The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

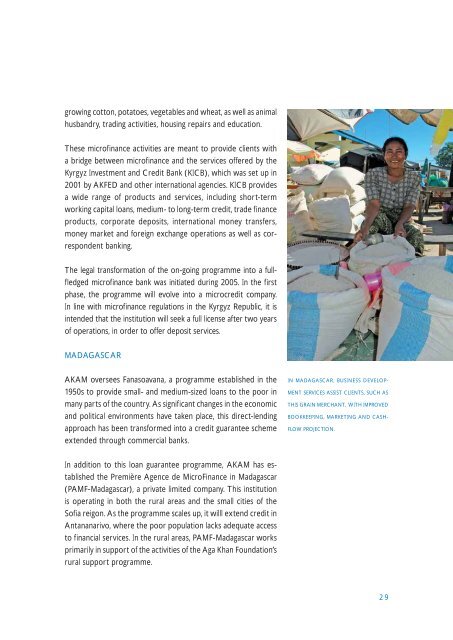

growing cotton, potatoes, vegetables and wheat, as well as animalhusbandry, trading activities, housing repairs and education.<strong>The</strong>se microfinance activities are meant to provide clients witha bridge between microfinance and the services offered by theKyrgyz Investment and Credit Bank (KICB), which was set up in2001 by AKFED and other international agencies. KICB providesa wide range of products and services, including short-termworking capital loans, medium- to long-term credit, trade financeproducts, corporate deposits, international money transfers,money market and <strong>for</strong>eign exchange operations as well as correspondentbanking.<strong>The</strong> legal trans<strong>for</strong>mation of the on-going programme into a fullfledgedmicrofinance bank was initiated during <strong>2005</strong>. In the firstphase, the programme will evolve into a microcredit company.In line with microfinance regulations in the Kyrgyz Republic, it isintended that the institution will seek a full license after two yearsof operations, in order to offer deposit services.MADAGASCARAKAM oversees Fanasoavana, a programme established in the1950s to provide small- and medium-sized loans to the poor inmany parts of the country. As significant changes in the economicand political environments have taken place, this direct-lendingapproach has been trans<strong>for</strong>med into a credit guarantee schemeextended through commercial banks.IN MADAGASCAR, BUSINESS DEVELOP-MENT SERVICES ASSIST CLIENTS, SUCH ASTHIS GRAIN MERCHANT, WITH IMPROVEDBOOKKEEPING, MARKETING AND CASH-FLOW PROJECTION.In addition to this loan guarantee programme, AKAM has establishedthe Première Agence de MicroFinance in Madagascar(PAMF-Madagascar), a private limited company. This institutionis operating in both the rural areas and the small cities of theSofia reigon. As the programme scales up, it willl extend credit inAntananarivo, where the poor population lacks adequate accessto financial services. In the rural areas, PAMF-Madagascar worksprimarily in support of the activities of the <strong>Aga</strong> <strong>Khan</strong> Foundation’srural support programme.29