M.A.R.C.: an Actuarial Model for Credit Risk - Proceedings ASTIN ...

M.A.R.C.: an Actuarial Model for Credit Risk - Proceedings ASTIN ...

M.A.R.C.: an Actuarial Model for Credit Risk - Proceedings ASTIN ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

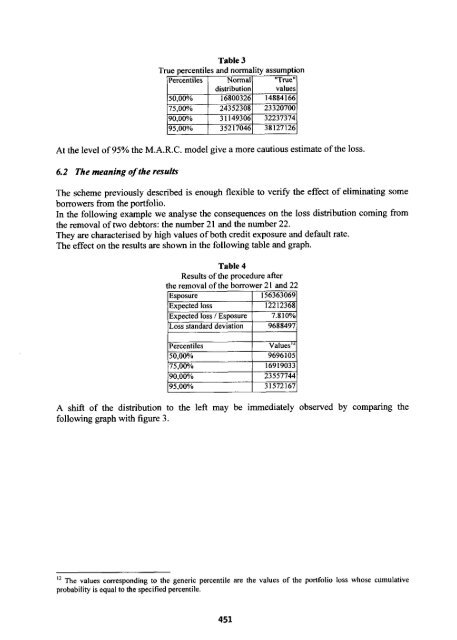

Percentiles Normal "True"distribution values1 - I50,00% I 168003261 1488416675.00% 243523081 23320700I90,00% I 311493061 3223737495.00% 1 352170461 38127126At the level of 95% the M.A.R.C. model give a more cautious estimate of the loss.6.2 The me<strong>an</strong>ing of the resultsThe scheme previously described is enough flexible to verify the effect of eliminating someborrowers from the portfolio.In the following example we <strong>an</strong>alyse the consequences on the loss distribution coming fromthe removal of two debtors: the number 21 <strong>an</strong>d the number 22.They are characterised by high values of both credit exposure <strong>an</strong>d default rate.The effect on the results are shown in the following table <strong>an</strong>d graph.Table 4Results of the procedure afterthe removal of the borrower 2 1 <strong>an</strong>d 22A shifi of the distribution to the left may be immediately observed by comparing thefollowing graph with figure 3.'' The values corresponding to the generic percentile are the values of the portfolio loss whose cumulativeprobability is equal to the specified percentile.451