Vendor Profile and W-9 Forms - Connecticut Commission on Culture ...

Vendor Profile and W-9 Forms - Connecticut Commission on Culture ...

Vendor Profile and W-9 Forms - Connecticut Commission on Culture ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

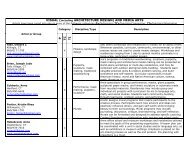

Form W-9 (Rev. 10-2007) Page 43. Real estate transacti<strong>on</strong>s. You must sign the certificati<strong>on</strong>.You may cross out item 2 of the certificati<strong>on</strong>.4. Other payments. You must give your correct TIN, but youdo not have to sign the certificati<strong>on</strong> unless you have beennotified that you have previously given an incorrect TIN. “Otherpayments” include payments made in the course of therequester’s trade or business for rents, royalties, goods (otherthan bills for merch<str<strong>on</strong>g>and</str<strong>on</strong>g>ise), medical <str<strong>on</strong>g>and</str<strong>on</strong>g> health care services(including payments to corporati<strong>on</strong>s), payments to an<strong>on</strong>employee for services, payments to certain fishing boat crewmembers <str<strong>on</strong>g>and</str<strong>on</strong>g> fishermen, <str<strong>on</strong>g>and</str<strong>on</strong>g> gross proceeds paid to attorneys(including payments to corporati<strong>on</strong>s).5. Mortgage interest paid by you, acquisiti<strong>on</strong> orab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong>ment of secured property, cancellati<strong>on</strong> of debt,qualified tuiti<strong>on</strong> program payments (under secti<strong>on</strong> 529), IRA,Coverdell ESA, Archer MSA or HSA c<strong>on</strong>tributi<strong>on</strong>s ordistributi<strong>on</strong>s, <str<strong>on</strong>g>and</str<strong>on</strong>g> pensi<strong>on</strong> distributi<strong>on</strong>s. You must give yourcorrect TIN, but you do not have to sign the certificati<strong>on</strong>.What Name <str<strong>on</strong>g>and</str<strong>on</strong>g> Number To Give the RequesterFor this type of account:1. Individual2. Two or more individuals (jointaccount)3. Custodian account of a minor(Uniform Gift to Minors Act)4. a. The usual revocable savingstrust (grantor is also trustee)b. So-called trust account that isnot a legal or valid trust understate law5. Sole proprietorship or disregardedentity owned by an individualFor this type of account:6. Disregarded entity not owned by anindividual7. A valid trust, estate, or pensi<strong>on</strong> trust8. Corporate or LLC electingcorporate status <strong>on</strong> Form 88329. Associati<strong>on</strong>, club, religious,charitable, educati<strong>on</strong>al, or othertax-exempt organizati<strong>on</strong>10. Partnership or multi-member LLC11. A broker or registered nominee12. Account with the Department ofAgriculture in the name of a publicentity (such as a state or localgovernment, school district, orpris<strong>on</strong>) that receives agriculturalprogram paymentsGive name <str<strong>on</strong>g>and</str<strong>on</strong>g> SSN of:The individualThe actual owner of the account or,if combined funds, the first1individual <strong>on</strong> the accountThe minor 2The grantor-trustee 1The actual owner 1The owner 3The ownerGive name <str<strong>on</strong>g>and</str<strong>on</strong>g> EIN of:Legal entity 4The corporati<strong>on</strong>The organizati<strong>on</strong>The partnershipThe broker or nomineeThe public entity1List first <str<strong>on</strong>g>and</str<strong>on</strong>g> circle the name of the pers<strong>on</strong> whose number you furnish. If <strong>on</strong>ly <strong>on</strong>e pers<strong>on</strong><strong>on</strong> a joint account has an SSN, that pers<strong>on</strong>’s number must be furnished.2Circle the minor’s name <str<strong>on</strong>g>and</str<strong>on</strong>g> furnish the minor’s SSN.3You must show your individual name <str<strong>on</strong>g>and</str<strong>on</strong>g> you may also enter your business or “DBA”name <strong>on</strong> the sec<strong>on</strong>d name line. You may use either your SSN or EIN (if you have <strong>on</strong>e),but the IRS encourages you to use your SSN.4List first <str<strong>on</strong>g>and</str<strong>on</strong>g> circle the name of the trust, estate, or pensi<strong>on</strong> trust. (Do not furnish the TINof the pers<strong>on</strong>al representative or trustee unless the legal entity itself is not designated inthe account title.) Also see Special rules for partnerships <strong>on</strong> page 1.Note. If no name is circled when more than <strong>on</strong>e