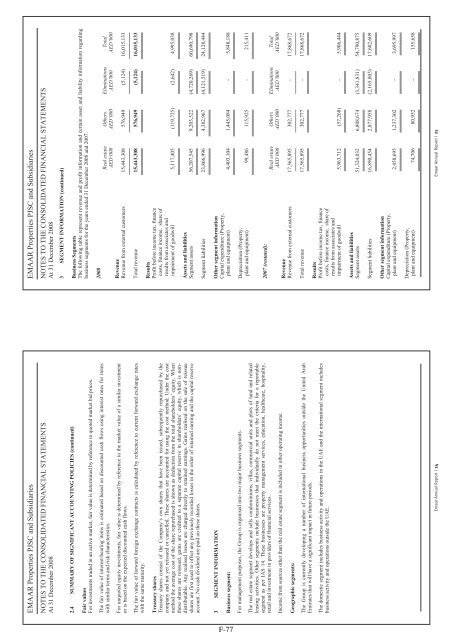

EMAAR Properties PJSC and SubsidiariesEMAAR Properties PJSC and SubsidiariesNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2008NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 20083 SEGMENT INFORMATION (continued)2.4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)Fair valuesFor investments traded in an active market, fair value is determined by reference to quoted market bid prices.The fair value of interest-bearing items is estimated based on discounted cash flows using interest rates for itemswith similar terms and risk characteristics.For unquoted equity investments, fair value is determined by reference to the market value of a similar investmentor is based on the expected discounted cash flows.The fair value of forward foreign exchange contracts is calculated by reference to current forward exchange rateswith the same maturity.Treasury sharesTreasury shares consist of the Company’s own shares that have been issued, subsequently repurchased by thecompany and not yet reissued or cancelled. These shares are accounted for using the cost method. Under the costmethod the average cost of the share repurchased is shown as deduction from the total shareholders’ equity. Whenthese shares are reissued, gains are credited to a separate capital reserve in shareholders’ equity, which is nondistributable.Any realised losses are charged directly to retained earnings. Gains realised on the sale of reissueshares are first used to offset any previously recorded losses in the order of retained earning and the capital reserveaccount. No cash dividend are paid on these shares.3 SEGMENT INFORMATIONBusiness segment:For management purposes, the Group is organised into two major business segments.The real estate segment develops and sells condominiums, villas, commercial units and plots of land and relatedleasing activities. Other segments include businesses that individually do not meet the criteria for a reportablesegment as per IAS 14. These businesses are property management services, education, healthcare, hospitality,retail and investment in providers of financial services.Income from sources other than the real estate segment is included in other operating income.Geographic segments:The Group is currently developing a number of international business opportunities outside the United ArabEmirates that will have a significant impact in future periods.The domestic segment includes business activity and operations in the UAE and the international segment includesbusiness activity and operations outside the UAE.Business SegmentsThe following table represent revenue and profit information and certain asset and liability information regardingbusiness segments for the years ended 31 December 2008 and 2007.2008Real estate Others Eliminations TotalAED’000 AED’000 AED’000 AED’000RevenueRevenue from external customers 15,443,308 576,949 (5,124) 16,015,133 ResultsProfit before income tax, financecosts, finance income, share ofresults from associates andimpairment of goodwill 5,117,405 (119,725) (2,642) 4,995,038 Assets and liabilitiesSegment assets 56,207,545 9,203,522 (4,720,269) 60,690,798 Segment liabilities 23,866,996 4,382,967 (4,121,519) 24,128,444 Other segment informationCapital expenditure (Property,plant and equipment) 4,403,104 1,445,084 - 5,848,188 Depreciation (Property,plant and equipment) 99,486 115,925 - 215,411 2007 (restated):Real estate Others Eliminations TotalAED’000 AED’000 AED’000 AED’000RevenueRevenue from external customers 17,565,895 302,777 - 17,868,672 Total revenue 17,565,895 302,777 - 17,868,672 ResultsProfit before income tax, financecosts, finance income, share ofresults from associates andimpairment of goodwill 5,963,712 (57,268) - 5,906,444 Assets and liabilitiesSegment assets 51,324,032 6,808,674 (3,341,831) 54,790,875 Segment liabilities 16,890,454 2,877,958 (2,165,803) 17,602,609 Other segment informationCapital expenditure (Property,plant and equipment) 2,458,695 1,237,302 - 3,695,997 Depreciation (Property,plant and equipment) 74,706 80,952 - 155,658 <strong>Emaar</strong> Annual Report I 24 <strong>Emaar</strong> Annual Report I 25F-77

