Vendor Profile and W-9 Forms - Connecticut Commission on Culture ...

Vendor Profile and W-9 Forms - Connecticut Commission on Culture ...

Vendor Profile and W-9 Forms - Connecticut Commission on Culture ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

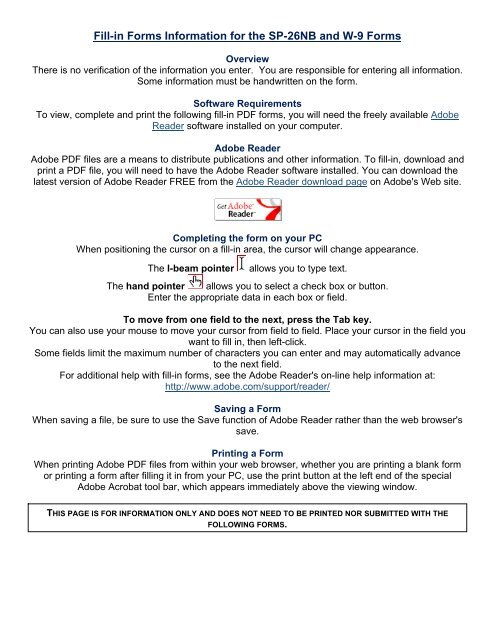

Fill-in <str<strong>on</strong>g>Forms</str<strong>on</strong>g> Informati<strong>on</strong> for the SP-26NB <str<strong>on</strong>g>and</str<strong>on</strong>g> W-9 <str<strong>on</strong>g>Forms</str<strong>on</strong>g>OverviewThere is no verificati<strong>on</strong> of the informati<strong>on</strong> you enter. You are resp<strong>on</strong>sible for entering all informati<strong>on</strong>.Some informati<strong>on</strong> must be h<str<strong>on</strong>g>and</str<strong>on</strong>g>written <strong>on</strong> the form.Software RequirementsTo view, complete <str<strong>on</strong>g>and</str<strong>on</strong>g> print the following fill-in PDF forms, you will need the freely available AdobeReader software installed <strong>on</strong> your computer.Adobe ReaderAdobe PDF files are a means to distribute publicati<strong>on</strong>s <str<strong>on</strong>g>and</str<strong>on</strong>g> other informati<strong>on</strong>. To fill-in, download <str<strong>on</strong>g>and</str<strong>on</strong>g>print a PDF file, you will need to have the Adobe Reader software installed. You can download thelatest versi<strong>on</strong> of Adobe Reader FREE from the Adobe Reader download page <strong>on</strong> Adobe's Web site.Completing the form <strong>on</strong> your PCWhen positi<strong>on</strong>ing the cursor <strong>on</strong> a fill-in area, the cursor will change appearance.The I-beam pointerallows you to type text.The h<str<strong>on</strong>g>and</str<strong>on</strong>g> pointer allows you to select a check box or butt<strong>on</strong>.Enter the appropriate data in each box or field.To move from <strong>on</strong>e field to the next, press the Tab key.You can also use your mouse to move your cursor from field to field. Place your cursor in the field youwant to fill in, then left-click.Some fields limit the maximum number of characters you can enter <str<strong>on</strong>g>and</str<strong>on</strong>g> may automatically advanceto the next field.For additi<strong>on</strong>al help with fill-in forms, see the Adobe Reader's <strong>on</strong>-line help informati<strong>on</strong> at:http://www.adobe.com/support/reader/Saving a FormWhen saving a file, be sure to use the Save functi<strong>on</strong> of Adobe Reader rather than the web browser'ssave.Printing a FormWhen printing Adobe PDF files from within your web browser, whether you are printing a blank formor printing a form after filling it in from your PC, use the print butt<strong>on</strong> at the left end of the specialAdobe Acrobat tool bar, which appears immediately above the viewing window.THIS PAGE IS FOR INFORMATION ONLY AND DOES NOT NEED TO BE PRINTED NOR SUBMITTED WITH THEFOLLOWING FORMS.

