The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

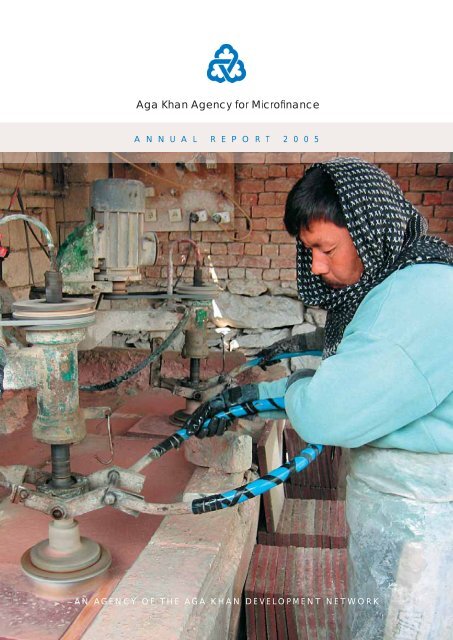

<strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong> <strong>for</strong> Microfi nanceA N N U A L R E P O R T 2 0 0 5AN AGENCY OF THE AGA KHAN DEVELOPMENT NETWORK

COVER: EBRAHIM MOHAMMED, A TILE-MAKER, HAS TAKEN SEVERAL LOANS, STARTING WITH US$ 500 IN 2002, TO BUY MACHINERY ANDEXPAND HIS BUSINESS. HE NOW HAS SIX EMPLOYEES, ONE OF WHOM IS SHOWN POLISHING TILES WITH MACHINERY PURCHASED WITHA LOAN. “EVENTUALLY,” EBRAHIM SAYS, “I WANT TO SELL MY TILES ACROSS AFGHANISTAN.”

<strong>2005</strong>CONTENTS25811151618203940444547THE AGA KHAN AGENCY FOR MICROFINANCE:INAUGUR AL STATEMENTSTHE YEAR IN REVIEWTHE AGA KHAN AGENCY FOR MICROFINANCEWORKING IN CONCERT WITH THE AGA KHANDEVELOPMENT NETWORKOBJECTIVES AND PRINCIPLESFINANCIAL SERVICES FOR THE POORTHE MICROFINANCE “LADDER”COUNTRY REVIEWSTHE MICROINSURANCE INITIATIVEFINANCIAL SUMMARYPROGRAMME PARTNERSFACTS AT A GLANCECONTACTS1

THE AGA KHAN AGENCY FOR MICROFINANCE:INAUGURAL STATEMENTSHis Highness the <strong>Aga</strong> <strong>Khan</strong>, Chairman, <strong>Aga</strong> <strong>Khan</strong> Development NetworkOften when we speak of microfinance, we think of small loans. But microfinance is moving beyondmicrocredit and now includes a range of new products and services to meet the needs ofthe poor. Simply put, the poor in the developing world require access to just about every kindof financial product and social service that individuals or small-enterprise owners require in thedeveloped world.<strong>The</strong> <strong>Aga</strong> <strong>Khan</strong> Development Network agencies have been involved in microcredit <strong>for</strong> more than60 years. During that time, a variety of institutions offering a range of products tailored to specificneeds have been established in many countries. We offer small saving accounts, housing loans andmicroinsurance <strong>for</strong> individuals. We provide international money transfer and short working capitalloans to small businesses. We have also extended loans <strong>for</strong> education and health care, which webelieve can be important ways to break down the barriers to access to those services <strong>for</strong> thepoor. It is important to note that the issue is not only the provision of services, but making themaccessible to the poor.In the process of offering these services, we have discovered that the poor are bankable. Ourloan-loss experience of two percent is less than many of the small business portfolios of Westerncommercial banks. We must be prepared to bank good character, good ideas and the willingnessto work hard.If we do bank those attributes, microfinance can be a <strong>for</strong>midable tool <strong>for</strong> poverty alleviation in largeparts of the developing world. Its versatility allows it to be adapted to the needs and circumstancesof the poor in urban and in rural environments. I am convinced we have only begun to tap intoits potential.22 February <strong>2005</strong>, Palais des Nations, Geneva, Switzerland2

<strong>2005</strong>James Wolfensohn, Former President, <strong>The</strong> World BankWhat is remarkable about the <strong>Aga</strong> <strong>Khan</strong> Development Network is that they have taken their experienceof 60 years and are <strong>for</strong>malising it in a way which essentially takes us to the next level of microcredit.We have gone beyond lending women US$ 50 and US$ 100 <strong>for</strong> chickens and sewing machines.Today, we are probably reaching 80 million people. If you think that four or five people are dependenton those 80 million people, you find that the impact of microcredit is now approaching 400to 500 million people.This year, the UN Year of Microcredit, is the coming of age of microcredit. We have gone beyondthe original perception to something that is becoming professional. <strong>The</strong>re<strong>for</strong>e, the governmentsneed to set up a framework in which microfinance can be established within the normal financialcommunity. Secondly, we need to set up credit bureaus to try and take advantage of the knowledgeof the credit of poor people.Thirdly, we need to diversify the types of products that are now available in terms of insurance,business loans, educational loans and work on cultural-related activities. In a sense, we are takingwhat was not expected, which is a financial product, and making it available not just to the rich, butto the poor who need it the most. It is work like that being done by the <strong>Aga</strong> <strong>Khan</strong> and this newentity that I think deserves all our support.From being a fringe activity, something that was done in Bangladesh and a few other places, we arenow finding that microcredit is really addressing the needs of five billion people in the developingworld… As we look at the next 25 years, when we will see an addition of two billion people tothe developing world, microcredit becomes not a fringe activity but a central activity.22 February <strong>2005</strong>, Palais des Nations, Geneva, Switzerland3

OVER 4,000 WOMEN HAVE BEEN PROVIDEDWITH CREDIT PRODUCTS AND SERVICES BYWOMEN CREDIT OFFICERS AT THE FIRSTMICROFINANCEBANK IN AFGHANISTANAND AT THE AFGHANISTAN RURAL MICRO-FINANCE PROGRAMME.4

