>and</strong> <strong>Use</strong> <strong>of</strong> Direct Bankingcancel particular Orders. Any PB Service may only be used tocancel a Batch that has been submitted via <strong>the</strong> same PB Service in<strong>the</strong> BEST or EDI BEST format. If a Batch has been submitted inano<strong>the</strong>r format via any PB Service, Orders contained in <strong>the</strong> Batchmay only be cancelled via MojeBanka Internet Banking orPr<strong>of</strong>iBanka PC Banking PB Services.5.46 Separate Orders contained in a continuous or batch-type Batch,which shall have remained unsettled by <strong>the</strong> Bank at <strong>the</strong>ir due dateby 17:00, may only be cancelled at <strong>the</strong> Client's Point <strong>of</strong> Sale,however, not earlier than on <strong>the</strong> Business Day following <strong>the</strong>ir duedate <strong>and</strong> on <strong>the</strong> condition that <strong>the</strong>y have not been settled orrejected by that time.5.47 If a Batch is cancelled on <strong>the</strong> same day on which it has beenauthorised by <strong>the</strong> same <strong>Use</strong>r who has authorised it, such <strong>Use</strong>r'sAccount Limit (or Individual FX Payment Limit) <strong>and</strong> Entity's Limitshall be increased by an aggregate sum <strong>of</strong> <strong>the</strong> cancelledpayments. In case that a Batch is cancelled by ano<strong>the</strong>r <strong>Use</strong>r or hasbeen authorised in accordance with <strong>the</strong> rules <strong>of</strong> Multiple/MultilevelAuthorisation, only <strong>the</strong> Entity's Limit shall be increased by anaggregate sum <strong>of</strong> <strong>the</strong> cancelled payments as a result <strong>of</strong> <strong>the</strong>cancellation <strong>of</strong> <strong>the</strong> Batch.5.48 The Bank shall be entitled to reject a submitted Order in casesenvisaged by <strong>the</strong> Insolvency Act.N) Joint <strong>Provision</strong>s on <strong>Terms</strong> <strong>of</strong> Executing <strong>the</strong> Orders5.49 The Moment <strong>of</strong> Effectiveness <strong>of</strong> an Order submitted using <strong>the</strong>Service shall fall on <strong>the</strong> required date <strong>of</strong> payment (due date) or onano<strong>the</strong>r date set forth in <strong>the</strong>se <strong>Conditions</strong>, provided that allprerequisites required by <strong>the</strong> Contract <strong>and</strong> by law for <strong>the</strong> execution<strong>of</strong> <strong>the</strong> Order are fulfilled, including sufficient funds available in <strong>the</strong>Account. Failing this, <strong>the</strong> Bank shall ei<strong>the</strong>r reject <strong>the</strong> Order or, ifagreed upon with <strong>the</strong> Client, <strong>the</strong> Moment <strong>of</strong> Effectiveness <strong>of</strong> <strong>the</strong>Order shall not occur before <strong>the</strong> day on which all prerequisitesrequired for <strong>the</strong> execution <strong>of</strong> <strong>the</strong> Order shall be fulfilled.5.50 An Order to <strong>the</strong> debit <strong>of</strong> an Account may only be submitted by a<strong>Use</strong>r who has a sufficient <strong>Use</strong>r's Account Limit or, in case <strong>of</strong> FXPayments, Individual FX Payment Limit; <strong>the</strong> payment transaction tobe executed based on <strong>the</strong> Order shall be deemed authorised assoon as such <strong>Use</strong>r attaches his/her Signature to it. If an amount <strong>of</strong>a submitted Order is in excess <strong>of</strong> <strong>the</strong> aforesaid limits, such Ordershall be automatically placed on <strong>the</strong> list <strong>of</strong> Orders to be authorised.If <strong>the</strong> Multiple/Multilevel Authorisation has been arranged, an Orderin excess <strong>of</strong> <strong>the</strong> <strong>Use</strong>r's Account Limit or Individual FX PaymentLimit shall be placed on <strong>the</strong> list <strong>of</strong> Orders to be authorised. TheBank shall not settle such Order unless it is (countersigned) by allauthorised <strong>Use</strong>rs in accordance with <strong>the</strong> Multiple/MultilevelAuthorisation rules.5.51 Submitted Orders whose amounts are in excess <strong>of</strong> <strong>the</strong> Entity’sLimit (except for Orders not included in <strong>the</strong> Entity’s Limit) shall beautomatically