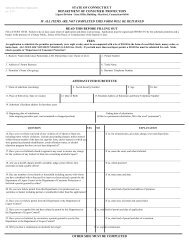

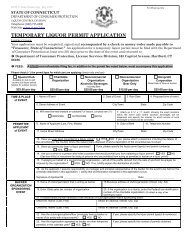

STATE OF CONNECTICUT - AGENCY VENDOR FORMIMPORTANT: ALL parts of this form must be completed, signed <str<strong>on</strong>g>and</str<strong>on</strong>g> returned by the vendor.& CCREAD OMPLETE AREFULLY SP-26NB-IPDF Rev. 4/10COMPLETE VENDOR LEGAL BUSINESS NAME Taxpayer ID # (TIN): SSN FEINBUSINESS NAME, TRADE NAME, DOING BUSINESS AS (IF DIFFERENT FROM ABOVE)WRITE/TYPE SSN/FEIN NUMBER ABOVEBUSINESS ENTITY: CORPORATION LLC CORPORATION LLC PARTNERSHIP LLC SINGLE MEMBER ENTITYNON-PROFIT PARTNERSHIP INDIVIDUAL/SOLE PROPRIETOR GOVERNMENTNOTE: IF INDIVIDUAL/SOLE PROPRIETOR, INDIVIDUAL’S NAME (AS OWNER) MUST APPEAR IN THE LEGAL BUSINESS NAME BLOCK ABOVE.BUSINESS TYPE: A. SALE OF COMMODITIES B. MEDICAL SERVICES C. ATTORNEY FEES D. RENTAL OF PROPERTY(REAL ESTATE & EQUIPMENT)E. OTHER (DESCRIBE IN DETAIL)UNDER THIS TIN, WHAT IS THE PRIMARY TYPE OF BUSINESS YOU PROVIDE TO THE STATE? (ENTER LETTER FROM ABOVE) ➝UNDER THIS TIN, WHAT OTHER TYPES OF BUSINESS MIGHT YOU PROVIDE TO THE STATE? (ENTER LETTER FROM ABOVE) ➝NOTE: IF YOUR BUSINESS IS A PARTNERSHIP, YOU MUST ATTACH THE NAMES AND TITLES OF ALL PARTNERS TO YOUR BID SUBMISSION.NOTE: IF YOUR BUSINESS IS A CORPORATION, IN WHICH STATE ARE YOU INCORPORATED?VENDOR ADDRESS STREET CITY STATE ZIP CODEVENDOR E-MAIL ADDRESSAdd Additi<strong>on</strong>al Business Address & C<strong>on</strong>tact informati<strong>on</strong> <strong>on</strong> back of this form.VENDOR WEB SITEREMITTANCE INFORMATION: INDICATE BELOW THE REMITTANCE ADDRESS OF YOUR BUSINESS. SAME AS VENDOR ADDRESS ABOVE.REMIT ADDRESS STREET CITY STATE ZIP CODECONTACT INFORMATION: NAME (TYPE OR PRINT)1 ST BUSINESS PHONE: Ext. # HOME PHONE:2 ND BUSINESS PHONE: Ext. # 1 ST PAGER:CELLULAR:2 ND PAGER:1 ST FAX NUMBER: TOLL FREE PHONE:2 ND FAX NUMBER: TELEX:WRITTEN SIGNATURE OF PERSON AUTHORIZED TO SIGN PROPOSALS ON BEHALF OF THE ABOVE NAMED VENDORSIGN HERETYPE OR PRINT NAME OF AUTHORIZED PERSONTITLE OF AUTHORIZED PERSONDATE EXECUTEDIS YOUR BUSINESS CURRENTLY A DAS CERTIFIED SMALL BUSINESS ENTERPRISE? YES (ATTACH COPY OF CERTIFICATE) NOIS YOUR BUSINESS CURRENTLY A CT DOT CERTIFIED DISADVANTAGED BUSINESS ENTERPRISE (DBE)? YES NOIF YOU ARE A STATE EMPLOYEE, INDICATE YOUR POSITION,AGENCY & AGENCY ADDRESSPURCHASE ORDER DISTRIBUTION:(E-MAIL ADDRESS)NOTE: THE E-MAIL ADDRESS INDICATED IMMEDIATELY ABOVE WILL BE USED TO FORWARD PURCHASE ORDERS TO YOUR BUSINESS.ADD FURTHER BUSINESS ADDRESS, E-MAIL & CONTACT INFORMATION ON SEPARATE SHEET IF REQUIRED

Form W-9 Request for Taxpayer(Rev. October 2007)Identificati<strong>on</strong> Number <str<strong>on</strong>g>and</str<strong>on</strong>g> Certificati<strong>on</strong>Department of the TreasuryInternal Revenue ServiceName (as shown <strong>on</strong> your income tax return)Give form to therequester. Do notsend to the IRS.Print or typeSee Specific Instructi<strong>on</strong>s <strong>on</strong> page 2.Business name, if different from aboveCheck appropriate box: Individual/Sole proprietor Corporati<strong>on</strong> PartnershipLimited liability company. Enter the tax classificati<strong>on</strong> (D=disregarded entity, C=corporati<strong>on</strong>, P=partnership) Other (see instructi<strong>on</strong>s) Address (number, street, <str<strong>on</strong>g>and</str<strong>on</strong>g> apt. or suite no.)City, state, <str<strong>on</strong>g>and</str<strong>on</strong>g> ZIP codeList account number(s) here (opti<strong>on</strong>al)ExemptpayeeRequester’s name <str<strong>on</strong>g>and</str<strong>on</strong>g> address (opti<strong>on</strong>al)Part ITaxpayer Identificati<strong>on</strong> Number (TIN)Enter your TIN in the appropriate box. The TIN provided must match the name given <strong>on</strong> Line 1 to avoidbackup withholding. For individuals, this is your social security number (SSN). However, for a residentalien, sole proprietor, or disregarded entity, see the Part I instructi<strong>on</strong>s <strong>on</strong> page 3. For other entities, it isyour employer identificati<strong>on</strong> number (EIN). If you do not have a number, see How to get a TIN <strong>on</strong> page 3.Note. If the account is in more than <strong>on</strong>e name, see the chart <strong>on</strong> page 4 for guidelines <strong>on</strong> whosenumber to enter.Part IICertificati<strong>on</strong>Under penalties of perjury, I certify that:Social security numberorEmployer identificati<strong>on</strong> number1. The number shown <strong>on</strong> this form is my correct taxpayer identificati<strong>on</strong> number (or I am waiting for a number to be issued to me), <str<strong>on</strong>g>and</str<strong>on</strong>g>2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the InternalRevenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS hasnotified me that I am no l<strong>on</strong>ger subject to backup withholding, <str<strong>on</strong>g>and</str<strong>on</strong>g>3. I am a U.S. citizen or other U.S. pers<strong>on</strong> (defined below).Certificati<strong>on</strong> instructi<strong>on</strong>s. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backupwithholding because you have failed to report all interest <str<strong>on</strong>g>and</str<strong>on</strong>g> dividends <strong>on</strong> your tax return. For real estate transacti<strong>on</strong>s, item 2 does not apply.For mortgage interest paid, acquisiti<strong>on</strong> or ab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong>ment of secured property, cancellati<strong>on</strong> of debt, c<strong>on</strong>tributi<strong>on</strong>s to an individual retirementarrangement (IRA), <str<strong>on</strong>g>and</str<strong>on</strong>g> generally, payments other than interest <str<strong>on</strong>g>and</str<strong>on</strong>g> dividends, you are not required to sign the Certificati<strong>on</strong>, but you mustprovide your correct TIN. See the instructi<strong>on</strong>s <strong>on</strong> page 4.SignHereSignature ofU.S. pers<strong>on</strong> General Instructi<strong>on</strong>sSecti<strong>on</strong> references are to the Internal Revenue Code unlessotherwise noted.Purpose of FormA pers<strong>on</strong> who is required to file an informati<strong>on</strong> return with theIRS must obtain your correct taxpayer identificati<strong>on</strong> number (TIN)to report, for example, income paid to you, real estatetransacti<strong>on</strong>s, mortgage interest you paid, acquisiti<strong>on</strong> orab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong>ment of secured property, cancellati<strong>on</strong> of debt, orc<strong>on</strong>tributi<strong>on</strong>s you made to an IRA.Use Form W-9 <strong>on</strong>ly if you are a U.S. pers<strong>on</strong> (including aresident alien), to provide your correct TIN to the pers<strong>on</strong>requesting it (the requester) <str<strong>on</strong>g>and</str<strong>on</strong>g>, when applicable, to:1. Certify that the TIN you are giving is correct (or you arewaiting for a number to be issued),2. Certify that you are not subject to backup withholding, or3. Claim exempti<strong>on</strong> from backup withholding if you are a U.S.exempt payee. If applicable, you are also certifying that as aU.S. pers<strong>on</strong>, your allocable share of any partnership income froma U.S. trade or business is not subject to the withholding tax <strong>on</strong>foreign partners’ share of effectively c<strong>on</strong>nected income.Note. If a requester gives you a form other than Form W-9 torequest your TIN, you must use the requester’s form if it issubstantially similar to this Form W-9.Date Definiti<strong>on</strong> of a U.S. pers<strong>on</strong>. For federal tax purposes, you arec<strong>on</strong>sidered a U.S. pers<strong>on</strong> if you are:● An individual who is a U.S. citizen or U.S. resident alien,● A partnership, corporati<strong>on</strong>, company, or associati<strong>on</strong> created ororganized in the United States or under the laws of the UnitedStates,● An estate (other than a foreign estate), or● A domestic trust (as defined in Regulati<strong>on</strong>s secti<strong>on</strong>301.7701-7).Special rules for partnerships. Partnerships that c<strong>on</strong>duct atrade or business in the United States are generally required topay a withholding tax <strong>on</strong> any foreign partners’ share of incomefrom such business. Further, in certain cases where a Form W-9has not been received, a partnership is required to presume thata partner is a foreign pers<strong>on</strong>, <str<strong>on</strong>g>and</str<strong>on</strong>g> pay the withholding tax.Therefore, if you are a U.S. pers<strong>on</strong> that is a partner in apartnership c<strong>on</strong>ducting a trade or business in the United States,provide Form W-9 to the partnership to establish your U.S.status <str<strong>on</strong>g>and</str<strong>on</strong>g> avoid withholding <strong>on</strong> your share of partnershipincome.The pers<strong>on</strong> who gives Form W-9 to the partnership forpurposes of establishing its U.S. status <str<strong>on</strong>g>and</str<strong>on</strong>g> avoiding withholding<strong>on</strong> its allocable share of net income from the partnershipc<strong>on</strong>ducting a trade or business in the United States is in thefollowing cases:● The U.S. owner of a disregarded entity <str<strong>on</strong>g>and</str<strong>on</strong>g> not the entity,Cat. No. 10231XForm W-9 (Rev. 10-2007)

Form W-9 (Rev. 10-2007) Page 2● The U.S. grantor or other owner of a grantor trust <str<strong>on</strong>g>and</str<strong>on</strong>g> not thetrust, <str<strong>on</strong>g>and</str<strong>on</strong>g>● The U.S. trust (other than a grantor trust) <str<strong>on</strong>g>and</str<strong>on</strong>g> not thebeneficiaries of the trust.Foreign pers<strong>on</strong>. If you are a foreign pers<strong>on</strong>, do not use FormW-9. Instead, use the appropriate Form W-8 (see Publicati<strong>on</strong>515, Withholding of Tax <strong>on</strong> N<strong>on</strong>resident Aliens <str<strong>on</strong>g>and</str<strong>on</strong>g> ForeignEntities).N<strong>on</strong>resident alien who becomes a resident alien. Generally,<strong>on</strong>ly a n<strong>on</strong>resident alien individual may use the terms of a taxtreaty to reduce or