<strong>2005</strong>THE YEAR IN REVIEW<strong>The</strong> year <strong>2005</strong> has been momentous <strong>for</strong> the <strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong> <strong>for</strong><strong>Microfinance</strong> (AKAM). Legally established in late 2004, it was <strong>for</strong>mallyinaugurated in February <strong>2005</strong> by His Highness the <strong>Aga</strong> <strong>Khan</strong> and JamesWolfensohn, then President of the World Bank.AKAM brings together, under one umbrella, all the microfinanceactivities previously managed by various entities within the <strong>Aga</strong><strong>Khan</strong> Development Network. AKAM’s mandate is to alleviatepoverty, diminish the vulnerability of poor populations and reduceeconomic and social exclusion. Underpinning this mandate,AKAM’s guiding principles are to achieve long-term sustainability,provide a broad range of services, expand its geographical outreachand realise substantial impact.Within this context, AKAM is pleased to report that <strong>2005</strong> wascharacterised by significant growth. While the number of borrowersgrew from 25,000 to 56,000 and the number of depositorsgrew from 20,000 to 31,000, AKAM’s overall loan portfoliogrew from US$ 14.3 million to US$ 35.5 million. Deposits grewfrom US$ 11.1 million to US$ 30.8 million. <strong>The</strong> capacity to deliverfinancial services to the poor also grew as the overall staff sizeincreased from 528 to 888 and the number of branches grewfrom 50 to 103. AKAM also began operations in Burkina Faso andMali, thereby bringing the total number of countries in which the<strong>Agency</strong> is actively involved to 12. In addition to Central and SouthAsia, the Middle East and Eastern Africa, these developments addWest Africa as a new regional focus <strong>for</strong> AKAM.DEC. 2004DEC. <strong>2005</strong><strong>The</strong> First MicroFinanceBank in Pakistan, established in 2002, nowhas a five-diamond public disclosure status on the MIX Market,BORROWERS25,00056,000a global microfinance plat<strong>for</strong>m that provides in<strong>for</strong>mation on mi-LOAN PORTFOLIO IN US$14.3 MILLION35.5 MILLIONcrofinance to sector actors and the public at large. <strong>The</strong> Bank inPakistan won the <strong>2005</strong> Consultative Group to Assist the PoorDEPOSITORS20,00031,000(CGAP) Financial Transparency Award, making it one of fiveDEPOSITS IN US$11.1 MILLION30.8 MILLIONmicrofinance institutions internationally to win this prestigiousaward. <strong>The</strong> First MicroFinanceBanks in Afghanistan and TajikistanBRANCHES50103also became sustainable in the course of <strong>2005</strong> – less than 18STAFF528888months after starting operations. Both of these banks now have5

AKAM AND THE AKDN AKDN Countries of ActivityAKAM Countries of Activity6

Afghanistan, they have supported returning refugees to start andexpand businesses. Residents of one of the poorest districts ofCairo have improved and rehabilitated their homes with loansfrom AKAM. <strong>The</strong> microfinance programme in Syria is contributingto the development of civil society through unique partnershipsbetween the Ministry of Health, the World Health Organisationand various village health organisations.In South Asia, AKAM’s programmes have helped indenturedworkers break the grip of multigenerational debts and liberatethemselves from perpetual servitude. Loans have helped Tajikfarmers expand yields of critical foodstuffs and enabled entrepreneursto open vegetable processing plants, hardware stores,pharmacies and bakeries.At the end of <strong>2005</strong>, AKAM was operating in over 100 branchesand loan offices in South and Central Asia, the Middle East andsub-Saharan Africa. Its then 900-strong work <strong>for</strong>ce had collectivelydistributed over 116,000 loans totalling over US$ 92 million tobeneficiaries.In all the contexts in which they operate, AKAM’s microfinanceprogrammes, institutions and banks aim to achieve a level oflong-term sustainability that covers both operational costs andcontributes to expansion in the future. In this process, emphasisis placed on enhancing the quality of financial services throughtransparent and detailed lending procedures, as well as the use ofbest practices that ensure financial discipline and efficiency.To maximise the impact <strong>for</strong> beneficiaries, AKAM has devised avariety of institutional approaches and instruments that facilitateaccess while addressing different contexts, cultures and local requirements.<strong>The</strong>se ef<strong>for</strong>ts are intended to ensure that resourcesflow to the poor and excluded. This process is greatly strengthenedby working in concert with other agencies of the AKDNas well as governments, international agencies and professionalorganisations. Such collaborations allow AKAM not only to reachgreater numbers of vulnerable populations, but also to developnew services and products that are appropriate and relevant.ABOVE: IN DAROOTKORGON, IN THEKYRGYZ REPUBLIC, A FOUNDRY RECEIVEDA SMALL LOAN FOR PURCHASING MATERI-ALS NEEDED TO FABRICATE VALVES USEDIN DIKES.BELOW: AKAM HAS PROVIDED CREDITFOR TRAINING PROGRAMMES AS PARTOF A BROAD INTEGRATED DEVELOPMENTPROGRAMME TO IMPROVE HEALTHCAREIN SALAMIEH, SYRIA.9

WORKING IN CONCERT WITHTHE AGA KHAN DEVELOPMENT NETWORKDespite the existence of more than 12,000 microfinance institutionsin the world, the promise of microfinance faces severalchallenges. Chief among these is the application of microfinance inisolation from social and cultural issues. Without addressing otherdetermining factors, the effect of microfinance is circumscribed,especially where infrastructure is poor, trade is impeded andtransaction costs are high. For example, when an entrepreneurcreates a new product or a farmer grows a surplus, he or shemight not be able to take the output to a market due to a lack oftransport. Other factors such as armed conflict, a lack of accessto basic healthcare and education, endemic corruption or a weakenabling environment can inhibit entrepreneurial activity.As an agency of the <strong>Aga</strong> <strong>Khan</strong> Development Network, AKAMis well-placed to benefit from the complementary developmentactivities and initiatives of its partner agencies. Indeed, as the heirof the microfinance activities of the <strong>Aga</strong> <strong>Khan</strong> Fund <strong>for</strong> EconomicDevelopment, the <strong>Aga</strong> <strong>Khan</strong> Foundation and the <strong>Aga</strong> <strong>Khan</strong> Trust<strong>for</strong> Culture, AKAM enjoys strong support and working relationshipswithin AKDN.Founded and guided by His Highness the <strong>Aga</strong> <strong>Khan</strong>, AKDN bringstogether a number of international development agencies, institutionsand programmes that work primarily in the poorest partsof South and Central Asia, Africa and the Middle East. All AKDNagencies are non-denominational and conduct their programmeswithout regard to faith, origin or gender. <strong>The</strong>y all operate in concertwith the other agencies of the Network.<strong>The</strong> <strong>Aga</strong> <strong>Khan</strong> Foundation (AKF) focuses on rural development,health, education, environment and the strengthening of civil society,with a special emphasis on the needs of rural communities inmountainous and other resource-poor areas. Its community-baseddevelopment approach, first developed in Pakistan and India, hasbeen replicated in many other environments in Asia and Africa.ABOVE: A SMALL VILLAGE COMMUNITYIN JALALABAD, AFGHANISTAN RECEIVEDMICROFINANCE ASSISTANCE TO BUILD AGIRLS SCHOOL.BELOW: RICE PRODUCTION HAS IN-CREASED IN MADAGASCAR AS MUCH AS600 PERCENT THANKS TO A COMBINA-TION OF AGRICULTURAL INPUTS ANDMICROFINANCE.LEFT: TO INCREASE INCOME FROM NON-AGRICULTURAL ACTIVITIES, AKAM OFFERSSMALL LOANS FOR THE PURCHASE OF LIVE-STOCK AND RELATED PROJECTS, SUCH ASTHIS VETERINARY HOSPITAL IN TAJIKISTAN,WHICH BORROWED US$ 1,000 TO BUYMEDICAL SUPPLIES.11

