M.A.R.C.: an Actuarial Model for Credit Risk - Proceedings ASTIN ...

M.A.R.C.: an Actuarial Model for Credit Risk - Proceedings ASTIN ...

M.A.R.C.: an Actuarial Model for Credit Risk - Proceedings ASTIN ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

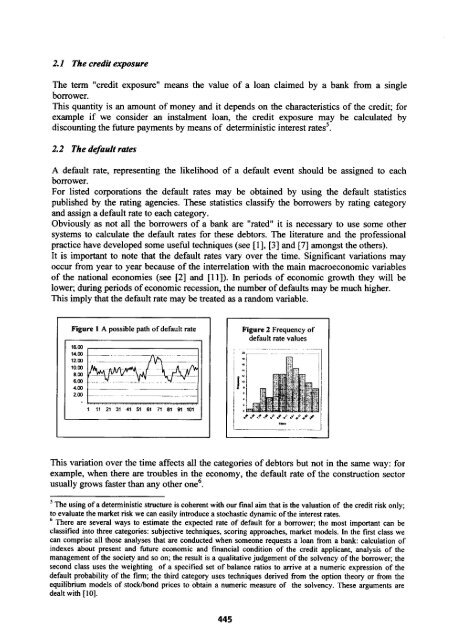

._2.1 The credit exposureThe term "credit exposure" me<strong>an</strong>s the value of a lo<strong>an</strong> claimed by a b<strong>an</strong>k from a singleborrower.This qu<strong>an</strong>tity is <strong>an</strong> amount of money <strong>an</strong>d it depends on the characteristics of the credit; <strong>for</strong>example if we consider <strong>an</strong> instalment lo<strong>an</strong>, the credit exposure may be calculated bydiscounting the future payments by me<strong>an</strong>s of deterministic interest rates5.2.2 The default ratesA default rate, representing the likelihood of a default event should be assigned to eachborrower.For listed corporations the default rates may be obtained by using the default statisticspublished by the rating agencies. These statistics classify the borrowers by rating category<strong>an</strong>d assign a default rate to each category.Obviously as not all the borrowers of a b<strong>an</strong>k are "rated" it is necessary to use some othersystems to calculate the default rates <strong>for</strong> these debtors. The literature <strong>an</strong>d the professionalpractice have developed some useful techniques (see [l], [3] <strong>an</strong>d [7] amongst the others).It is import<strong>an</strong>t to note that the default rates vary over the time. Signific<strong>an</strong>t variations mayoccur from year to year because of the interrelation with the main macroeconomic variablesof the national economies (see [2] <strong>an</strong>d [ll]). In periods of economic growth they will belower; during periods of economic recession, the number of defaults may be much higher.This imply that the default rate may be treated as a r<strong>an</strong>dom variable.Figure 1 A possible path of default rate16 001400 ~~Figure 2 Frequency ofdefault rate values400200 - ~1 11 21 31 41 51 61 71 81 91 101This variation over the time affects all the categories of debtors but not in the same way: <strong>for</strong>example, when there are troubles in the economy, the default rate of the construction sectorusually grows faster th<strong>an</strong> <strong>an</strong>y other one6.The using of a deterministic structure is coherent with our fmal aim that is the valuation of the credit risk only;to evaluate the market risk we c<strong>an</strong> easily introduce a stochastic dynamic of the interest rates.There are several ways to estimate the expected rate of default <strong>for</strong> a borrower; the most import<strong>an</strong>t c<strong>an</strong> beclassified into three categories: subjective techniques, scoring approaches, market models. In the first class wec<strong>an</strong> comprise all those <strong>an</strong>alyses that are conducted when someone requests a lo<strong>an</strong> from a b<strong>an</strong>k: calculation ofindexes about present <strong>an</strong>d fbture economic <strong>an</strong>d fin<strong>an</strong>cial condition of the credit applic<strong>an</strong>t, <strong>an</strong>alysis of them<strong>an</strong>agement of the society <strong>an</strong>d so on; the result is a qualitative judgement of the solvency of the borrower; thesecond class uses the weighting of a specified set of bal<strong>an</strong>ce ratios to m've at a numeric expression of thedefault probability of the firm; the third category uses techniques derived from the option theory or from theequilibrium models of stockhond prices to obtain a numeric measure of the solvency. These arguments aredealt with [lo].445