c103695pu030 Proof 7: 17.1.11 B/L Revision:In these Conditions, Business Day means a day which is both:(a)(b)a day on which commercial banks and foreign exchange markets settle payments and areopen for general business (including dealing in foreign exchange and foreign currencydeposits) in <strong>London</strong> and any Additional Business Centre specified in the applicable FinalTerms; andeither (i) in relation to any sum payable in a Specified Currency other than euro, a day onwhich commercial banks and foreign exchange markets settle payments and are open forgeneral business (including dealing in foreign exchange and foreign currency deposits) inthe principal financial centre of the country of the relevant Specified Currency (if otherthan <strong>London</strong> and any Additional Business Centre) or (ii) in relation to any sum payable ineuro, a TARGET2 Settlement Day.8.3 Screen Rate Determination(a) If Screen Rate Determination is specified in the applicable Final Terms as the manner inwhich the Rate(s) is/are to be determined, the Rate applicable to the Trust Certificates foreach Return Accumulation Period will, subject as provided below, be either:(i) the offered quotation; or(ii) the arithmetic mean (rounded if necessary to the fifth decimal place, with 0.000005being rounded upwards) of the offered quotations,(expressed as a percentage rate per annum), for the Reference Rate which appears orappear, as the case may be, on the Relevant Screen Page as at the Relevant Time on thePeriodic Distribution Determination Date in question plus or minus (as indicated in theapplicable Final Terms) the Margin (if any), all as determined by the Calculation Agent. Iffive or more of such offered quotations are available on the Relevant Screen Page, thehighest (or, if there is more than one highest quotation, one only of those quotations) andthe lowest (or, if there is more than one lowest quotation, one only of those quotations)shall be disregarded by the Calculation Agent for the purpose of determining thearithmetic mean (rounded as provided above) of the offered quotations.(b) If the Relevant Screen Page is not available or if, in the case of Condition 8.3(a)(i), nooffered quotation appears or, in the case of Condition 8.3(a)(ii), fewer than three offeredquotations appear, in each case as at the Relevant Time, the Calculation Agent shallrequest each of the Reference Banks to provide the Calculation Agent with its offeredquotation (expressed as a percentage rate per annum) for the Reference Rate atapproximately the Relevant Time on the Periodic Distribution Determination Date inquestion. If two or more of the Reference Banks provide the Calculation Agent withoffered quotations, the Rate for such Return Accumulation Period shall be the arithmeticmean (rounded if necessary to the fifth decimal place with 0.000005 being roundedupwards) of the offered quotations plus or minus (as appropriate) the Margin (if any), allas determined by the Calculation Agent.(c) If on any Periodic Distribution Determination Date one only or none of the ReferenceBanks provides the Calculation Agent with an offered quotation as provided in thepreceding paragraph, the Rate for such Return Accumulation Period shall be the rate perannum which the Calculation Agent determines as being the arithmetic mean (rounded ifnecessary to the fifth decimal place, with 0.000005 being rounded upwards) of the rates, ascommunicated to (and at the request of) the Agent by the Reference Banks or any two ormore of them, at which such banks were offered, at approximately the Relevant Time onthe relevant Periodic Distribution Determination Date, deposits in the Specified Currencyfor a period equal to that which would have been used for the Reference Rate by leadingbanks in the <strong>London</strong> inter-bank market (if the Reference Rate is LIBOR) or the Eurozoneinter-bank market (if the Reference Rate is EURIBOR) plus or minus (asappropriate) the Margin (if any) or, if fewer than two of the Reference Banks provide theAgent with such offered rates, the offered rate for deposits in the Specified Currency for aperiod equal to that which would have been used for the Reference Rate, or the arithmeticmean (rounded as provided above) of the offered rates for deposits in the SpecifiedCurrency for a period equal to that which would have been used for the Reference Rate,at which, at approximately the Relevant Time on the relevant Periodic DistributionDetermination Date, any one or more banks (which bank or banks is or are in the58