<strong>Aga</strong> <strong>Khan</strong> Education Services (AKES) aims to diminish obstaclesto educational access, quality and achievement. It operates morethan 300 schools and advanced educational programmes at thepre-school, primary, secondary and higher secondary levels inBangladesh, India, Kenya, Kyrgyz Republic, Pakistan, Tajikistan,Tanzania and Uganda. It emphasises student-centred teachingmethods, field-based teacher training and school improvement.<strong>Aga</strong> <strong>Khan</strong> Health Services (AKHS) provides primary and curativehealth care in Afghanistan, India, Kenya, Pakistan, Tajikistanand Tanzania through 237 health centres, dispensaries, hospitals,diagnostic centres and community health outlets. <strong>Annual</strong>ly, AKHSprovides primary health care to one million beneficiaries and handles1.2 million patient visits. AKHS also works with governmentsand other institutions to improve national health systems.<strong>Aga</strong> <strong>Khan</strong> Planning and Building Services(AKPBS) assists communitieswith village planning, natural hazard mitigation, environmentalsanitation, water supply systems and improved designand construction of both housing and public buildings. It providesmaterial and technical expertise, training and construction managementservices to rural and urban areas.ABOVE: AKES OPERATES OVER 300SCHOOLS, INCLUDING 82 IN INDIA.MIDDLE: ALLTEX, AN AKFED PROJECTCOMPANY, MANUFACTURES GARMENTSTHAT ARE EXPORTED.BELOW AKTC’S RESTORATION PROJECTSINCLUDE PARTS OF THE ANCIENT CITA-DEL OF ALEPPO IN SYRIA.<strong>The</strong> <strong>Aga</strong> <strong>Khan</strong> Fund <strong>for</strong> Economic Development (AKFED)is theonly <strong>for</strong>-profit agency in the Network. Often acting in collaborationwith local and international partners, AKFED takes bold butcalculated steps to invest in fragile and complex environments. Itmobilises investment <strong>for</strong> the construction, rehabilitation or expansionof infrastructure, sets up sustainable financial institutions,builds economically viable enterprises that provide essential goodsand services and creates employment opportunities.<strong>The</strong> <strong>Aga</strong> <strong>Khan</strong> Trust <strong>for</strong> Culture (AKTC) encompasses the triennial<strong>Aga</strong> <strong>Khan</strong> Award <strong>for</strong> Architecture; the Historic Cities SupportProgramme, which undertakes conservation and rehabilitationin ways that act as catalysts <strong>for</strong> development; the HumanitiesProject, which develops humanities curricula <strong>for</strong> use in universitiesin Central Asia; the Music Initiative, which preserves and12

promotes the traditional music of Central Asia; ArchNet.org,an online archive of materials on architecture and related issues;the <strong>Aga</strong> <strong>Khan</strong> Program <strong>for</strong> Islamic Architecture, which is basedat Harvard and MIT; and the Museums Project, which is creatingmuseums in Toronto and Zanzibar.<strong>The</strong> <strong>Aga</strong> <strong>Khan</strong> University (AKU) is a major centre <strong>for</strong> education,training and research. Chartered as Pakistan’s first private internationaluniversity in 1983, AKU has made significant contributionson a range of development challenges. It has teaching sitesin Afghanistan, Kenya, Pakistan, Syria, Tanzania, Uganda and theUnited Kingdom. With the establishment of the Faculty of HealthSciences, the Institute <strong>for</strong> Educational Development, the Institute<strong>for</strong> the Study of Muslim Civilisations and the planned establishmentof the Faculty of Arts and Sciences, AKU is rapidly becoming acomprehensive institution of higher education.<strong>The</strong> University of Central Asia (UCA), chartered in 2000, is locatedon three campuses: in Khorog, Tajikistan; Tekeli, Kazakhstan;and Naryn, Kyrgyz Republic. UCA’s mission is to foster economicand social development in the mountain regions of Central Asia.It will offer a Master of Arts degree in mountain development,a Bachelor of Arts programme based on the liberal arts and sciencesand non-degree continuing education courses.FOCUS Humanitarian Assistance, an AKDN affiliate, providesemergency relief supplies and services to victims of conflict andnatural disasters. It also works within the AKDN to help peoplerecover from these events and make the transition to long-termdevelopment and self-reliance.<strong>The</strong>se institutional connections have proven essential to creatingthe critical mass of development activity necessary to achievelasting improvements in the quality of life.ABOVE: AKHS OPERATES 325 HEALTHCENTRES AND HOSPITALS.MIDDLE: WITH CAMPUSES IN TAJIKISTAN,KYRGYZSTAN AND KAZAKHSTAN, UCA ISDEDICATED TO FOSTERING DEVELOPMENTIN MOUNTAIN REGIONS.BELOW: FOCUS HUMANITARIAN ASSIST-ANCE PROVIDED AID WITHIN HOURS OFTHE PAKISTAN EARTHQUAKE OF <strong>2005</strong>.13

OBJECTIVES AND PRINCIPLES<strong>The</strong> underlying objectives of AKAM are to alleviate poverty, diminishthe vulnerability of poor populations and reduce economicand social exclusion. This endeavour is governed by the followingprinciples, which apply universally to the <strong>Agency</strong>’s programmes,institutions and banks:A Broad Range of Services: To reduce vulnerability to financialrisks, AKAM offers a range of microfinance services, includingcredit, microinsurance, savings, housing credits and educationloans, among others.Assessment of Impact: Through careful targeting, monitoringand evaluation, AKAM works to maximise the socio-economicbenefits of its services on poor communities.Sustainability: To ensure that financial services survive and growover the long term, AKAM seeks to cover inflation-adjustedcosts through revenues and contribute to expanding the rangeof services and geographical coverage.Integrated Development: AKAM works in concert with otherAKDN agencies and external organisations to integrate microfinancewith complementary development activities.Easy Access and Flexible Solutions: AKAM has devised a varietyof institutional approaches and instruments that facilitate accessand address different contexts, cultures and local requirements.Efficiency and Transparency: A major focus of AKAM staff is toenhance the quality of credit through clear and detailed lending procedures,well-documented manuals, properly trained staff and theuse of best practices ensuring financial discipline and cost control.Evolution: As a microfinance programme grows, AKAM nurturesits evolution as required by the demands and circumstances of thelocal context, from small microfinance initiatives to full-fledgedmicrofinance banks.Business Development Services: Loans are accompanied bytraining in basic business concepts so borrowers can becomefinancially disciplined, self-reliant entrepreneurs.Partnerships: AKAM works closely with governments, internationalagencies and professional organisations to ensure thatit contributes to and benefits from best practice and expertisewithin the industry.LEFT: IN EGYPT, TRAINEE PLASTER-WORKERS HELP RESTORE THE WINDOWSOF MONUMENTS IN DARB AL-AHMAR,A POOR AREA OF CAIRO, AS PART OF ABROAD PROGRAMME THAT INCLUDESLOANS FOR HOUSING RESTORATION.15