eliminate U.S. tax <strong>on</strong> certain types of income.However, most tax treaties c<strong>on</strong>tain a provisi<strong>on</strong> known as a“saving clause.” Excepti<strong>on</strong>s specified in the saving clause maypermit an exempti<strong>on</strong> from tax to c<strong>on</strong>tinue for certain types ofincome even after the payee has otherwise become a U.S.resident alien for tax purposes.If you are a U.S. resident alien who is relying <strong>on</strong> an excepti<strong>on</strong>c<strong>on</strong>tained in the saving clause of a tax treaty to claim anexempti<strong>on</strong> from U.S. tax <strong>on</strong> certain types of income, you mustattach a statement to Form W-9 that specifies the following fiveitems:1. The treaty country. Generally, this must be the same treatyunder which you claimed exempti<strong>on</strong> from tax as a n<strong>on</strong>residentalien.2. The treaty article addressing the income.3. The article number (or locati<strong>on</strong>) in the tax treaty thatc<strong>on</strong>tains the saving clause <str<strong>on</strong>g>and</str<strong>on</strong>g> its excepti<strong>on</strong>s.4. The type <str<strong>on</strong>g>and</str<strong>on</strong>g> amount of income that qualifies for theexempti<strong>on</strong> from tax.5. Sufficient facts to justify the exempti<strong>on</strong> from tax under theterms of the treaty article.Example. Article 20 of the U.S.-China income tax treaty allowsan exempti<strong>on</strong> from tax for scholarship income received by aChinese student temporarily present in the United States. UnderU.S. law, this student will become a resident alien for taxpurposes if his or her stay in the United States exceeds 5calendar years. However, paragraph 2 of the first Protocol to theU.S.-China treaty (dated April 30, 1984) allows the provisi<strong>on</strong>s ofArticle 20 to c<strong>on</strong>tinue to apply even after the Chinese studentbecomes a resident alien of the United States. A Chinesestudent who qualifies for this excepti<strong>on</strong> (under paragraph 2 ofthe first protocol) <str<strong>on</strong>g>and</str<strong>on</strong>g> is relying <strong>on</strong> this excepti<strong>on</strong> to claim anexempti<strong>on</strong> from tax <strong>on</strong> his or her scholarship or fellowshipincome would attach to Form W-9 a statement that includes theinformati<strong>on</strong> described above to support that exempti<strong>on</strong>.If you are a n<strong>on</strong>resident alien or a foreign entity not subject tobackup withholding, give the requester the appropriatecompleted Form W-8.What is backup withholding? Pers<strong>on</strong>s making certain paymentsto you must under certain c<strong>on</strong>diti<strong>on</strong>s withhold <str<strong>on</strong>g>and</str<strong>on</strong>g> pay to theIRS 28% of such payments. This is called “backup withholding.”Payments that may be subject to backup withholding includeinterest, tax-exempt interest, dividends, broker <str<strong>on</strong>g>and</str<strong>on</strong>g> barterexchange transacti<strong>on</strong>s, rents, royalties, n<strong>on</strong>employee pay, <str<strong>on</strong>g>and</str<strong>on</strong>g>certain payments from fishing boat operators. Real estatetransacti<strong>on</strong>s are not subject to backup withholding.You will not be subject to backup withholding <strong>on</strong> paymentsyou receive if you give the requester your correct TIN, make theproper certificati<strong>on</strong>s, <str<strong>on</strong>g>and</str<strong>on</strong>g> report all your taxable interest <str<strong>on</strong>g>and</str<strong>on</strong>g>dividends <strong>on</strong> your tax return.Payments you receive will be subject to backupwithholding if:1. You do not furnish your TIN to the requester,2. You do not certify your TIN when required (see the Part IIinstructi<strong>on</strong>s <strong>on</strong> page 3 for details),3. The IRS tells the requester that you furnished an incorrectTIN,4. The IRS tells you that you are subject to backupwithholding because you did not report all your interest <str<strong>on</strong>g>and</str<strong>on</strong>g>dividends <strong>on</strong> your tax return (for reportable interest <str<strong>on</strong>g>and</str<strong>on</strong>g>dividends <strong>on</strong>ly), or5. You do not certify to the requester that you are not subjectto backup withholding under 4 above (for reportable interest <str<strong>on</strong>g>and</str<strong>on</strong>g>dividend accounts opened after 1983 <strong>on</strong>ly).Certain payees <str<strong>on</strong>g>and</str<strong>on</strong>g> payments are exempt from backupwithholding. See the instructi<strong>on</strong>s below <str<strong>on</strong>g>and</str<strong>on</strong>g> the separateInstructi<strong>on</strong>s for the Requester of Form W-9.Also see Special rules for partnerships <strong>on</strong> page 1.PenaltiesFailure to furnish TIN. If you fail to furnish your correct TIN to arequester, you are subject to a penalty of $50 for each suchfailure unless your failure is due to reas<strong>on</strong>able cause <str<strong>on</strong>g>and</str<strong>on</strong>g> not