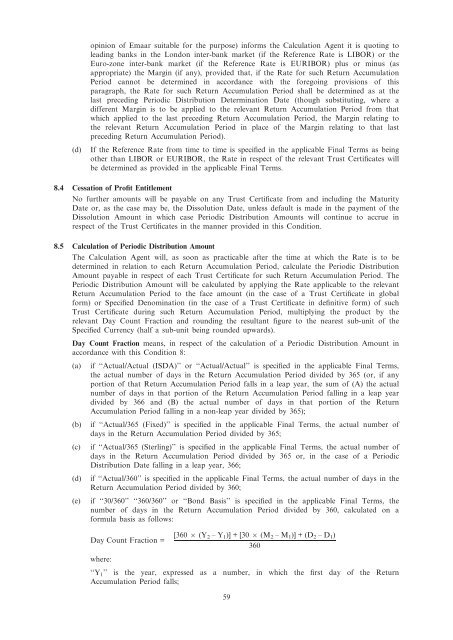

c103695pu030 Proof 7: 17.1.11 B/L Revision:opinion of <strong>Emaar</strong> suitable for the purpose) informs the Calculation Agent it is quoting toleading banks in the <strong>London</strong> inter-bank market (if the Reference Rate is LIBOR) or theEuro-zone inter-bank market (if the Reference Rate is EURIBOR) plus or minus (asappropriate) the Margin (if any), provided that, if the Rate for such Return AccumulationPeriod cannot be determined in accordance with the foregoing provisions of thisparagraph, the Rate for such Return Accumulation Period shall be determined as at thelast preceding Periodic Distribution Determination Date (though substituting, where adifferent Margin is to be applied to the relevant Return Accumulation Period from thatwhich applied to the last preceding Return Accumulation Period, the Margin relating tothe relevant Return Accumulation Period in place of the Margin relating to that lastpreceding Return Accumulation Period).(d)If the Reference Rate from time to time is specified in the applicable Final Terms as beingother than LIBOR or EURIBOR, the Rate in respect of the relevant Trust Certificates willbe determined as provided in the applicable Final Terms.8.4 Cessation of Profit EntitlementNo further amounts will be payable on any Trust Certificate from and including the MaturityDate or, as the case may be, the Dissolution Date, unless default is made in the payment of theDissolution Amount in which case Periodic Distribution Amounts will continue to accrue inrespect of the Trust Certificates in the manner provided in this Condition.8.5 Calculation of Periodic Distribution AmountThe Calculation Agent will, as soon as practicable after the time at which the Rate is to bedetermined in relation to each Return Accumulation Period, calculate the Periodic DistributionAmount payable in respect of each Trust Certificate for such Return Accumulation Period. ThePeriodic Distribution Amount will be calculated by applying the Rate applicable to the relevantReturn Accumulation Period to the face amount (in the case of a Trust Certificate in globalform) or Specified Denomination (in the case of a Trust Certificate in definitive form) of suchTrust Certificate during such Return Accumulation Period, multiplying the product by therelevant Day Count Fraction and rounding the resultant figure to the nearest sub-unit of theSpecified Currency (half a sub-unit being rounded upwards).Day Count Fraction means, in respect of the calculation of a Periodic Distribution Amount inaccordance with this Condition 8:(a)(b)(c)(d)(e)if ‘‘Actual/Actual (ISDA)’’ or ‘‘Actual/Actual’’ is specified in the applicable Final Terms,the actual number of days in the Return Accumulation Period divided by 365 (or, if anyportion of that Return Accumulation Period falls in a leap year, the sum of (A) the actualnumber of days in that portion of the Return Accumulation Period falling in a leap yeardivided by 366 and (B) the actual number of days in that portion of the ReturnAccumulation Period falling in a non-leap year divided by 365);if ‘‘Actual/365 (Fixed)’’ is specified in the applicable Final Terms, the actual number ofdays in the Return Accumulation Period divided by 365;if ‘‘Actual/365 (Sterling)’’ is specified in the applicable Final Terms, the actual number ofdays in the Return Accumulation Period divided by 365 or, in the case of a PeriodicDistribution Date falling in a leap year, 366;if ‘‘Actual/360’’ is specified in the applicable Final Terms, the actual number of days in theReturn Accumulation Period divided by 360;if ‘‘30/360’’ ‘‘360/360’’ or ‘‘Bond Basis’’ is specified in the applicable Final Terms, thenumber of days in the Return Accumulation Period divided by 360, calculated on aformula basis as follows:Day Count Fraction = [360 6 (Y 2 –Y 1 )] + [30 6 (M 2 –M 1 )] + (D 2 –D 1 )360where:‘‘Y 1 ’’ is the year, expressed as a number, in which the first day of the ReturnAccumulation Period falls;59