FINANCIAL SERVICES FOR THE POOR<strong>The</strong> array of services and products that AKAM’s programmes,institutions and banks provide is continually expanding to meetneeds. Research initiatives are geared toward developing newservices that are sustainable, appropriate and high-quality. Emphasisis placed on vulnerable groups, focussing on women in particular.Currently, this range of services includes the following:ABOVE: IN PAKISTAN, SERVICES ARE AVAIL-ABLE IN THE REMOTE TOWN OF SHIGAR.BELOW: FOR HANY FATTOH IN CAIRO,LOANS HAVE HELPED HIM TO BUY NEEDEDMATERIALS, EXPAND HIS BUSINESS ANDRAISE HIS INCOME.Income generation loans: Credit financing ranging from US$ 10to US$ 5,000 is available <strong>for</strong> start-ups, re-starts and the expansionof current entrepreneurial and other income-generating activities.Projects financed include farming inputs and machinery, livestockrearing and breeding, shoemaking, furniture, handicraft, retail enterprises,cottage industries, tourism initiatives, small restaurants,mini-marts, hairdressers, internet cafes and many other <strong>for</strong>ms ofentrepreneurial activity.Health, education, habitat and other loans: In addition to providingloans specifically directed towards income generation, AKAMprovides loans to finance health care, education, habitat and housingimprovements, land acquisition and construction, retirement ofusurious multigenerational debt and, in Afghanistan, the financingof alternative livelihoods in place of the cultivation of poppy.Savings: A variety of savings products including current accountsand savings accounts are offered by both banks and some microfinanceinstitutions. <strong>The</strong>se allow <strong>for</strong> multiple withdrawals and termdeposits of various maturities. In most cases, deposit accountscan be opened and maintained with less than one dollar. Savingsare mobilised from individuals, groups and institutions.Microinsurance: Some of AKAM’s banks are also providing microinsuranceproducts to borrowers. In Pakistan, <strong>for</strong> example,two types of microinsurance policies are offered, often as abundle, with small fees of less than US$ 2 per annum: a policy inwhich the insurance company would pay the outstanding balancein case of death or permanent disability of a borrower and apolicy which provides a cash pay-out to the family of a borrower<strong>for</strong> funeral-related costs in the event of his or her death. A new16

initiative in microinsurance is seeking to develop products thatspecifically seek to safeguard the poor against loss of savings andincome as a result of family catastrophes such as death, long-termhospitalisation and business or crop loss.Microleasing: In some countries, AKAM is providing microleasingservices, enabling clients to purchase fixed assets and businessequipment <strong>for</strong> productive purposes. As they involve large capitalexpenditures, these loans can range from US$ 500 to US$ 10,000and be repaid within six months to three years.ABOVE: AKAM LOAN OFFICERS TRAVELMoney Transfer and Remittance Services: AKAM’s banks alsoprovide money transfer and remittance services to clients. Thisservice allows clients to transfer money inexpensively from onecity to another within a country or to remit funds internationallythrough the Swift payment system. <strong>The</strong>se services are becomingchannels <strong>for</strong> proposing microcredit products to overseas clients,helping them to invest productively at home from abroad.TO REMOTE MOUNTAINOUS VILLAGES,SUCH AS CHON ALAI, KYRGYZSTAN.AKAM’S PROGRAMME CONTINUES TOGROW RAPIDLY IN THE COUNTRY.Small Business Loans: <strong>The</strong> most successful businesses will eventuallyevolve into small enterprises, which are more sophisticated,employ people outside the proprietor’s family and producea broader range of quality products that are sold in largergeographic areas. <strong>Microfinance</strong> institutions are ideally placed toreduce the financing gap that these budding small and mediumenterprises (SME) face be<strong>for</strong>e reaching a scale more attuned tothe mainstream financial markets. In collaboration with DeutscheEntwicklung Gesellschaft (DEG), AKAM is there<strong>for</strong>e piloting anSME Programme in Afghanistan. Once tested, this is expected tobecome a mainstream activity <strong>for</strong> the First MicroFinanceBanks.RIGHT: BY GRANTING CREDIT TO ENTREPRENEURS FOR THEEXPANSION OF PRODUCTIVE INFRASTRUCTURE, SUCH AS THISCEMENT AND BRICK FACTORY, AKAM’S PROGRAMME IN SYRIAHELPS RAISE INCOMES AND REDUCE UNEMPLOYMENT.17

THE MICROFINANCE “LADDER”AKAM’s philosophy in the delivery of microfinance is to deployinstitutional vehicles that are appropriate to the local context andaccount <strong>for</strong> the size and scope of the intended beneficiary communities.As these beneficiaries advance in their development andbegin to require a wider range of services, the institutionas alsoadvance in their development. This process involves an evolution,which can be divided into three categories:1. Entry-level microfinance programmes, usually at the communitylevel, which are designed to give people the means to startor expand economic activity and, over time, diversify beyondtraditional microenterprises.2. Autonomous microfinance institutions with a more <strong>for</strong>malstructure and a network of sub-branches.3. <strong>Microfinance</strong> banks, which are regulated entities that lend tomicro and small enterprises and offer an array of services comparableto, and in some cases even broader than, those of localcommercial banks.While microfinance activities are typically delivered through smallintegrated programmes in the initial years, these integrated programmesevolve over time into self-standing, legally independententities and eventually into regulated microfinance banks offeringa range of services. Bank structures are generally preferred<strong>for</strong> long-term delivery of microfinance services because of theirrobust institutional arrangements and their capacity to mobilisea broader range of financial resources.ABOVE: ENTRY-LEVEL PROGRAMMESSUPPORT AND HELP PEOPLE START OREXPAND ECONOMIC ACTIVITIES.MIDDLE: MICROFINANCE INSTITUTIONSARE OFTEN ABLE TO PROVIDE BOTHInstitutional evolution is there<strong>for</strong>e accompanied by portfoliogrowth and the broadening of services. In the process, beneficiariesbecome aware that the institutional changes underway offergreater benefits to them in the <strong>for</strong>m of a wide range of servicesand access to larger funding amounts, among others.CREDIT AND SAVINGS SERVICES.BELOW: MICROFINANCE BANKS AREREGULATED ENTITIES THAT OFFER ANARRAY OF SERVICES COMPARABLE TOCOMMERCIAL BANKS.RIGHT: NUMEROUS WOMEN'S GROUPSIN THE KYRGYZ REPUBLIC HAVE RECEIVEDHANDICRAFT TRAINING AND LOANS.18

