UPHS_Enrollment_Flipbook_Print_Version

UPHS_Enrollment_Flipbook_Print_Version

UPHS_Enrollment_Flipbook_Print_Version

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

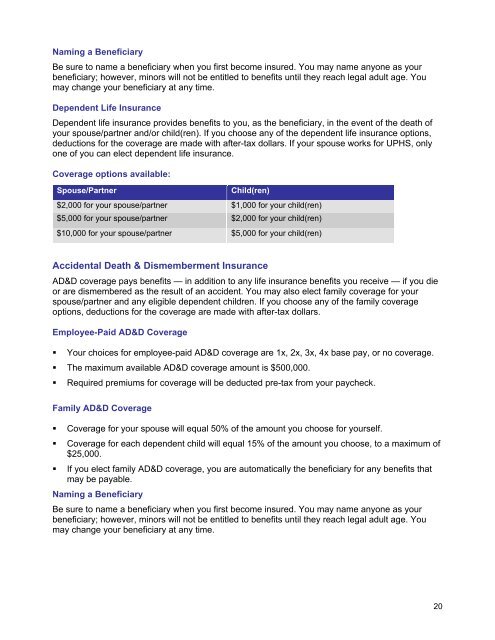

Naming a BeneficiaryBe sure to name a beneficiary when you first become insured. You may name anyone as yourbeneficiary; however, minors will not be entitled to benefits until they reach legal adult age. Youmay change your beneficiary at any time.Dependent Life InsuranceDependent life insurance provides benefits to you, as the beneficiary, in the event of the death ofyour spouse/partner and/or child(ren). If you choose any of the dependent life insurance options,deductions for the coverage are made with after-tax dollars. If your spouse works for <strong>UPHS</strong>, onlyone of you can elect dependent life insurance.Coverage options available:Spouse/PartnerChild(ren)$2,000 for your spouse/partner $1,000 for your child(ren)$5,000 for your spouse/partner $2,000 for your child(ren)$10,000 for your spouse/partner $5,000 for your child(ren)Accidental Death & Dismemberment InsuranceAD&D coverage pays benefits — in addition to any life insurance benefits you receive — if you dieor are dismembered as the result of an accident. You may also elect family coverage for yourspouse/partner and any eligible dependent children. If you choose any of the family coverageoptions, deductions for the coverage are made with after-tax dollars.Employee-Paid AD&D Coverage• Your choices for employee-paid AD&D coverage are 1x, 2x, 3x, 4x base pay, or no coverage.• The maximum available AD&D coverage amount is $500,000.• Required premiums for coverage will be deducted pre-tax from your paycheck.Family AD&D Coverage• Coverage for your spouse will equal 50% of the amount you choose for yourself.• Coverage for each dependent child will equal 15% of the amount you choose, to a maximum of$25,000.• If you elect family AD&D coverage, you are automatically the beneficiary for any benefits thatmay be payable.Naming a BeneficiaryBe sure to name a beneficiary when you first become insured. You may name anyone as yourbeneficiary; however, minors will not be entitled to benefits until they reach legal adult age. Youmay change your beneficiary at any time.20