Emaar Sukuk Ltd XS0586840588 - London Stock Exchange

Emaar Sukuk Ltd XS0586840588 - London Stock Exchange

Emaar Sukuk Ltd XS0586840588 - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

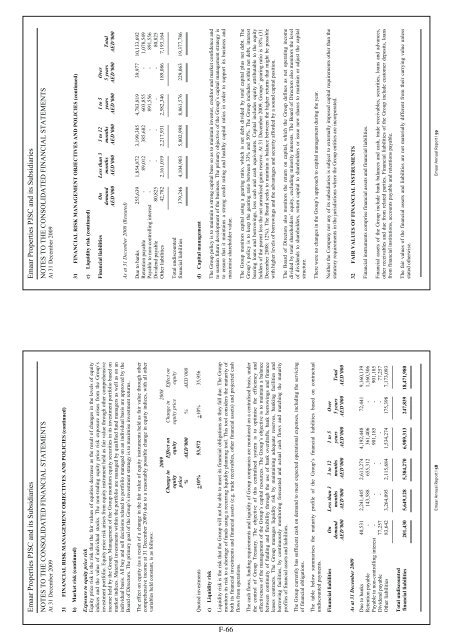

<strong>Emaar</strong> Properties PJSC and its SubsidiariesNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 200931 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)b) Market risk (continued)Exposure to equity price riskEquity price risk is the risk that the fair values of equities decrease as the result of changes in the levels of equityindices and the value of individual stocks. The non-trading equity price risk exposure arises from the Group’sinvestment portfolio. Equity price risk arises from equity instrument held as fair value through other comprehensiveincome held by the Group. Management of the Group monitors equity securities in its investment portfolio based onmarket indices. Material investments within the portfolio are managed by qualified fund managers as well as on anindividual basis. All buy and sell decisions related to portfolio managed on an individual basis are approved by theBoard of Directors. The primary goal of the Group’s investment strategy is to maximise investment returns.The effect on equity (as a result of a change in the fair value of equity instruments held as fair value through othercomprehensive income at 31 December 2009) due to a reasonably possible change in equity indices, with all othervariables held constant, is as follows:Change inequityprice2009 2008Effect onequityChange inequity priceEffect onequity% AED’000 % AED’000Quoted investments +10% 53,572 +10% 35,956c) Liquidity riskLiquidity risk is the risk that the Group will not be able to meet its financial obligations as they fall due. The Groupmonitors its risk to a shortage of funds using a recurring liquidity planning tool. This tool considers the maturity ofboth its financial investments and financial assets (e.g. trade receivables, other financial assets) and projected cashflows from operations.The cash flows, funding requirements and liquidity of Group companies are monitored on a centralised basis, underthe control of Group Treasury. The objective of this centralised system is to optimise the efficiency andeffectiveness of the management of the Group’s capital resources. The Group’s objective is to maintain a balancebetween continuity of funding and flexibility through the use of bank overdrafts, bank borrowings and financeleases contracts. The Group manages liquidity risk by maintaining adequate reserves, banking facilities andborrowing facilities, by continuously monitoring forecasted and actual cash flows and matching the maturityprofiles of financial assets and liabilities.The Group currently has sufficient cash on demand to meet expected operational expenses, including the servicingof financial obligations.The table below summarises the maturity profile of the Group’s financial liabilities based on contractualundiscounted payments.Financial liabilities On Less than 3 3 to 12 1 to 5 Overdemand months months years 5 years TotalAED’000 AED’000 AED’000 AED’000 AED’000 AED’000As at 31 December 2009Due to banks 40,531 2,241,445 2,613,274 4,192,448 72,441 9,160,139Retention payable - 143,588 655,312 361,406 - 1,160,306Payable to non-controlling interest - - - 901,185 - 901,185Dividend payable 77,257 - - - - 77,257Other liabilities 83,642 3,264,095 2,115,684 1,534,274 175,398 7,173,093 Total undiscountedfinancial liabilities 201,430 5,649,128 5,384,270 6,989,313 247,839 18,471,980 <strong>Emaar</strong> Annual Report I 58<strong>Emaar</strong> Properties PJSC and its SubsidiariesNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 200931 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)c) Liquidity risk (continued)Financial liabilities On Less than 3 3 to 12 1 to 5 Overdemand months months years 5 years TotalAED’000 AED’000 AED’000 AED’000 AED’000 AED’000As at 31 December 2008 (Restated)Due to banks 255,639 1,854,872 3,199,385 4,783,819 39,977 10,133,692Retention payable - 89,012 385,682 603,855 - 1,078,549Payable to non-controlling interest - - - 891,556 - 891,556Dividend payable 80,825 - - - - 80,825Other liabilities 42,782 2,161,019 2,217,931 2,582,346 189,086 7,193,164 Total undiscountedfinancial liabilities 379,246 4,104,903 5,802,998 8,861,576 229,063 19,377,786 d) Capital managementThe Group policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence andto sustain future development of the business. The primary objective of the Group’s capital management strategy isto ensure that it maintains a strong credit rating and healthy capital ratios in order to support its business andmaximise shareholder value.The Group monitors capital using a gearing ratio, which is net debt divided by total capital plus net debt. TheGroup’s policy is to keep the gearing ratio between 33% and 50%. The Group includes within net debt, interestbearing loans and borrowings, less cash and cash equivalents. Capital includes equity attributable to the equityholders of the parent less the net unrealised gains reserve. At 31 December 2009, Groups’ gearing ratio is 18% (31December 2008: 12%). The Board seeks to maintain a balance between the higher returns that might be possiblewith higher levels of borrowings and the advantages and security afforded by a sound capital position.The Board of Directors also monitors the return on capital, which the Group defines as net operating incomedivided by total shareholders’ equity, excluding minority interests. The Board of Directors also monitors the levelof dividends to shareholders, return capital to shareholders or issue new shares to maintain or adjust the capitalstructure.There were no changes in the Group’s approach to capital management during the year.Neither the Company nor any of its subsidiaries is subject to externally imposed capital requirements other than thestatutory requirements in the jurisdictions where the Group entities are incorporated.32 FAIR VALUES OF FINANCIAL INSTRUMENTSFinancial instruments comprise financial assets and financial liabilities.Financial assets of the Group include bank balances and cash, trade receivables, securities, loans and advances,other receivables and due from related parties. Financial liabilities of the Group include customer deposits, loansfrom financial institutions, accounts payable and retentions payable.The fair values of the financial assets and liabilities are not materially different from their carrying value unlessstated otherwise.<strong>Emaar</strong> Annual Report I 59F-66