COUNTRY REVIEWSAKAM’s microfinance initiatives range from village lendingcooperatives to self-standing microfinance institutions to fullfledgedmicrofinance banks. <strong>The</strong>se activities currently operatein Afghanistan, Burkina Faso, Egypt, India, Kazakhstan, Kenya,Kyrgyz Republic, Madagascar, Mali, Mozambique, Pakistan, Syria,Tajikistan, Tanzania and Zanzibar. Often they are part of a widerintegrated development strategy being implemented by AKDNwithin each country. In addition to providing financial services tothe poor, they may include business or technical advisory/trainingextension services and business development programmes thatwork directly with local entrepreneurs.AKAM’S ACTIVITIES IN MALI WILL FOCUS,IN THE EARLY STAGES, ON THE MOPTIREGION, WHERE THERE IS SCOPE FORENTERPRISE, HOUSING REHABILITATIONAND AGRICULTURAL LOANS.Several of these programmes were initiated by the AKF’s ruraldevelopment programmes, including well developed savingsand credit programmes in northern Pakistan (<strong>Aga</strong> <strong>Khan</strong> RuralSupport Programme), Tajikistan (Mountain Societies Develop-20

ment Support Programme) and India (<strong>Aga</strong> <strong>Khan</strong> Rural SupportProgramme (India)). <strong>The</strong> focus of these programmes has beento target areas and populations that are vulnerable and do nothave access to <strong>for</strong>mal credit.In addition, AKAM oversees microfinance activities, includingsupport <strong>for</strong> credit cooperatives in poorer rural and urban communitiesin India and Pakistan. It has taken over the EnterpriseSupport Facility, a microfinance and small business support programmethat has been operational in Tajikistan since 1996. <strong>The</strong>Facility trains entrepreneurs and finances a wide range of microand small-scale businesses ranging from farming, cottage industriesand agroprocessing to services and commerce.Microcredit, provided within the context of the AKTC’s HistoricCities Support Programme, is supervised by AKAM. <strong>The</strong> HistoricCities Support Programme uses microfinance as a tool to aid inthe revitalisation of poor neighbourhoods in conjunction withother projects <strong>for</strong> architectural restoration, conservation andurban development. <strong>The</strong>se ef<strong>for</strong>ts consist of activities rangingfrom the provision of rehabilitation loans to help restore housesdilapidated by years of neglect, to business development programmesunder which competitive credit is provided to smallscaleentrepreneurs in the areas surrounding rehabilitated andredeveloped cultural sites.LENDING TO WOMEN’S GROUPS IN EASTAFRICA HAS PROVEN TO BE AN EFFECTIVETOOL IN POVERTY ALLEVIATION.AKAM currently operates the First MicroFinanceBanks (FMFB) inAfghanistan, Pakistan, Tajikistan and a steadily increasing number ofcountries. <strong>The</strong>se banks are <strong>for</strong>mally regulated by the Central Bankof the countries in which they operate and direct their servicesto the poor and their micro and small enterprises.Reaching beneficiaries through geographically distributed branchesand mobile banks, this bank network offers an array of servicescomparable to – and in some cases even broader than – thoseof commercial banks, including credit, savings, payment services,money transfers, microleasing and microinsurance, among others.<strong>The</strong> banks also support clients who have reached a higher level21

of financial stability and have developed into small and mediumenterprises. <strong>The</strong> aim of these banks is to operate at internationalstandards, conserve the capital base and reach sustainability asrapidly as possible.AFGHANISTANFollowing the collapse of the Taliban regime in Afghanistan, AKDNestablished the Emergency Microcredit Programme, which wasaimed at improving the economic security of the population,particularly displaced persons, and offering credit <strong>for</strong> start-ups,re-starts and the expansion of income-generating activities.PRESENT IN ELEVEN PROVINCES INAFGHANISTAN, AKAM’S PROGRAMMESSERVED 26,623 RURAL, PERI-URBAN ANDURBAN BORROWERS WITH AN ARRAYOF LOAN PRODUCTS VALUED, IN <strong>2005</strong>,AT OVER US$ 25 MILLION. THIS FIGUREREPRESENTED OVER HALF OF THE TO-TAL DOLLAR VALUE OF MICROFINANCELOANS DISBURSED IN THE COUNTRYDURING THE YEAR.AKAM’s long-term plan in Afghanistan, launched in 2003-2004,was built around the establishment, in parallel, of the First Micro-FinanceBank in Afghanistan (FMFB-A) and the Afghanistan RuralMicrocredit Programme (ARMP). FMFB-A was first deployedin Afghanistan’s main urban centres, with a view that the urbanbranches would eventually serve as regional hubs <strong>for</strong> graduallyextending FMFB-A’s reach into peri-urban and rural areas. At thesame time, ARMP would concentrate on building a viable microcreditprogramme and human capacity in the rural areas. Overtime, the two structures would be merged to <strong>for</strong>m a nationalnetwork of regional hubs, each overseeing a secondary networkof peri-urban and rural branches.ARMP’s ef<strong>for</strong>ts in building appropriate and accessible financialservices in rural areas complement AKDN’s activities in rebuildingthe asset base of rural households and revitalising markets and therural economy. In particular, AKDN has closely linked its businessdevelopment services and vocational training programmes withARMP’s credit options. ARMP provides a wide range of creditproducts to farmers and traders in rural provinces. It has alsoprovided special credit <strong>for</strong> over-indebted farmers and financing<strong>for</strong> crop substitution in poppy-growing areas. Loans have allowedsome farmers to repurchase land sold during civil strife to poppyfarminglandlords and warlords. <strong>The</strong>se farmers have replanted thefields with wheat and potatoes and acquired livestock.22

With an initial capital of US$ 5 million invested by the AKFED,the International Finance Corporation (IFC) and Kreditanstaltfür Wiederaufbau (KfW), FMFB-A was the first of its kind underthe country’s new regulatory structure and was granted the firstlicense under the new banking law in the autumn of 2003. In <strong>2005</strong>,the remaining urban portions of the Emergency <strong>Microfinance</strong>Programme in Pul-i-Khumri and Mazar-e-Sharif were absorbedinto FMFB-A.<strong>The</strong> Bank provides credit and saving products as well as domesticand international payment services. It focuses on microenterprises,small businesses and the creation of productive sources of incomeand employment.Beginning in Kabul and urban centres in the northeast of the country,the Bank is gradually expanding to urban and rural areas ofSPECIAL CREDIT FOR OVER-INDEBT-ED FARMERS COMBINED WITH CROPSUBSTITUTION HAS REDUCED POPPYGROWING IN PARTS OF AFGHANISTAN.AKAM’S GEOGRAPHIC COVERAGE IN THEREIGON IS SET TO EXPAND AS ITS FIRSTMICROFINANCEBANK LOOKS TO OPEN14 NEW BRANCHES OVER THE NEXTTHREE YEARS.23

