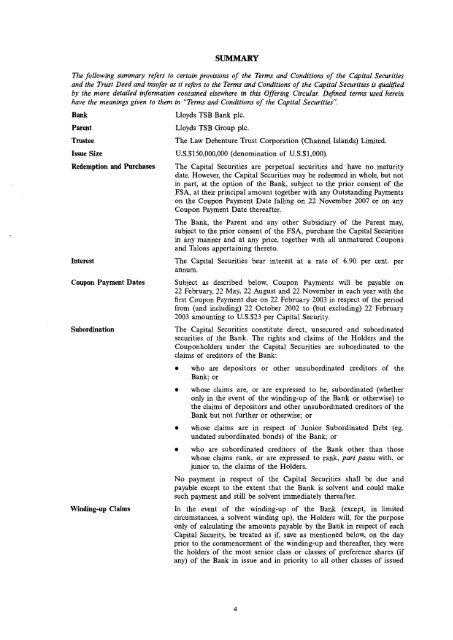

SUMMARYThe following summary refers to certain provisions of the Terms and Conditions of the Capital Securitiesand the Trust Deed and insofar as it refers to the Terms and Conditions of the Capital Securities is qualifiedby the more detailed information contained elsewhere in this Offering Circular. Defined terms used hereinhave the meanings given to them in "Terms and Conditions of the Capital Securities".<strong>Bank</strong>ParentTrusteeIssue SizeRedemption and Purchases<strong>Lloyds</strong> <strong>TSB</strong> <strong>Bank</strong> <strong>plc</strong>.<strong>Lloyds</strong> <strong>TSB</strong> Group <strong>plc</strong>.The Law Debenture Trust Corporation (Channel Islands) Limited.U.S.$150,000,000 (denomination of U.S.$1,000).The Capital Securities are perpetual securities and have no maturitydate. However, the Capital Securities may be redeemed in whole, but notin part, at the option of the <strong>Bank</strong>, subject to the prior consent of theFSA, at their principal amount together with any Outstanding Paymentson the Coupon Payment Date falling on 22 November 2007 or on anyCoupon Payment Date thereafter.The <strong>Bank</strong>, the Parent and any other Subsidiary of the Parent may,subject to the prior consent of the FSA, purchase the Capital Securitiesin any manner and at any price, together with all unmatured Couponsand Talons appertaining thereto.InterestThe Capital Securities bear interest at a rate of 6.90 per cent. perannum.Coupon Payment Dates Subject as described below, Coupon Payments will be payable on22 February, 22 May, 22 August and 22 November in each year with thefirst Coupon Payment due on 22 February 2003 in respect of the periodfrom (and including) 22 October 2002 to (but excluding) 22 February2003 amounting to U.S.$23 per Capital Security.Subordination The Capital Securities constitute direct, unsecured and subordinatedsecurities of the <strong>Bank</strong>. The rights and claims of the Holders and theCouponholders under the Capital Securities are subordinated to theclaims of creditors of the <strong>Bank</strong>:• who are depositors or other unsubordinated creditors of the<strong>Bank</strong>; or• whose claims are, or are expressed to be, subordinated (whetheronly in the event of the winding-up of the <strong>Bank</strong> or otherwise) tothe claims of depositors and other unsubordinated creditors of the<strong>Bank</strong> but not further or otherwise; or• whose claims are in respect of Junior Subordinated Debt (eg.undated subordinated bonds) of the <strong>Bank</strong>; or• who are subordinated creditors of the <strong>Bank</strong> other than thosewhose claims rank, or are expressed to rank, pari passu with, orjunior to, the claims of the Holders.No payment in respect of the Capital Securities shall be due andpayable except to the extent that the <strong>Bank</strong> is solvent and could makesuch payment and still be solvent immediately thereafter.Winding-up Claims In the event of the winding-up of the <strong>Bank</strong> (except, in limitedcircumstances, a solvent winding up), the Holders will, for the purposeonly of calculating the amounts payable by the <strong>Bank</strong> in respect of eachCapital Security, be treated as if, save as mentioned below, on the dayprior to the commencement of the winding-up and thereafter, they werethe holders of the most senior class or classes of preference shares (ifany) of the <strong>Bank</strong> in issue and in priority to all other classes of issued4