EMAAR Properties PJSC and SubsidiariesEMAAR Properties PJSC and SubsidiariesNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2008NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 20083 SEGMENT INFORMATION (continued)Geographic SegmentsThe following tables represent revenue and profit information and certain asset and liability information regardinggeographic segments for the years ended 31 December 2008 and 2007.2008:Domestic International TotalAED’000 AED’000 AED’000RevenueRevenue from external customers 13,926,334 2,088,799 16,015,133 Total revenue 13,926,334 2,088,799 16,015,133 AssetsSegment assets 35,460,931 16,447,622 51,908,553Investment in associates 2,552,415 6,229,830 8,782,245 Total assets 38,013,346 22,677,452 60,690,798 Other segment informationCapital expenditure (property,plant and equipment) 5,471,970 376,218 5,848,188 2007 (restated)Domestic International TotalAED’000 AED’000 AED’000RevenueRevenue from external customers 14,278,224 3,590,448 17,868,672 Total revenue 14,278,224 3,590,448 17,868,672 AssetsSegment assets 28,392,470 17,291,108 45,683,578Investment in associates 2,219,696 6,887,601 9,107,297 Total assets 30,612,166 24,178,709 54,790,875 Other segment informationCapital expenditure (Property,plant and equipment) 3,491,746 204,251 3,695,997 4 REVENUE AND COST OF REVENUERevenue2008 2007AED’000 AED’000(Restated)Revenue from property sales:Sale of condominiums 6,283,607 8,670,040Sale of villas 4,255,225 6,093,713Sale of plots of land 1,997,078 1,496,452Sale of commercial and others 2,403,316 1,026,282Revenue from hospitality 576,949 302,777Rental income from leased properties and related income 498,958 279,408———— ————16,015,133 17,868,672 Cost of revenueCost of revenue of property sales:Cost of condominiums 4,037,105 6,136,740Cost of villas 2,614,583 3,627,098Cost of plots of land 75,857 311,690Cost of commercial and others 847,666 360,591Write down of development properties 1,084,017 458,409Reversal of provision for impairment lossof investment property (note 16) - (291,076)Operating cost of hospitality 366,653 174,677Operating cost of leased properties 177,894 36,778———— ————9,203,775 10,814,907 AED 1,084,017 thousands relates to the write down of development properties in the Group's US subsidiary WLHomes LLC (31 December 2007: AED 458,409 thousands).The Group has reclassified the 2007 figures by transferring revenue and operating cost of hospitality from otheroperating income and other operating expenses to revenue and cost of revenue for the year, respectively.5 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES2008 2007AED’000 AED’000Payroll and related expenses 734,726 703,985Sales and marketing expenses 505,129 632,555Depreciation of property, plant and equipment (note 15) 215,411 155,658Depreciation of investment properties (note 16) 85,637 25,300Contribution to educational and other charitable funds 56,345 79,164Property management expenses 70,671 46,673Land registration fees 96,930 85,229Pre-operating expenses 69,462 31,073Other expenses 448,286 358,953———— ————2,282,597 2,118,590 <strong>Emaar</strong> Annual Report I 26 <strong>Emaar</strong> Annual Report I 27F-78