IN BURKINA FASO, AKFED'S SN-SOSUCOREFINERY HAS PROVIDED JOBS TO OVER4,000 PEOPLE. AKAM IS NOW MAKINGLOANS TO FARMERS OUTSIDE THE SUGARCANE GROWING SEASON, HELPING THEMMANAGE SEASONAL FLUCTUATIONS INTHEIR INCOME.Afghanistan, with a view to opening 14 branches in the next threeyears. Its main underpinnings are sustainability, broad geographicaland service outreach, as well as maximising impact.<strong>The</strong> establishment of the Bank is an integral part of the AKDN’slong-term commitment to contribute to the reconstruction andrehabilitation of the economic infrastructure and civil societyinstitutions in Afghanistan.BURKINA FASOA microfinance initiative in Burkina Faso began in <strong>2005</strong> in theBan<strong>for</strong>a area. <strong>The</strong> area is home to SN-SOSUCO, a sugar plantationand refinery acquired by AKFED under the Burkina Fasoprivatisation programme. <strong>The</strong> company, which farms its own24

sugar cane plantations and operates the country’s largest sugarrefinery, employs nearly 4,000 permanent and seasonal workers.<strong>The</strong> Ban<strong>for</strong>a area near the company is home to 70,000 people.<strong>The</strong> microfinance programme is designed to complement and expandthe input credit scheme currently managed by SN-SOSUCO.<strong>The</strong> programme caters to the population at large and particularlytargets seasonal workers, who often must find other economicactivity during the off-season. It will include credit <strong>for</strong> education,health, housing improvement, economic diversification, groupcredit, emergency loans, as well as others.A second initiative in Burkina Faso concerns the vast cottongrowing areas south of Ouagadougou, where over 15,000 farmersare cotton growers. <strong>The</strong> local ginneries are operated by FASOCOTON, a subsidiary of AKFED. As in the case of SN-SOSUCO,the concept is to deliver microcredit first to cotton farmers,building on the infrastructure of the industrial venture, whichwill then serve as a cornerstone <strong>for</strong> the broader local populationand provide them with an array of services extending far beyondcotton finance.IN COLLABORATION WITH AKTC, AKAMPROVIDES LOANS TO RESIDENTS OF HIS-TORIC CAIRO TO ASSIST IN THE REHABILITA-TION OF HOUSES AND THE REVITALISATIONOF THE DISTRICT’S CULTURAL HERITAGE.EGYPT<strong>The</strong> microfinance programme in Egypt began in the district ofDarb Al-Ahmar in Cairo’s Historic City. It is managed centrallyby the First MicroFinance Foundation, which was established in<strong>2005</strong> and since expanded beyond Cairo to the rural areas of theAswan Governorate.<strong>The</strong> programme in Cairo focuses on the revitalisation of animpoverished and dense district, called Darb al-Ahmar, whichborders Al-Azhar Park, one of the AKTC’s largest projects. Duemainly to the lack of infrastructure maintenance, low family incomesand the severe deterioration of monuments and privatehousing, development of the area has lagged behind other partsof Cairo. Living conditions have deteriorated over the past fewdecades. <strong>The</strong> institution supports local ownership, stimulates the25

development of enterprise, traditional workshops and tourismand ensures sustainability of the rehabilitation work. In additionto these income-oriented loans, the programme in Cairo isworking with technical teams of AKTC to assist residents of theDarb al-Ahmar rehabilitate their homes. <strong>The</strong> aim is to preservethe area’s historic character while simultaneously increasing theavailability of suitable rental housing.IN INDIA, MICROFINANCE LOANS HAVEHELPED CREATE INCENTIVES THAT RE-WARD FAMILIES FOR SENDING THEIRCHILDREN TO SCHOOL.With the establishment of a microfinance programme in the AswanGovernorate in early 2006, the programme is now operating intwo important regions in this country. It has adapted productsand services to meet local needs, including agriculture, animalhusbandry and rural enterprise loans.INDIAAKDN’s microcredit operations in India are concentrated in ruraland urban areas of Gujarat, Andra Pradesh and Maharashtra. Itslargest programme is in Gujarat, where the <strong>Aga</strong> <strong>Khan</strong> Rural SupportProgramme (India) has run savings and credit programmes thatoperate as part of an overall rural development programme.<strong>The</strong>se loans have ranged from financing of agricultural inputs torainwater harvesting systems, livestock purchases and communitywater initiatives. Special instruments have been designed to assistindentured workers repay usurious multigenerational loans thatwere keeping them in perpetual servitude. Other instrumentsreward families <strong>for</strong> sending their children to school.KENYASince March <strong>2005</strong>, AKAM’s activities have been centred in the Kwale/Kilifi districts in the Coast Province and in the Murang’a/Kirinyagadistricts in the Central Province. <strong>The</strong> coastal programme operatesin collaboration with AKF’s rural support initiatives in the area. Sincetaking over AKF's microfinance activities, AKAM has used the grouplending methodology and microloans in support of income-generatingactivities such as farming, animal husbandry and retail enterprises. Thishas benefited over 350 individuals, two-thirds of whom are women.26

In an area that is particularly vulnerable to drought and famine, closeto 80 percent of these individuals earned less than a dollar a day atthe time of their loan application.In the Central Province, Frigoken, an agro-industrial project companyof AKFED, is the backdrop <strong>for</strong> AKAM’s microcredit activities.Over 900 individuals, approximately 50 percent of whom arefarmers, have gained access to credit under AKAM’s programme.<strong>The</strong> loans assist farmers to enhance supplies of French beans <strong>for</strong>purchase, processing and export by Frigoken. In addition, loans aregiven to farmers to diversify their crop range <strong>for</strong> greater stabilityof incomes. <strong>The</strong> start-up of close to 250 retail enterprises hasbenefited from this programme.CREDIT HAS HELPED WORKERS AT FRIGO-KEN, AN AKFED PROJECT COMPANY INKENYA, TO AUGMENT THEIR INCOMESTHROUGH THE START UP OF INDEPEND-ENT ECONOMIC ACTIVITY.<strong>The</strong> initial successes in both these provinces have given impetusto plans <strong>for</strong> a rapid expansion of activities as well as the introductionof loans <strong>for</strong> housing improvement, education and health.27

