Emaar Sukuk Ltd XS0586840588 - London Stock Exchange

Emaar Sukuk Ltd XS0586840588 - London Stock Exchange

Emaar Sukuk Ltd XS0586840588 - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

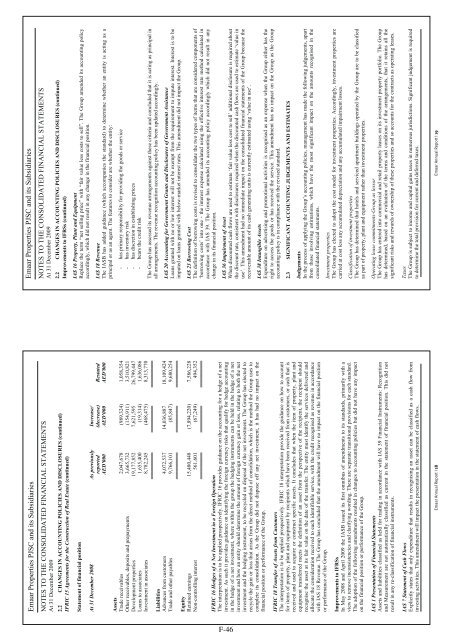

<strong>Emaar</strong> Properties PJSC and its SubsidiariesNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 20092.2 CHANGES IN ACCOUNTING POLICIES AND DISCLOSURES (continued)IFRIC 15 Agreements for the Construction of Real Estate (continued)Statement of financial positionAt 31 December 2008 As previously Increase/reported (decrease) RestatedAED'000 AED'000 AED'000AssetsTrade receivables 2,047,678 (989,324) 1,058,354Other receivables, deposits and prepayments 3,665,732 (154,911) 3,510,821Development properties 19,177,852 7,621,595 26,799,447Loans to associates 1,655,400 (19,314) 1,636,086Investment in associates 8,782,245 (468,475) 8,313,770 LiabilitiesAdvances from customers 4,072,537 14,036,887 18,109,424Trade and other payables 9,766,101 (85,847) 9,680,254 EquityRetained earnings 15,480,448 (7,894,220) 7,586,228Non-controlling interest 561,601 (67,249) 494,352 IFRIC 16 Hedges of a Net Investment in a Foreign OperationThe interpretation is to be applied prospectively. IFRIC 16 provides guidance on the accounting for a hedge of a netinvestment. As such it provides guidance on identifying the foreign currency risks that qualify for hedge accountingin the hedge of a net investment, where within the group the hedging instruments can be held in the hedge of a netinvestment and how an entity should determine the amount of foreign currency gain or loss, relating to both the netinvestment and the hedging instrument, to be recycled on disposal of the net investment. The Group has elected torecycle the gain or loss that arises from the direct method of consolidation, which is the method the Group uses tocomplete its consolidation. As the Group did not dispose off any net investment, it has had no impact on thefinancial position or performance of the Group.IFRIC 18 Transfer of Assets from CustomersThe interpretation is to be applied prospectively. IFRIC 18 interpretation provide the guidance on how to accountfor items of property, plant and equipment by recipients which have been received from customers, or cash that isreceived and used to acquire or construct specific assets. It concludes that when the item of property, plant andequipment transferred meets the definition of an asset from the perspective of the recipient, the recipient shouldrecognise the asset at its fair value on the date of the transfer. The entity must identify the services delivered andallocate the consideration received to each identifiable service, with the credit recognised as revenue in accordancewith IAS 18 Revenue. The Group has concluded that the amendment will have no impact on the financial positionor performance of the Group.Improvements to IFRSsIn May 2008 and April 2009 the IASB issued its first omnibus of amendments to its standards, primarily with aview to remove inconsistencies and clarifying wording. There are separate transitional provisions for each standard.The adoption of the following amendments resulted in changes to accounting policies but did not have any impacton the financial position or performance of the Group.<strong>Emaar</strong> Properties PJSC and its SubsidiariesNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 20092.2 CHANGES IN ACCOUNTING POLICIES AND DISCLOSURES (continued)Improvements to IFRSs (continued)IAS 16 Property, Plant and EquipmentReplace the term “net selling price” with “fair value less costs to sell”. The Group amended its accounting policyaccordingly, which did not result in any change in the financial position.IAS 18 RevenueThe IASB has added guidance (which accompanies the standard) to determine whether an entity is acting as aprincipal or as an agent. The features to consider are whether the entity:- has primary responsibility for providing the goods or service- has inventory risk- has discretion in establishing prices- bears the credit riskThe Group has assessed its revenue arrangements against these criteria and concluded that it is acting as principal inall arrangements. The revenue recognition accounting policy has been updated accordingly.IAS 20 Accounting for Government Grants and Disclosures of Government AssistanceLoans granted with no or low interest will not be exempt from the requirement to impute interest. Interest is to beimputed on loans granted with below-market interest rates. This amendment did not impact the Group.IAS 23 Borrowing CostThe definition of borrowing costs is revised to consolidate the two types of items that are considered components of‘borrowing costs’ into one - the interest expense calculated using the effective interest rate method calculated inaccordance with IAS 39. The Group has amended its accounting policy accordingly which did not result in anychange in its financial position.IAS 36 Impairment of AssetWhen discounted cash flows are used to estimate ‘fair value less cost to sell’ additional disclosure is required aboutthe discount rate, consistent with disclosures required when the discounted cash flows are used to estimate ‘value inuse’. This amendment had no immediate impact on the consolidated financial statements of the Group because therecoverable amount of its cash generating units is currently estimated using ‘value in use’.IAS 38 Intangible AssetsExpenditure on advertising and promotional activities is recognised as an expense when the Group either has theright to access the goods or has received the service. This amendment has no impact on the Group as the Groupaccounting policy is in compliance with the revised standard.2.3 SIGNIFICANT ACCOUNTING JUDGEMENTS AND ESTIMATESJudgementsIn the process of applying the Group’s accounting policies, management has made the following judgements, apartfrom those involving estimations, which have the most significant impact on the amounts recognised in theconsolidated financial statements.Investment propertiesThe Group has elected to adopt the cost model for investment properties. Accordingly, investment properties arecarried at cost less any accumulated depreciation and any accumulated impairment losses.Classification of investment propertiesThe Group has determined that hotels and serviced apartment buildings operated by the Group are to be classifiedas part of property, plant and equipment rather than investment properties.IAS 1 Presentation of Financial StatementsAssets and liabilities classified as held for trading in accordance with IAS 39 Financial Instruments: Recognitionand Measurement are not automatically classified as current in the statement of financial position. This did notresult in any re-classification of financial instruments.Operating lease commitments-Group as lessorThe Group has entered into commercial and retail property leases on its investment property portfolio. The Grouphas determined, based on an evaluation of the terms and conditions of the arrangements, that it retains all thesignificant risks and rewards of ownership of these properties and so accounts for the contracts as operating leases.IAS 7 Statement of Cash FlowsExplicitly states that only expenditure that results in recognising an asset can be classified as a cash flow frominvesting activities. This amendment will impact the presentation in the statement of cash flows.TaxesThe Group is subject to income and capital gains taxes in numerous jurisdictions. Significant judgement is requiredto determine the total provision for current and deferred taxes.<strong>Emaar</strong> Annual Report I 18 <strong>Emaar</strong> Annual Report I 19F-46