placed on <strong>the</strong> list <strong>of</strong> Orders to be authorised. It isnecessary to prearrange a sufficiently high Entity’s Limit so thatsuch Orders can be authorised.5.52 Orders placed on <strong>the</strong> list <strong>of</strong> Orders to be authorised must beauthorised by a <strong>Use</strong>r with a sufficient <strong>Use</strong>r's Account Limit orIndividual FX Payment Limit (in case <strong>of</strong> FX Payments) or, in case<strong>of</strong> a Multiple/Multilevel Authorisation, by a <strong>Use</strong>r or a requirednumber <strong>of</strong> <strong>Use</strong>rs authorised to perform <strong>the</strong> authorisation, within 30calendar days <strong>of</strong> <strong>the</strong>ir being placed on <strong>the</strong> list. The Signature <strong>of</strong> <strong>the</strong>Order shall be considered as its authorisation.5.53 Payments with an advanced due date may be submitted up to 364days before <strong>the</strong> required date <strong>of</strong> payment. An advanced due date<strong>of</strong> an Order must not fall on a day that is not a Business Day,except in case <strong>of</strong> Orders associated with term accounts.5.54 Upon a submission <strong>of</strong> an Order, <strong>the</strong> Bank shall check its formalparticulars, especially <strong>the</strong> format <strong>of</strong> <strong>the</strong> payer's Account number<strong>and</strong> payee’s bank Unique Identifier; make sure whe<strong>the</strong>r <strong>the</strong> amount<strong>of</strong> <strong>the</strong> Order is not in excess <strong>of</strong> relevant limits at <strong>the</strong> moment <strong>the</strong>order is being submitted; <strong>and</strong> verify <strong>the</strong> legitimacy <strong>of</strong> <strong>the</strong> <strong>Use</strong>r’sSignature attached to <strong>the</strong> Order.5.55 The Client is aware <strong>of</strong> <strong>the</strong> fact that <strong>the</strong> payment sent <strong>of</strong>f by <strong>the</strong>Bank in a currency different from <strong>the</strong> currency in which <strong>the</strong> payee'saccount is kept does not have to be credited to <strong>the</strong> payee'saccount by <strong>the</strong> payee's bank if this concerns a bank in a country,which is not a member <strong>of</strong> <strong>the</strong> European Economic Area, due to <strong>the</strong>difference between <strong>the</strong> currencies. The Bank shall not be heldliable for any possible damage suffered by <strong>the</strong> Client as a result <strong>of</strong>non-execution <strong>of</strong> a payment transaction on part <strong>of</strong> <strong>the</strong> payee’sbank for <strong>the</strong> aforesaid reason. In such a case, <strong>the</strong> Bank shall notbe held liable for any unauthorised or erroneously performedtransaction.5.56 The Bank shall not be held liable for <strong>the</strong> succession in whichOrders are settled.5.57 The Client shall be informed about settled Orders by settlementreports.5.58 In case <strong>of</strong> insufficient funds at <strong>the</strong> Moment <strong>of</strong> Effectiveness <strong>of</strong> anOrder, such Order shall be transferred to <strong>the</strong> multiple-roundprocessing mode. All types <strong>of</strong> Orders shall be subject to <strong>the</strong>multiple-round processing, unless stipulated o<strong>the</strong>rwise herein or in<strong>the</strong> Manuals.5.59 Orders whose due dates fall on a Business Day following a daythat is not a Business Day may be processed by <strong>the</strong> Bank even ono<strong>the</strong>r days than Business Days immediately preceding <strong>the</strong> duedate <strong>of</strong> <strong>the</strong> Order. The due date <strong>of</strong> such Order shall remainunaltered. The orders processed in this manner cannot becancelled via <strong>the</strong> PB Service.5.60 If <strong>the</strong> Entity’s Account is taken over by ano<strong>the</strong>r entity for whateverreason (e.g., as a result <strong>of</strong> a merger, sale <strong>of</strong> <strong>the</strong> company,assignment <strong>of</strong> rights or assumption <strong>of</strong> obligations <strong>and</strong> liabilities),<strong>the</strong> Entity hereby agrees that <strong>the</strong> new entity shall have <strong>the</strong> right toaccess information on payment transactions executed in <strong>the</strong>Account