name is listed,the number will be c<strong>on</strong>sidered to be that of the first name listed.Secure Your Tax Records from Identity TheftIdentity theft occurs when some<strong>on</strong>e uses your pers<strong>on</strong>alinformati<strong>on</strong> such as your name, social security number (SSN), orother identifying informati<strong>on</strong>, without your permissi<strong>on</strong>, to commitfraud or other crimes. An identity thief may use your SSN to geta job or may file a tax return using your SSN to receive a refund.To reduce your risk:● Protect your SSN,● Ensure your employer is protecting your SSN, <str<strong>on</strong>g>and</str<strong>on</strong>g>● Be careful when choosing a tax preparer.Call the IRS at 1-800-829-1040 if you think your identity hasbeen used inappropriately for tax purposes.Victims of identity theft who are experiencing ec<strong>on</strong>omic harmor a system problem, or are seeking help in resolving taxproblems that have not been resolved through normal channels,may be eligible for Taxpayer Advocate Service (TAS) assistance.You can reach TAS by calling the TAS toll-free case intake lineat 1-877-777-4778 or TTY/TDD 1-800-829-4059.Protect yourself from suspicious emails or phishingschemes. Phishing is the creati<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> use of email <str<strong>on</strong>g>and</str<strong>on</strong>g>websites designed to mimic legitimate business emails <str<strong>on</strong>g>and</str<strong>on</strong>g>websites. The most comm<strong>on</strong> act is sending an email to a userfalsely claiming to be an established legitimate enterprise in anattempt to scam the user into surrendering private informati<strong>on</strong>that will be used for identity theft.The IRS does not initiate c<strong>on</strong>tacts with taxpayers via emails.Also, the IRS does not request pers<strong>on</strong>al detailed informati<strong>on</strong>through email or ask taxpayers for the PIN numbers, passwords,or similar secret access informati<strong>on</strong> for their credit card, bank, orother financial accounts.If you receive an unsolicited email claiming to be from the IRS,forward this message to phishing@irs.gov. You may also reportmisuse of the IRS name, logo, or other IRS pers<strong>on</strong>al property tothe Treasury Inspector General for Tax Administrati<strong>on</strong> at1-800-366-4484. You can forward suspicious emails to theFederal Trade <str<strong>on</strong>g>Commissi<strong>on</strong></str<strong>on</strong>g> at: spam@uce.gov or c<strong>on</strong>tact them atwww.c<strong>on</strong>sumer.gov/idtheft or 1-877-IDTHEFT(438-4338).Visit the IRS website at www.irs.gov to learn more aboutidentity theft <str<strong>on</strong>g>and</str<strong>on</strong>g> how to reduce your risk.Privacy Act NoticeSecti<strong>on</strong> 6109 of the Internal Revenue Code requires you to provide your correct TIN to pers<strong>on</strong>s who must file informati<strong>on</strong> returns with the IRS to report interest,dividends, <str<strong>on</strong>g>and</str<strong>on</strong>g> certain other income paid to you, mortgage interest you paid, the acquisiti<strong>on</strong> or ab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong>ment of secured property, cancellati<strong>on</strong> of debt, orc<strong>on</strong>tributi<strong>on</strong>s you made to an IRA, or Archer MSA or HSA. The IRS uses the numbers for identificati<strong>on</strong> purposes <str<strong>on</strong>g>and</str<strong>on</strong>g> to help verify the accuracy of your tax return.The IRS may also provide this informati<strong>on</strong> to the Department of Justice for civil <str<strong>on</strong>g>and</str<strong>on</strong>g> criminal litigati<strong>on</strong>, <str<strong>on</strong>g>and</str<strong>on</strong>g> to cities, states, the District of Columbia, <str<strong>on</strong>g>and</str<strong>on</strong>g> U.S.possessi<strong>on</strong>s to carry out their tax laws. We may also disclose this informati<strong>on</strong> to other countries under a tax treaty, to federal <str<strong>on</strong>g>and</str<strong>on</strong>g> state agencies to enforce federaln<strong>on</strong>tax criminal laws, or to federal law enforcement <str<strong>on</strong>g>and</str<strong>on</strong>g> intelligence agencies to combat terrorism.You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold 28% of taxable interest, dividend, <str<strong>on</strong>g>and</str<strong>on</strong>g> certain otherpayments to a payee who does not give a TIN to a payer. Certain penalties may also apply.