KYRGYZ REPUBLICTHE PURCHASE AND REARING OF LIVE-STOCK, PARTICULARLY BY WOMEN, IS SUP-PORTED THROUGH VARIOUS GROUP LOANSCHEMES OFFERED BY AKAM IN RURALPARTS OF THE KYRGYZ REPUBLIC.AKAM’s microfinance activities in the Kyrgyz Republic haveprimarily been in the rural mountainous areas of the Osh andNaryn provinces. Beginning in the Alai and Chon Alai districtsthat border Tajikistan, the programme extended its operationsto areas adjoining the mountainous districts of Karasu and Uzgen.To complement the provision of mountain studies and entrepreneurshipat the University of Central Asia, microcredit activitieshave also been initiated in Naryn Province, which is at the heartof Tien-Shan mountain range.In less than three years, the microfinance programme has disbursedover US$ 4.6 million to 11,789 beneficiaries. Nearly half ofthem are women. <strong>The</strong>se loans have financed agricultural inputs <strong>for</strong>28

growing cotton, potatoes, vegetables and wheat, as well as animalhusbandry, trading activities, housing repairs and education.<strong>The</strong>se microfinance activities are meant to provide clients witha bridge between microfinance and the services offered by theKyrgyz Investment and Credit Bank (KICB), which was set up in2001 by AKFED and other international agencies. KICB providesa wide range of products and services, including short-termworking capital loans, medium- to long-term credit, trade financeproducts, corporate deposits, international money transfers,money market and <strong>for</strong>eign exchange operations as well as correspondentbanking.<strong>The</strong> legal trans<strong>for</strong>mation of the on-going programme into a fullfledgedmicrofinance bank was initiated during <strong>2005</strong>. In the firstphase, the programme will evolve into a microcredit company.In line with microfinance regulations in the Kyrgyz Republic, it isintended that the institution will seek a full license after two yearsof operations, in order to offer deposit services.MADAGASCARAKAM oversees Fanasoavana, a programme established in the1950s to provide small- and medium-sized loans to the poor inmany parts of the country. As significant changes in the economicand political environments have taken place, this direct-lendingapproach has been trans<strong>for</strong>med into a credit guarantee schemeextended through commercial banks.IN MADAGASCAR, BUSINESS DEVELOP-MENT SERVICES ASSIST CLIENTS, SUCH ASTHIS GRAIN MERCHANT, WITH IMPROVEDBOOKKEEPING, MARKETING AND CASH-FLOW PROJECTION.In addition to this loan guarantee programme, AKAM has establishedthe Première Agence de MicroFinance in Madagascar(PAMF-Madagascar), a private limited company. This institutionis operating in both the rural areas and the small cities of theSofia reigon. As the programme scales up, it willl extend credit inAntananarivo, where the poor population lacks adequate accessto financial services. In the rural areas, PAMF-Madagascar worksprimarily in support of the activities of the <strong>Aga</strong> <strong>Khan</strong> Foundation’srural support programme.29

MALIIn <strong>2005</strong>, the Malian government launched an ambitious planto develop the microfinance industry in the country. In thiscontext, the government addressed a request to His Highnessthe <strong>Aga</strong> <strong>Khan</strong> and the AKDN to set up a microfinance institutionin each of the regions where these services are not yet sufficientlyavailable. In response to this request, AKAM established thePremière Agence de MicroFinance in Mali (PAMF-Mali).In collaboration with the Historic Cities Support Programme managedby AKTC, this programme is targeting both urban and ruralpopulations in the Mopti region. An extended branch networkin Timbuktu and Gao is also planned. Loans are being extendedto both groups and individuals to address specific financial needssuch as rural credit, financing of service activities, working capital<strong>for</strong> commercial activities, among others. In due course, PAMF-Maliwill extend savings products as well as loans <strong>for</strong> housing improvement,education and health.MOZAMBIQUEWOMEN ARE A KEY FOCUS OF AKAM’SACTIVITIES IN MALI. BUSINESS DEVELOP-MENT SERVICES WILL PLAY AN IMPORTANTROLE IN ASSISTING WOMEN INCREASETHEIR INCOMES.As with all of AKAM’s initiatives, the microfinance programme inMozambique targets areas and populations that are vulnerableand do not have access to <strong>for</strong>mal credit. <strong>The</strong> programme operatesin the northern province of Cabo Delgado, one of the poorestareas in the region and one that has been devastated by yearsof civil strife. Most of the farmers, fishermen and women in theprogramme barely attain subsistence, and in<strong>for</strong>mal moneylenderscan charge as much as 80 percent interest per month.Through collaboration with the AKF’s Coastal Rural SupportProgramme, AKAM’s activities centre on helping borrowers raiseincomes through the provision of credit. <strong>The</strong> programme’s primaryobjective is to provide loans to microenterprises and smallbusinesses <strong>for</strong> income-generating activities such as promotingsmall-scale agricultural, fishing, retail and industrial enterprises.Microloans in these parts of the country can reach as low as30

US$ 25, while still having a meaningful effect on the borrower.At the same time, some loans categorised as “small loans”, canbe as much as US$ 10,000, in cases where the credit enables aborrower to employ several others while increasing his or herproductive capacity.PAKISTANOperating across a range of entities from small savings and microcreditorganisations to major commercial banks and insurancecompanies listed on national stock exchanges, AKDN institutions inPakistan have provided financial services <strong>for</strong> more than 60 years.<strong>The</strong> <strong>Aga</strong> <strong>Khan</strong> Rural Support Programme (AKRSP) laid thefoundations of the microfinance sector in the country in 1982,beginning in the Northern Areas and Chitral provinces. By 2000,WITH FINANCIAL AND TECHNICAL AS-SISTANCE FROM THE AGA KHAN RURALSUPPORT PROGRAMME, THE PRODUCTIONOF APRICOT OIL HAS GREATLY IMPROVED INTHE NORTHERN AREAS OF PAKISTAN. IT ISNOW SOLD THROUGHOUT PAKISTAN ANDIS BEING MARKETED ABROAD.31

a total of over US$10 million had been saved by members ofmore than 3,260 village organisations with more than US$2 milliondisbursed in credit each year.<strong>The</strong> First MicroFinanceBank Ltd. of Pakistan (FMFB-P) startedoperations in May 2002 as the first microfinance bank licensedunder the regulatory framework of the <strong>Microfinance</strong> InstitutionsOrdinance 2001. It initially took over the rural credit and savingsactivity of AKRSP and began a programme of urban microcreditin Rawalpindi and Karachi in 2003. Since then, the Bank has expandedits reach to a network of over 30 branches or units inboth rural and urban areas of the country.LOANS FOR MULBERRY CULTIVATION INTHE NORTHERN AREAS OF PAKISTANHELP CREATE INCOME-GENERATING OP-PORTUNITIES FOR RURAL PEOPLE.FMFB-P has successfully launched a domestic electronic fundstransfer service that allows customers to remit funds across thecountry quickly and in a secure manner. <strong>The</strong> Bank also offers a32

