bank secrecy act / anti-money laundering (bsa/aml) compliance

bank secrecy act / anti-money laundering (bsa/aml) compliance

bank secrecy act / anti-money laundering (bsa/aml) compliance

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

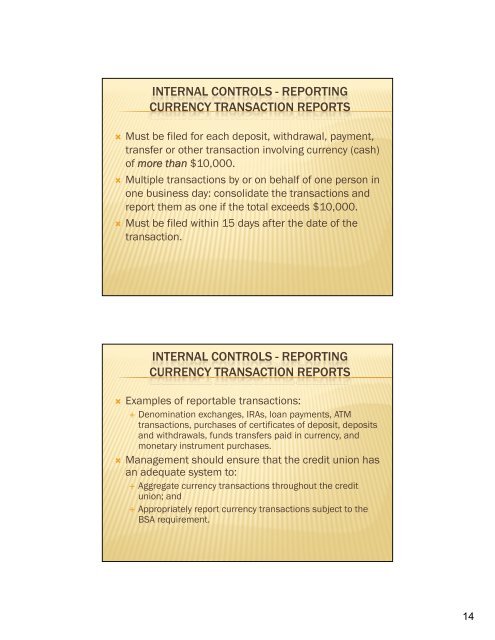

INTERNAL CONTROLS - REPORTINGCURRENCY TRANSACTION REPORTS Must be filed for each deposit, withdrawal, payment,transfer or other trans<strong>act</strong>ion involving currency (cash)of more than $10,000. Multiple trans<strong>act</strong>ions by or on behalf of one person inone business day: consolidate the trans<strong>act</strong>ions andreport them as one if the total exceeds $10,000. Must be filed within 15 days after the date of thetrans<strong>act</strong>ion.INTERNAL CONTROLS - REPORTINGCURRENCY TRANSACTION REPORTS Examples of reportable trans<strong>act</strong>ions: Denomination exchanges, IRAs, loan payments, ATMtrans<strong>act</strong>ions, purchases of certificates of deposit, depositsand withdrawals, funds transfers paid in currency, andmonetary instrument purchases. Management should ensure that the credit union hasan adequate system to: Aggregate g currency trans<strong>act</strong>ions throughout the creditunion; and Appropriately report currency trans<strong>act</strong>ions subject to theBSA requirement.14