The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

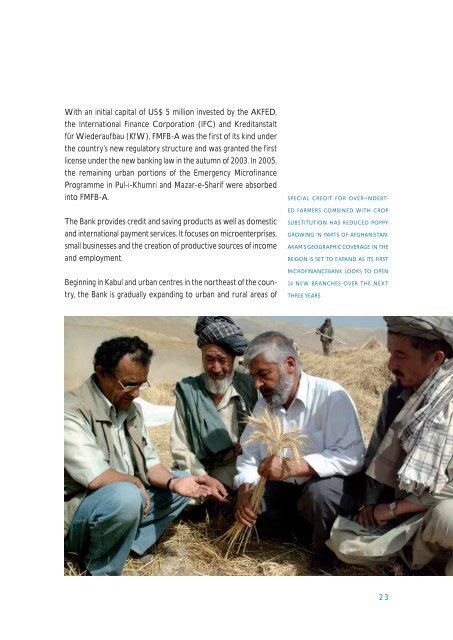

With an initial capital of US$ 5 million invested by the AKFED,the International Finance Corporation (IFC) and Kreditanstaltfür Wiederaufbau (KfW), FMFB-A was the first of its kind underthe country’s new regulatory structure and was granted the firstlicense under the new banking law in the autumn of 2003. In <strong>2005</strong>,the remaining urban portions of the Emergency <strong>Microfinance</strong>Programme in Pul-i-Khumri and Mazar-e-Sharif were absorbedinto FMFB-A.<strong>The</strong> Bank provides credit and saving products as well as domesticand international payment services. It focuses on microenterprises,small businesses and the creation of productive sources of incomeand employment.Beginning in Kabul and urban centres in the northeast of the country,the Bank is gradually expanding to urban and rural areas ofSPECIAL CREDIT FOR OVER-INDEBT-ED FARMERS COMBINED WITH CROPSUBSTITUTION HAS REDUCED POPPYGROWING IN PARTS OF AFGHANISTAN.AKAM’S GEOGRAPHIC COVERAGE IN THEREIGON IS SET TO EXPAND AS ITS FIRSTMICROFINANCEBANK LOOKS TO OPEN14 NEW BRANCHES OVER THE NEXTTHREE YEARS.23