towillful neglect.Civil penalty for false informati<strong>on</strong> with respect towithholding. If you make a false statement with no reas<strong>on</strong>ablebasis that results in no backup withholding, you are subject to a$500 penalty.Criminal penalty for falsifying informati<strong>on</strong>. Willfully falsifyingcertificati<strong>on</strong>s or affirmati<strong>on</strong>s may subject you to criminalpenalties including fines <str<strong>on</strong>g>and</str<strong>on</strong>g>/or impris<strong>on</strong>ment.Misuse of TINs. If the requester discloses or uses TINs inviolati<strong>on</strong> of federal law, the requester may be subject to civil <str<strong>on</strong>g>and</str<strong>on</strong>g>criminal penalties.Specific Instructi<strong>on</strong>sNameIf you are an individual, you must generally enter the nameshown <strong>on</strong> your income tax return. However, if you have changedyour last name, for instance, due to marriage without informingthe Social Security Administrati<strong>on</strong> of the name change, enteryour first name, the last name shown <strong>on</strong> your social securitycard, <str<strong>on</strong>g>and</str<strong>on</strong>g> your new last name.If the account is in joint names, list first, <str<strong>on</strong>g>and</str<strong>on</strong>g> then circle, thename of the pers<strong>on</strong> or entity whose number you entered in Part Iof the form.Sole proprietor. Enter your individual name as shown <strong>on</strong> yourincome tax return <strong>on</strong> the “Name” line. You may enter yourbusiness, trade, or “doing business as (DBA)” name <strong>on</strong> the“Business name” line.Limited liability company (LLC). Check the “Limited liabilitycompany” box <strong>on</strong>ly <str<strong>on</strong>g>and</str<strong>on</strong>g> enter the appropriate code for the taxclassificati<strong>on</strong> (“D” for disregarded entity, “C” for corporati<strong>on</strong>, “P”for partnership) in the space provided.For a single-member LLC (including a foreign LLC with adomestic owner) that is disregarded as an entity separate fromits owner under Regulati<strong>on</strong>s secti<strong>on</strong> 301.7701-3, enter theowner’s name <strong>on</strong> the “Name” line. Enter the LLC’s name <strong>on</strong> the“Business name” line.For an LLC classified as a partnership or a corporati<strong>on</strong>, enterthe LLC’s name <strong>on</strong> the “Name” line <str<strong>on</strong>g>and</str<strong>on</strong>g> any business, trade, orDBA name <strong>on</strong> the “Business name” line.Other entities. Enter your business name as shown <strong>on</strong> requiredfederal tax documents <strong>on</strong> the “Name” line. This name shouldmatch the name shown <strong>on</strong> the charter or other legal documentcreating the entity. You may enter any business, trade, or DBAname <strong>on</strong> the “Business name” line.Note. You are requested to check the appropriate box for yourstatus (individual/sole proprietor, corporati<strong>on</strong>, etc.).Exempt PayeeIf you are exempt from backup withholding, enter your name asdescribed above <str<strong>on</strong>g>and</str<strong>on</strong>g> check the appropriate box for your status,then check the “Exempt payee” box in the line following thebusiness name, sign <str<strong>on</strong>g>and</str<strong>on</strong>g> date the form.

Form W-9 (Rev. 10-2007) Page 3Generally, individuals (including sole proprietors) are not exemptfrom backup withholding. Corporati<strong>on</strong>s are exempt from backupwithholding for certain payments, such as interest <str<strong>on</strong>g>and</str<strong>on</strong>g> dividends.Note. If you are exempt from backup withholding, you shouldstill complete this form to avoid possible err<strong>on</strong>eous backupwithholding.The following payees are exempt from backup withholding:1. An organizati<strong>on</strong> exempt from tax under secti<strong>on</strong> 501(a), anyIRA, or a custodial account under secti<strong>on</strong> 403(b)(7) if the accountsatisfies the requirements of secti<strong>on</strong> 401(f)(2),2. The United States or any of its agencies orinstrumentalities,3. A state, the District of Columbia, a possessi<strong>on</strong> of the UnitedStates, or any of their political subdivisi<strong>on</strong>s or instrumentalities,4. A foreign government or any of its political subdivisi<strong>on</strong>s,agencies, or instrumentalities, or5. An internati<strong>on</strong>al organizati<strong>on</strong> or any of its agencies orinstrumentalities.Other payees that may be exempt from backup withholdinginclude:6. A corporati<strong>on</strong>,7. A foreign central bank of issue,8. A dealer in securities or commodities required to register inthe United States, the District of Columbia, or a possessi<strong>on</strong> ofthe United States,9. A futures commissi<strong>on</strong> merchant registered with theCommodity Futures Trading <str<strong>on</strong>g>Commissi<strong>on</strong></str<strong>on</strong>g>,10. A real estate investment trust,11. An entity registered at all times during the tax year underthe Investment Company Act of 1940,12. A