before it has been taken over. Such consent shall remainin force even after <strong>the</strong> discharge/termination <strong>of</strong> <strong>the</strong> Contract.Submitted Orders with advanced due dates shall remainunaffected by <strong>the</strong> takeover <strong>of</strong> <strong>the</strong> Account.5.61 The multiple-round processing shall take place on Business Daysat 8:00, 8:50, 9:50, 11:50, 13:50, 14:50, 16:00, 17:30 <strong>and</strong> 18:30,unless set forth o<strong>the</strong>rwise in <strong>the</strong> Manuals for particular types <strong>of</strong>Orders. If available funds are insufficient to settle an Order evenafter <strong>the</strong> last round <strong>of</strong> <strong>the</strong> processing, <strong>the</strong> Order shall be rejected<strong>and</strong> shall not be processed any longer. An FX Payment shall bekept being sent <strong>of</strong>f for settlement repeatedly until 16:00 <strong>and</strong> <strong>the</strong>n, ifavailable funds are insufficient to settle <strong>the</strong> Payment, rejected <strong>and</strong>not processed any longer.5.62 If <strong>the</strong> <strong>Use</strong>r executes a Conversion Transaction, <strong>the</strong> Bank shallapply to it an Exchange Rate effective as at <strong>the</strong> Moment <strong>of</strong>Effectiveness <strong>of</strong> <strong>the</strong> Order.5.63 Conversion Transactions shall be subject to <strong>the</strong> multiple-roundprocessing.5.64 The Bank shall be entitled to impose a fee for ConversionTransactions submitted between 18:00 <strong>of</strong> a Business Day <strong>and</strong> 8:00<strong>of</strong> <strong>the</strong> immediately following Business Day, if an aggregate sum <strong>of</strong>such Conversion Transactions executed by <strong>the</strong> Client is in excess<strong>of</strong> CZK 5 million or an equivalent in a foreign currency convertedusing a KB mid-market Exchange Rate <strong>and</strong>, at <strong>the</strong> same time, atleast one <strong>of</strong> <strong>the</strong> KB mid-market Exchange Rates quoted in <strong>the</strong>used exchange lists substantially differs from <strong>the</strong> nearestsubsequent mid-market exchange rate published by <strong>the</strong> CNB. Thefee shall be calculated as <strong>the</strong> difference between <strong>the</strong> relevant KBmid-market Exchange Rate taken from <strong>the</strong> used exchange list <strong>and</strong><strong>the</strong> nearest subsequent mid-market exchange rate published by<strong>the</strong> CNB, multiplied by <strong>the</strong> volume <strong>of</strong> <strong>the</strong> particular ConversionTransaction in <strong>the</strong> given foreign currency, fur<strong>the</strong>r multiplied by (-1)if <strong>the</strong> Bank is selling <strong>the</strong> foreign currency. In case <strong>of</strong> a ConversionTransaction between two foreign currencies, <strong>the</strong> resultant fee shallconsists <strong>of</strong> a sum <strong>of</strong> fees calculated separately for each <strong>of</strong> <strong>the</strong>foreign currencies using <strong>the</strong> method described in <strong>the</strong> foregoingsentence. If <strong>the</strong> value <strong>of</strong> <strong>the</strong> fee calculated in this manner isnegative, it shall not be charged to <strong>the</strong> Client. O<strong>the</strong>rwise, <strong>the</strong> Bankshall charge <strong>the</strong> fee on <strong>the</strong> second Business Day following <strong>the</strong>execution <strong>of</strong> <strong>the</strong> given Conversion Transaction at <strong>the</strong> latest. Thisprovision does not relate to Qualified clients.5.65 The Bank reserves <strong>the</strong> right to modify <strong>the</strong> time at which Orders forpayments made in CZK <strong>and</strong>/or Foreign Payments are settled.O) Limits5.66 The Entity's Limit, <strong>Use</strong>r's Account Limit <strong>and</strong> Individual FX PaymentLimit shall be reduced as from <strong>the</strong> moment <strong>of</strong> submission <strong>of</strong> an<strong>Komerční</strong> <strong>banka</strong>, a. s., with <strong>the</strong> registered <strong>of</strong>fice in:Prague 1, Na Příkopě 33, indication no. 969, postcode 114 07, Identification No.: 45317054ENTERED IN THE COMMERCIAL REGISTER KEPT WITH THE MUNICIPAL COURT IN PRAGUE, SECTION B, INSERT 13606/12