shares of the <strong>Bank</strong>. Such class would rank junior to the claims ofSenior Creditors and junior to any notional class of preference shares inthe capital of the <strong>Bank</strong> by reference to which the amount payable inrespect of any Junior Subordinated Debt in the winding-up of the <strong>Bank</strong>is determined. The Holders' claims in a winding-up shall be limited to(other than in the case of a solvent winding up) the principal amount ofthe relevant Capital Securities (and no amounts will be payable inrespect of any Coupon including any Deferred Coupon Payment) or (inthe case of a solvent winding up) the principal amount of the relevantCapital Securities (and amounts accrued and unpaid in respect of anyCoupon including any Deferred Coupon Payment).Deferral of Coupon PaymentsDividend and CapitalRestrictionIf the <strong>Bank</strong>, at its sole discretion, determines on the 20th business dayprior to the date on which any Coupon Payment would, in the absenceof deferral in accordance with Condition 4, be due and payable, that itis, or payment of the relevant Coupon Payment will result in the <strong>Bank</strong>being, in non-compliance with applicable Capital Regulations, the <strong>Bank</strong>may elect to defer such Coupon Payment, subject to the restrictionsdescribed below. Such Deferred Coupon Payment shall be satisfied onlyon the date upon which the Capital Securities are redeemed, but shallnot be paid in any other circumstances. No interest will accrue on aDeferred Coupon Payment.If the <strong>Bank</strong> defers a Payment for any reason as described above then nopayments will be permitted on (and no purchases or redemptions will bepermitted of) the ordinary share capital or directly or indirectly issuedpreference or preferred securities or other issued Tier 1 securities of the<strong>Bank</strong> or the Parent until the <strong>Bank</strong> next makes a Coupon Payment.Alternative Coupon Satisfaction Investors will always receive payments made in respect of the CapitalMechanismSecurities in cash. However, if the <strong>Bank</strong> defers a Coupon Payment, thenany such Deferred Coupon Payment must be satisfied by the <strong>Bank</strong> bythe issue of its ordinary shares. In that event, the Parent will issue itsordinary shares to the Trustee or its agent in exchange for the ordinaryshares so issued by the <strong>Bank</strong>. When sold, the Parent's shares willprovide a cash amount which, when converted into U.S. dollars, thePrincipal Paying Agent, on behalf of the Trustee, will pay to theHolders in respect of the relevant Payment. The Calculation Agent willcalculate in advance the number of ordinary shares of the <strong>Bank</strong> or theParent to be issued in order to enable the Trustee or its agent to raisethe full amount of money due on the relevant payment date to Holders.InsufficiencyMarket Disruption EventSuspensionEach of the <strong>Bank</strong> and the Parent is required to keep available for issueenough ordinary shares as it reasonably considers would be required tosatisfy from time to time any Deferred Coupon Payments and the nextyear's Coupon Payments or Payments using the alternative couponsatisfaction mechanism.If, in the opinion of the <strong>Bank</strong>, a Market Disruption Event in respect ofthe Parent's shares exists on or after the 15th Business Day precedingany date upon which the <strong>Bank</strong> is due to satisfy a payment using thealternative coupon satisfaction mechanism, the payment to Holders maybe deferred until the Market Disruption Event no longer exists.If, following any take-over offer or any reorganisation, restructuring orscheme of arrangement, the Parent or any subsequent New Ownerceases to be the ultimate holding company of the <strong>Lloyds</strong> <strong>TSB</strong> group ofcompanies, the <strong>Bank</strong> shall give notice thereof and any changes to thedocumentation relating to the Capital Securities determined by anindependent investment bank to be appropriate in order to preservesubstantially the economic effect for the Holders of a holding of theCapital Securities prior to the Suspension will be made by the <strong>Bank</strong> andthe Trustee. Pending such changes the <strong>Bank</strong> will be unable to satisfy5