Lloyds TSB Bank plc

Lloyds TSB Bank plc

Lloyds TSB Bank plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

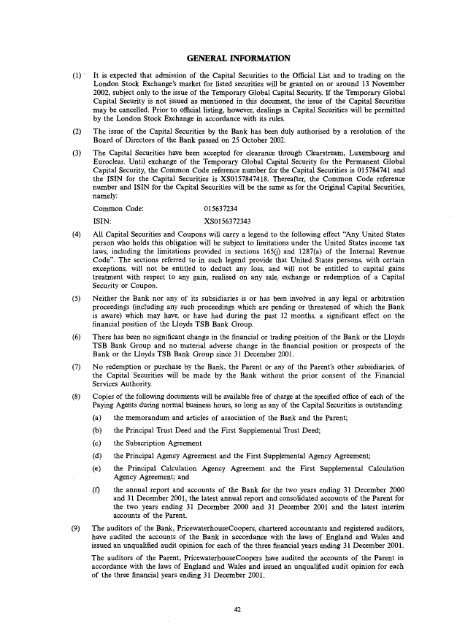

GENERAL INFORMATION(1) It is expected that admission of the Capital Securities to the Official List and to trading on theLondon Stock Exchange's market for listed securities will be granted on or around 13 November2002, subject only to the issue of the Temporary Global Capital Security. If the Temporary GlobalCapital Security is not issued as mentioned in this document, the issue of the Capital Securitiesmay be cancelled. Prior to official listing, however, dealings in Capital Securities will be permittedby the London Stock Exchange in accordance with its rules.(2) The issue of the Capital Securities by the <strong>Bank</strong> has been duly authorised by a resolution of theBoard of Directors of the <strong>Bank</strong> passed on 25 October 2002.(3) The Capital Securities have been accepted for clearance through Clearstream, Luxembourg andEuroclear. Until exchange of the Temporary Global Capital Security for the Permanent GlobalCapital Security, the Common Code reference number for the Capital Securities is 015784741 andthe ISIN for the Capital Securities is XS0157847418. Thereafter, the Common Code referencenumber and ISIN for the Capital Securities will be the same as for the Original Capital Securities,namely:Common Code: 015637234ISIN:XS0156372343(4) All Capital Securities and Coupons will carry a legend to the following effect "Any United Statesperson who holds this obligation will be subject to limitations under the United States income taxlaws, including the limitations provided in sections 165(j) and 1287(a) of the Internal RevenueCode". The sections referred to in such legend provide that United States persons, with certainexceptions, will not be entitled to deduct any loss, and will not be entitled to capital gainstreatment with respect to any gain, realised on any sale, exchange or redemption of a CapitalSecurity or Coupon.(5) Neither the <strong>Bank</strong> nor any of its subsidiaries is or has been involved in any legal or arbitrationproceedings (including any such proceedings which are pending or threatened of which the <strong>Bank</strong>is aware) which may have, or have had during the past 12 months, a significant effect on thefinancial position of the <strong>Lloyds</strong> <strong>TSB</strong> <strong>Bank</strong> Group.(6) There has been no significant change in the financial or trading position of the <strong>Bank</strong> or the <strong>Lloyds</strong><strong>TSB</strong> <strong>Bank</strong> Group and no material adverse change in the financial position or prospects of the<strong>Bank</strong> or the <strong>Lloyds</strong> <strong>TSB</strong> <strong>Bank</strong> Group since 31 December 2001.(7) No redemption or purchase by the <strong>Bank</strong>, the Parent or any of the Parent's other subsidiaries, ofthe Capital Securities will be made by the <strong>Bank</strong> without the prior consent of the FinancialServices Authority.(8) Copies of the following documents will be available free of charge at the specified office of each of thePaying Agents during normal business hours, so long as any of the Capital Securities is outstanding:(a)(b)(c)(d)the memorandum and articles of association of the <strong>Bank</strong> and the Parent;the Principal Trust Deed and the First Supplemental Trust Deed;the Subscription Agreementthe Principal Agency Agreement and the First Supplemental Agency Agreement;(e) the Principal Calculation Agency Agreement and the First Supplemental CalculationAgency Agreement; and(f) the annual report and accounts of the <strong>Bank</strong> for the two years ending 31 December 2000and 31 December 2001, the latest annual report and consolidated accounts of the Parent forthe two years ending 31 December 2000 and 31 December 2001 and the latest interimaccounts of the Parent.(9) The auditors of the <strong>Bank</strong>, PricewaterhouseCoopers, chartered accountants and registered auditors,have audited the accounts of the <strong>Bank</strong> in accordance with the laws of England and Wales andissued an unqualified audit opinion for each of the three financial years ending 31 December 2001.The auditors of the Parent, PricewaterhouseCoopers have audited the accounts of the Parent inaccordance with the laws of England and Wales and issued an unqualified audit opinion for eachof the three financial years ending 31 December 2001.42