bank secrecy act / anti-money laundering (bsa/aml) compliance

bank secrecy act / anti-money laundering (bsa/aml) compliance

bank secrecy act / anti-money laundering (bsa/aml) compliance

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

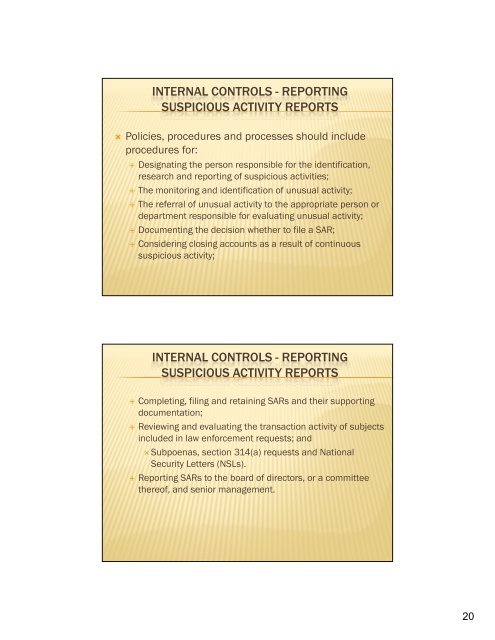

INTERNAL CONTROLS - REPORTINGSUSPICIOUS ACTIVITY REPORTS Policies, procedures and processes should includeprocedures for: Designating the person responsible for the identification,research and reporting of suspicious <strong>act</strong>ivities; The monitoring and identification of unusual <strong>act</strong>ivity; The referral of unusual <strong>act</strong>ivity to the appropriate person ordepartment responsible for evaluating unusual <strong>act</strong>ivity; Documenting the decision whether to file a SAR; Considering closing accounts as a result of continuoussuspicious <strong>act</strong>ivity;INTERNAL CONTROLS - REPORTINGSUSPICIOUS ACTIVITY REPORTS Completing, filing and retaining SARs and their supportingdocumentation; Reviewing and evaluating the trans<strong>act</strong>ion <strong>act</strong>ivity of subjectsincluded in law enforcement requests; and Subpoenas, section 314(a) requests and NationalSecurity Letters (NSLs). Reporting SARs to the board of directors, or a committeethereof, and senior management.20