- Page 4 and 5:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 6 and 7:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 8 and 9:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 10 and 11:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 13 and 14:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 15 and 16:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 17 and 18:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 19 and 20:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 21 and 22:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 23 and 24:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 25 and 26:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 27 and 28:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 29 and 30:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 31 and 32:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 33 and 34:

c103695pu010 Proof 7: 17.1.11 B/L R

- Page 35 and 36:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 37 and 38:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 39 and 40:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 41 and 42:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 43 and 44:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 45 and 46:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 47 and 48:

c103695pu020 Proof 7: 17.1.11 B/L R

- Page 49 and 50:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 51 and 52:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 53 and 54:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 55 and 56:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 57 and 58:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 59 and 60:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 61 and 62:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 63 and 64:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 65 and 66:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 67 and 68:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 69 and 70:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 71 and 72:

c103695pu030 Proof 7: 17.1.11 B/L R

- Page 73 and 74:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 75 and 76:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 77 and 78:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 79 and 80:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 81 and 82:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 83 and 84:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 85 and 86:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 87 and 88:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 89 and 90:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 91 and 92:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 93 and 94:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 95 and 96:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 97 and 98:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 99 and 100:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 101 and 102:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 103 and 104:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 105 and 106:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 107 and 108:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 109 and 110:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 111 and 112:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 113 and 114:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 115 and 116:

c103695pu040 Proof 7: 17.1.11 B/L R

- Page 117 and 118:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 119 and 120:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 121 and 122:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 123 and 124:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 125 and 126:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 127 and 128:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 129 and 130:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 131 and 132:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 133 and 134:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 135 and 136:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 137 and 138:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 139 and 140:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 141 and 142:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 143 and 144:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 145 and 146:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 147 and 148:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 149 and 150:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 151 and 152:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 153 and 154:

c103695pu050 Proof 7: 17.1.11 B/L R

- Page 155 and 156:

F-2

- Page 157 and 158:

F-4

- Page 159 and 160:

F-6

- Page 161 and 162:

F-8

- Page 163 and 164:

F-10

- Page 165 and 166:

F-12

- Page 167 and 168:

F-14

- Page 169 and 170:

F-16

- Page 171 and 172:

F-18

- Page 173 and 174:

F-20

- Page 175 and 176:

F-22

- Page 177 and 178:

F-24

- Page 179 and 180: F-26

- Page 181 and 182: F-28

- Page 183 and 184: F-30

- Page 185 and 186: F-32

- Page 187 and 188: F-34

- Page 189 and 190: F-36

- Page 191 and 192: F-38

- Page 193 and 194: INDEPENDENT AUDITORS' REPORT TO THE

- Page 195 and 196: Emaar Properties PJSC and its Subsi

- Page 197 and 198: Emaar Properties PJSC and its Subsi

- Page 199 and 200: Emaar Properties PJSC and its Subsi

- Page 201 and 202: Emaar Properties PJSC and its Subsi

- Page 203 and 204: Emaar Properties PJSC and its Subsi

- Page 205 and 206: Emaar Properties PJSC and its Subsi

- Page 207 and 208: Emaar Properties PJSC and its Subsi

- Page 209 and 210: Emaar Properties PJSC and its Subsi

- Page 211 and 212: Emaar Properties PJSC and its Subsi

- Page 213 and 214: Emaar Properties PJSC and its Subsi

- Page 215 and 216: Emaar Properties PJSC and its Subsi

- Page 217 and 218: Emaar Annual Report I 54Emaar Prope

- Page 219 and 220: Emaar Properties PJSC and its Subsi

- Page 221 and 222: P.O. Box 926728th Floor - Al Attar

- Page 223 and 224: EMAAR Properties PJSC and Subsidiar

- Page 225 and 226: EMAAR Properties PJSC and Subsidiar

- Page 227 and 228: EMAAR Properties PJSC and Subsidiar

- Page 229: EMAAR Properties PJSC and Subsidiar

- Page 233 and 234: EMAAR Properties PJSC and Subsidiar

- Page 235 and 236: EMAAR Properties PJSC and Subsidiar

- Page 237 and 238: EMAAR Properties PJSC and Subsidiar

- Page 239 and 240: EMAAR Properties PJSC and Subsidiar

- Page 241 and 242: EMAAR Properties PJSC and Subsidiar

- Page 243 and 244: EMAAR Properties PJSC and Subsidiar

- Page 245 and 246: c103695pu080 Proof 7: 17.1.11 B/L R