comm<strong>on</strong> trust fund operated by a bank under secti<strong>on</strong>584(a),13. A financial instituti<strong>on</strong>,14. A middleman known in the investment community as anominee or custodian, or15. A trust exempt from tax under secti<strong>on</strong> 664 or described insecti<strong>on</strong> 4947.The chart below shows types of payments that may beexempt from backup withholding. The chart applies to theexempt payees listed above, 1 through 15.IF the payment is for . . .Interest <str<strong>on</strong>g>and</str<strong>on</strong>g> dividend paymentsBroker transacti<strong>on</strong>sBarter exchange transacti<strong>on</strong>s<str<strong>on</strong>g>and</str<strong>on</strong>g> patr<strong>on</strong>age dividendsPayments over $600 requiredto be reported <str<strong>on</strong>g>and</str<strong>on</strong>g> direct1sales over $5,0001THEN the payment is exemptfor . . .All exempt payees exceptfor 9Exempt payees 1 through 13.Also, a pers<strong>on</strong> registered underthe Investment Advisers Act of1940 who regularly acts as abrokerExempt payees 1 through 5Generally, exempt payees21 through 7See Form 1099-MISC, Miscellaneous Income, <str<strong>on</strong>g>and</str<strong>on</strong>g> its instructi<strong>on</strong>s.2However, the following payments made to a corporati<strong>on</strong> (including grossproceeds paid to an attorney under secti<strong>on</strong> 6045(f), even if the attorney is acorporati<strong>on</strong>) <str<strong>on</strong>g>and</str<strong>on</strong>g> reportable <strong>on</strong> Form 1099-MISC are not exempt frombackup withholding: medical <str<strong>on</strong>g>and</str<strong>on</strong>g> health care payments, attorneys’ fees, <str<strong>on</strong>g>and</str<strong>on</strong>g>payments for services paid by a federal executive agency.Part I. Taxpayer Identificati<strong>on</strong>Number (TIN)Enter your TIN in the appropriate box. If you are a residentalien <str<strong>on</strong>g>and</str<strong>on</strong>g> you do not have <str<strong>on</strong>g>and</str<strong>on</strong>g> are not eligible to get an SSN,your TIN is your IRS individual taxpayer identificati<strong>on</strong> number(ITIN). Enter it in the social security number box. If you do nothave an ITIN, see How to get a TIN below.If you are a sole proprietor <str<strong>on</strong>g>and</str<strong>on</strong>g> you have an EIN, you mayenter either your SSN or EIN. However, the IRS prefers that youuse your SSN.If you are a single-member LLC that is disregarded as anentity separate from its owner (see Limited liability company(LLC) <strong>on</strong> page 2), enter the owner’s SSN (or EIN, if the ownerhas <strong>on</strong>e). Do not enter the disregarded entity’s EIN. If the LLC isclassified as a corporati<strong>on</strong> or partnership, enter the entity’s EIN.Note. See the chart <strong>on</strong> page 4 for further clarificati<strong>on</strong> of name<str<strong>on</strong>g>and</str<strong>on</strong>g> TIN combinati<strong>on</strong>s.How to get a TIN. If you do not have a TIN, apply for <strong>on</strong>eimmediately. To apply for an SSN, get Form SS-5, Applicati<strong>on</strong>for a Social Security Card, from your local Social SecurityAdministrati<strong>on</strong> office or get this form <strong>on</strong>line at www.ssa.gov. Youmay also get this form by calling 1-800-772-1213. Use FormW-7, Applicati<strong>on</strong> for IRS Individual Taxpayer Identificati<strong>on</strong>Number, to apply for an ITIN, or Form SS-4, Applicati<strong>on</strong> forEmployer Identificati<strong>on</strong> Number, to apply for an EIN. You canapply for an EIN <strong>on</strong>line by accessing the IRS website atwww.irs.gov/businesses <str<strong>on</strong>g>and</str<strong>on</strong>g> clicking <strong>on</strong> Employer Identificati<strong>on</strong>Number (EIN) under Starting a Business. You can get <str<strong>on</strong>g>Forms</str<strong>on</strong>g> W-7<str<strong>on</strong>g>and</str<strong>on</strong>g> SS-4 from the IRS by visiting www.irs.gov or by calling1-800-TAX-FORM (1-800-829-3676).If you are asked to complete Form W-9 but do not have a TIN,write “Applied For” in the space for the TIN, sign <str<strong>on</strong>g>and</str<strong>on</strong>g> date theform, <str<strong>on</strong>g>and</str<strong>on</strong>g> give it to the requester. For interest <str<strong>on</strong>g>and</str<strong>on</strong>g> dividendpayments, <str<strong>on</strong>g>and</str<strong>on</strong>g> certain payments made with respect to readilytradable instruments, generally you will have 60 days to get aTIN <str<strong>on</strong>g>and</str<strong>on</strong>g> give it to the requester before you are subject to backupwithholding <strong>on</strong> payments. The 60-day rule does not apply toother types of payments. You will be subject to backupwithholding <strong>on</strong> all such payments until you provide your TIN tothe requester.Note. Entering “Applied For” means that you have alreadyapplied for a TIN or that you intend to apply for <strong>on</strong>e so<strong>on</strong>.Cauti<strong>on</strong>: A disregarded domestic entity that has a foreign ownermust use the appropriate