You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

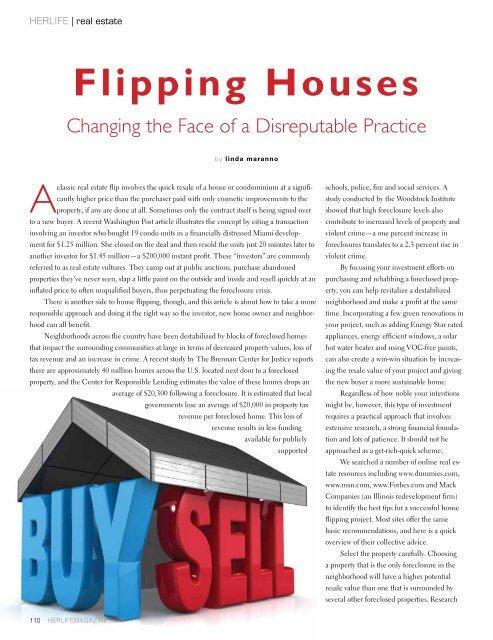

herlife | real estateFlipping HousesChanging the Face of a Disreputable Practiceby linda marannoAclassic real estate flip involves the quick resale of a house or condominium at a significantlyhigher price than the purchaser paid with only cosmetic improvements to theproperty, if any are done at all. Sometimes only the contract itself is being signed overto a new buyer. A recent Washington Post article illustrates the concept by citing a transactioninvolving an investor who bought 19 condo units in a financially distressed Miami developmentfor $1.25 million. She closed on the deal and then resold the units just 20 minutes later toanother investor for $1.45 million—a $200,000 instant profit. These “investors” are commonlyreferred to as real estate vultures. They camp out at public auctions, purchase abandonedproperties they’ve never seen, slap a little paint on the outside and inside and resell quickly at aninflated price to often unqualified buyers, thus perpetuating the foreclosure crisis.There is another side to house flipping, though, and this article is about how to take a moreresponsible approach and doing it the right way so the investor, new home owner and neighborhoodcan all benefit.Neighborhoods across the country have been destabilized by blocks of foreclosed homesthat impact the surrounding communities at large in terms of decreased property values, loss oftax revenue and an increase in crime. A recent study by The Brennan Center for Justice reportsthere are approximately 40 million homes across the U.S. located next door to a foreclosedproperty, and the Center for Responsible Lending estimates the value of these homes drops anaverage of $20,300 following a foreclosure. It is estimated that localgovernments lose an average of $20,000 in property taxrevenue per foreclosed home. This loss ofrevenue results in less fundingavailable for publiclysupportedschools, police, fire and social services. Astudy conducted by the Woodstock Instituteshowed that high foreclosure levels alsocontribute to increased levels of property andviolent crime—a one percent increase inforeclosures translates to a 2.3 percent rise inviolent crime.By focusing your investment efforts onpurchasing and rehabbing a foreclosed property,you can help revitalize a destabilizedneighborhood and make a profit at the sametime. Incorporating a few green renovations inyour project, such as adding Energy Star ratedappliances, energy efficient windows, a solarhot water heater and using VOC-free paints,can also create a win-win situation by increasingthe resale value of your project and givingthe new buyer a more sustainable home.Regardless of how noble your intentionsmight be, however, this type of investmentrequires a practical approach that involvesextensive research, a strong financial foundationand lots of patience. It should not beapproached as a get-rich-quick scheme.We searched a number of online real estateresources including www.dummies.com,www.msn.com, www.Forbes.com and MackCompanies (an Illinois redevelopment firm)to identify the best tips for a successful houseflipping project. Most sites offer the samebasic recommendations, and here is a quickoverview of their collective advice.Select the property carefully. Choosinga property that is the only foreclosure in theneighborhood will have a higher potentialresale value than one that is surrounded byseveral other foreclosed properties. Research110 <strong>HERLIFE</strong>MAGAZINE.COM