Form W-8.Part II. Certificati<strong>on</strong>To establish to the withholding agent that you are a U.S. pers<strong>on</strong>,or resident alien, sign Form W-9. You may be requested to signby the withholding agent even if items 1, 4, <str<strong>on</strong>g>and</str<strong>on</strong>g> 5 below indicateotherwise.For a joint account, <strong>on</strong>ly the pers<strong>on</strong> whose TIN is shown inPart I should sign (when required). Exempt payees, see ExemptPayee <strong>on</strong> page 2.Signature requirements. Complete the certificati<strong>on</strong> as indicatedin 1 through 5 below.1. Interest, dividend, <str<strong>on</strong>g>and</str<strong>on</strong>g> barter exchange accountsopened before 1984 <str<strong>on</strong>g>and</str<strong>on</strong>g> broker accounts c<strong>on</strong>sidered activeduring 1983. You must give your correct TIN, but you do nothave to sign the certificati<strong>on</strong>.2. Interest, dividend, broker, <str<strong>on</strong>g>and</str<strong>on</strong>g> barter exchangeaccounts opened after 1983 <str<strong>on</strong>g>and</str<strong>on</strong>g> broker accounts c<strong>on</strong>sideredinactive during 1983. You must sign the certificati<strong>on</strong> or backupwithholding will apply. If you are subject to backup withholding<str<strong>on</strong>g>and</str<strong>on</strong>g> you are merely providing your correct TIN to the requester,you must cross out item 2 in the certificati<strong>on</strong> before signing theform.

Form W-9 (Rev. 10-2007) Page 43. Real estate transacti<strong>on</strong>s. You must sign the certificati<strong>on</strong>.You may cross out item 2 of the certificati<strong>on</strong>.4. Other payments. You must give your correct TIN, but youdo not have to sign the certificati<strong>on</strong> unless you have beennotified that you have previously given an incorrect TIN. “Otherpayments” include payments made in the course of therequester’s trade or business for rents, royalties, goods (otherthan bills for merch<str<strong>on</strong>g>and</str<strong>on</strong>g>ise), medical <str<strong>on</strong>g>and</str<strong>on</strong>g> health care services(including payments to corporati<strong>on</strong>s), payments to an<strong>on</strong>employee for services, payments to certain fishing boat crewmembers <str<strong>on</strong>g>and</str<strong>on</strong>g> fishermen, <str<strong>on</strong>g>and</str<strong>on</strong>g> gross proceeds paid to attorneys(including payments to corporati<strong>on</strong>s).5. Mortgage interest paid by you, acquisiti<strong>on</strong> orab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong>ment of secured property, cancellati<strong>on</strong> of debt,qualified tuiti<strong>on</strong> program payments (under secti<strong>on</strong> 529), IRA,Coverdell ESA, Archer MSA or HSA c<strong>on</strong>tributi<strong>on</strong>s ordistributi<strong>on</strong>s, <str<strong>on</strong>g>and</str<strong>on</strong>g> pensi<strong>on</strong> distributi<strong>on</strong>s. You must give yourcorrect TIN, but you do not have to sign the certificati<strong>on</strong>.What Name <str<strong>on</strong>g>and</str<strong>on</strong>g> Number To Give the RequesterFor this type of account:1. Individual2. Two or more individuals (jointaccount)3. Custodian account of a minor(Uniform Gift to Minors Act)4. a. The usual revocable savingstrust (grantor is also trustee)b. So-called trust account that isnot a legal or valid trust understate law5. Sole proprietorship or disregardedentity owned by an individualFor this type of account:6. Disregarded entity not owned by anindividual7. A valid trust, estate, or pensi<strong>on</strong> trust8. Corporate or LLC electingcorporate status <strong>on</strong> Form 88329. Associati<strong>on</strong>, club, religious,charitable, educati<strong>on</strong>al, or othertax-exempt organizati<strong>on</strong>10. Partnership or multi-member LLC11. A broker or registered nominee12. Account with the Department ofAgriculture in the name of a publicentity (such as a state or localgovernment, school district, orpris<strong>on</strong>) that receives agriculturalprogram paymentsGive name <str<strong>on</strong>g>and</str<strong>on</strong>g> SSN of:The individualThe actual owner of the account or,if combined funds, the first1individual <strong>on</strong> the accountThe minor 2The grantor-trustee 1The actual owner 1The owner 3The ownerGive name <str<strong>on</strong>g>and</str<strong>on</strong>g> EIN of:Legal entity 4The corporati<strong>on</strong>The organizati<strong>on</strong>The partnershipThe broker or nomineeThe public entity1List first <str<strong>on</strong>g>and</str<strong>on</strong>g> circle the name of the pers<strong>on</strong> whose number you furnish. If <strong>on</strong>ly <strong>on</strong>e pers<strong>on</strong><strong>on</strong> a joint account has an SSN, that pers<strong>on</strong>’s number must be furnished.2Circle the minor’s name <str<strong>on</strong>g>and</str<strong>on</strong>g> furnish the minor’s SSN.3You must show your individual name <str<strong>on</strong>g>and</str<strong>on</strong>g> you may also enter your business or “DBA”name <strong>on</strong> the sec<strong>on</strong>d name line. You may use either your SSN or EIN (if you have <strong>on</strong>e),but the IRS encourages you to use your SSN.4List first <str<strong>on</strong>g>and</str<strong>on</strong>g> circle the name of the trust, estate, or pensi<strong>on</strong> trust. (Do not furnish the TINof the pers<strong>on</strong>al representative or trustee unless the legal entity itself is not designated inthe account title.) Also see Special rules for partnerships <strong>on</strong> page 1.Note. If no name is circled when more than <strong>on</strong>e name is listed,the number will be c<strong>on</strong>sidered to be that of the first name listed.Secure Your Tax Records from Identity TheftIdentity theft occurs when some<strong>on</strong>e uses your pers<strong>on</strong>alinformati<strong>on</strong> such as your name, social security number (SSN), orother identifying informati<strong>on</strong>, without your permissi<strong>on</strong>, to commitfraud or other crimes. An identity thief may use your SSN to geta job or may file a tax return using your SSN to receive a refund.To reduce your risk:● Protect your SSN,● Ensure your employer is protecting your SSN, <str<strong>on</strong>g>and</str<strong>on</strong>g>● Be careful when choosing a tax preparer.Call the IRS at 1-800-829-1040 if you think your identity hasbeen used inappropriately for tax purposes.Victims of identity theft who are experiencing ec<strong>on</strong>omic harmor a system problem, or are seeking help in resolving taxproblems that have not been resolved through normal channels,may be eligible for Taxpayer Advocate Service (TAS) assistance.You can reach TAS by calling the TAS toll-free case intake lineat 1-877-777-4778 or TTY/TDD 1-800-829-4059.Protect yourself from suspicious emails or phishingschemes. Phishing is the creati<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> use of email <str<strong>on</strong>g>and</str<strong>on</strong>g>websites designed to mimic legitimate business emails <str<strong>on</strong>g>and</str<strong>on</strong>g>websites. The most comm<strong>on</strong> act is sending an email to a userfalsely claiming to be an established legitimate enterprise in anattempt to scam the user into surrendering private informati<strong>on</strong>that will be used for identity theft.The IRS does not initiate c<strong>on</strong>tacts with taxpayers via emails.Also, the IRS does not request pers<strong>on</strong>al detailed informati<strong>on</strong>through email or ask taxpayers for the PIN numbers, passwords,or similar secret access informati<strong>on</strong> for their credit card, bank, orother financial accounts.If you receive an unsolicited email claiming to be from the IRS,forward this message to phishing@irs.gov. You may also reportmisuse of the IRS name, logo, or other IRS pers<strong>on</strong>al property tothe Treasury Inspector General for Tax Administrati<strong>on</strong> at1-800-366-4484. You can forward suspicious emails to theFederal Trade <str<strong>on</strong>g>Commissi<strong>on</strong></str<strong>on</strong>g> at: spam@uce.gov or c<strong>on</strong>tact them atwww.c<strong>on</strong>sumer.gov/idtheft or 1-877-IDTHEFT(438-4338).Visit the IRS website at www.irs.gov to learn more aboutidentity theft <str<strong>on</strong>g>and</str<strong>on</strong>g> how to reduce your risk.Privacy Act NoticeSecti<strong>on</strong> 6109 of the Internal Revenue Code requires you to provide your correct TIN to pers<strong>on</strong>s who must file informati<strong>on</strong> returns with the IRS to report interest,dividends, <str<strong>on</strong>g>and</str<strong>on</strong>g> certain other income paid to you, mortgage interest you paid, the acquisiti<strong>on</strong> or ab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong>ment of secured property, cancellati<strong>on</strong> of debt, orc<strong>on</strong>tributi<strong>on</strong>s you made to an IRA, or Archer MSA or HSA. The IRS uses the numbers for identificati<strong>on</strong> purposes <str<strong>on</strong>g>and</str<strong>on</strong>g> to help verify the accuracy of your tax return.The IRS may also provide this informati<strong>on</strong> to the Department of Justice for civil <str<strong>on</strong>g>and</str<strong>on</strong>g> criminal litigati<strong>on</strong>, <str<strong>on</strong>g>and</str<strong>on</strong>g> to cities, states, the District of Columbia, <str<strong>on</strong>g>and</str<strong>on</strong>g> U.S.possessi<strong>on</strong>s to carry out their tax laws. We may also disclose this informati<strong>on</strong> to other countries under a tax treaty, to federal <str<strong>on</strong>g>and</str<strong>on</strong>g> state agencies to enforce federaln<strong>on</strong>tax criminal laws, or to federal law enforcement <str<strong>on</strong>g>and</str<strong>on</strong>g> intelligence agencies to combat terrorism.You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold 28% of taxable interest, dividend, <str<strong>on</strong>g>and</str<strong>on</strong>g> certain otherpayments to a payee who does not give a TIN to a payer. Certain penalties may also apply.