housing improvement loan product in its rural branches and plansto extend its core business to include microinsurance, health andeducation related products. Besides providing financial services,it plans to offer non-financial services to microentrepreneursthat focus on enterprise development, as well as client wellbeingincluding health, nutrition and education.As part of AKAM’s endeavour to provide broader services to thepoor, the Bank is serving as the plat<strong>for</strong>m from which new andinnovative microinsurance products, funded through a grant of theBill & Melinda Gates Foundation to <strong>Aga</strong> <strong>Khan</strong> Foundation USA, willbe developed and launched. FMFB-P is also working in partnershipwith Citigroup Foundation USA to improve health awarenessthrough its microfinance activities, particularly to women in theurban areas.<strong>The</strong> ef<strong>for</strong>ts of FMFB-P have gained international recognition. It wasthe youngest of the five winners of <strong>2005</strong> Consultative Group toAssist to the Poor Financial Transparency Award. In addition, twoclients won the <strong>2005</strong> Global Microentrepreneurship Award.SYRIAAKDN launched its microfinance facilities in Syria in 2003 as theSyria Microcredit Programme (SMP). <strong>The</strong> programme, currentlyworking in five provinces of the country, is aimed at stimulatingincome-generation in low-income areas and promoting small-scaleagricultural and industrial enterprises. AKAM’s activities encompasshousing rehabilitation as well as seasonal and commercial loansassociated with rural development, including guarantees <strong>for</strong> acquiringmachinery, land and agricultural inputs. <strong>The</strong>y include credits<strong>for</strong> creating or expanding small-scale businesses or industries andfinancing cottage industries, handicraft production and tourisminitiatives. <strong>The</strong>y also encompass technical assistance, training andother <strong>for</strong>ms of support to encourage private enterprise.IN A SMALL WORKSHOP IN SALAMIEH,SYRIA, MAYSA QANNOU PROUDLY DIS-PLAYS DRESSES SHE HAS PRODUCED WITHTHE ASSISTANCE OF AN ENTERPRISE LOANFROM AKAM. THROUGH THE SALE ORRENTAL OF DRESSES, SHE HAS INCREASEDHER INCOME AND GONE ON TO PRODUCEDRESSES OF EVEN GREATER VALUE.With a view to enhancing the tourism and leisure industry in theAleppo and Hama provinces, SMP is working in concert with33

AKTC to help finance housing improvement in areas where therehabilitation of historic spaces is underway. In Lattakia province,microfinance activities began with a focus on eight villagesin Hafeh District which are part of the Syrian Government’sHealthy Village Programme. Through this partnership, the institutionis contributing to the development of civil society at thevillage level. Activities have begun in five districts of the Tartousprovince as well as in the Old City of Aleppo, where SMP hasinitiated a special credit service, extending loans to borrowers<strong>for</strong> the rehabilitation of homes.A LOAN FOR MACHINERY HAS HELPEDMAKE THIS KEY CUTTING BUSINESS INKHOROG, TAJIKISTAN MORE PRODUCTIVE,THEREBY INCREASING THE OWNER’S OVER-ALL INCOME.Over the last twelve months, AKAM has been active in trans<strong>for</strong>mingthe ongoing programme into a full-fledged microfinance bank.AKAM has been working closely with the Syrian authorities andwith international experts towards the development of a specificframework that would foster the establishment of sound and efficientmicrofinance institutions.TAJIKISTANSince 1993, two AKDN programmes have been lending to theregion’s budding entrepreneurs. <strong>The</strong> Mountain Societies DevelopmentSupport Programme, which was serving over 20,000small farmers, helped Tajikistan make the difficult transitionfrom dependence on the Soviet centrally planned economy toindependence and free markets. Three years later, the EnterpriseSupport Facility (ESF) was established. It has supported over 4,000microenterprises with loans averaging US$ 1,380, helping smallbusinessmen and women launch various enterprises, includinghardware stores, greenhouses, bakeries and pharmacies. WhenESF became part of AKAM, it provided the First<strong>Microfinance</strong>Bankof Tajikistan (FMFB-T) with core microfinance expertise and asolid client base.Established in 2003, FMFB-T was the first bank of its kind inTajikistan with a principal focus on the provision of microcreditlending. <strong>The</strong> Bank has a national mandate to provide a comprehensiverange of financial services to the poor throughout the34

country. In addition to its Head Office in Dushanbe, the Bankcurrently has branches in Khorog, Garm and Khojand and willopen another branch in the Khatlon district in 2006. Brancheswill eventually be opened in all the main cities with district officesserving peri-urban and rural areas.Services, which already include various <strong>for</strong>ms of credit and depositservices, are being broadened to include fund transfers,payment services, microinsurance, low-income housing financeand microleasing.AT THE END OF <strong>2005</strong>, THE FIRST MICRO-FINANCEBANK IN TAJIKISTAN HAD MADELOANS IN EXCESS OF US$ 6.7 MILLION,BENEFITING 3,594 BORROWERS ACROSSTHE COUNTRY. THE BANK HAS ALSODIVERSIFIED ITS PRODUCT OFFERINGTO INCLUDE MICROLEASING, FUNDSTRANSFERS AND COMMERCIAL SERVICES,AMONG OTHERS.<strong>The</strong> Bank is greatly strengthened by the ongoing commitment ofits shareholders and partners. <strong>The</strong> Bank’s equity is held by twoAKDN agencies, as well as the International Finance Corporation(IFC) and Germany’s KfW Banking Group. <strong>The</strong> internationalreputation and financial strength of these shareholders play animportant role in building local confidence in the Bank’s durability35

SMALL LOANS FOR FUEL AND TRANSPOR-TATION HAVE IMPROVED MARKET ACCESSFOR MANY FARMERS IN TAJIKISTAN.and the security of customer deposits. <strong>The</strong> Bank receives vitaltechnical support from KfW and the Canadian InternationalDevelopment <strong>Agency</strong> (CIDA).Fully licensed by the National Bank of Tajikistan (NBT), FMFB-T isperiodically inspected by the NBT and other statutory authorities.As a key investment of the AKDN in the long-term developmentof Tajikistan, the Bank regularly consults other agencies of theAKDN and various international agencies and NGOs workingin Tajikistan to ensure that its operations are contributing to theoverall development of the country.<strong>The</strong> Micro Lending Fund (MLF) in Tajikistan carries out microfinanceactivities in the country in areas where FMFB-T is notoperational. Established by AKAM as a locally licensed fund, itis operating primarily in the southwest mountainous and ruralregions of the country and has extended its activities from the36

three districts of Shurabad, Mominabad and Khovaling to Jilikul,Kholkozabad and Qumsangir.At December <strong>2005</strong>, it had disbursed 550 loans to groups and individuals<strong>for</strong> agricultural inputs, animal husbandry and trading activities<strong>for</strong> total value of US$ 220,000. As this portfolio matures, FMFB-Twill absorb these activities, once it deploys in these areas.TANZANIA AND ZANZIBAR<strong>Microfinance</strong> activities in Zanzibar will be closely linked toAKTC’s conservation programme in the historic Stone Town.<strong>The</strong> programme will include housing rehabilitation and businessdevelopment services in and around the restoration of the StoneTown. <strong>The</strong>se loans will work to reduce poverty by supportinglocal ownership, stimulating the development of tourism andensuring sustainability of the rehabilitation programme. In addition,the microcredit activities will aim at supporting civil societyinstitutions, help communities to expand agricultural and fishingactivities, build schools and address other social challenges.SMALL INPUTS OF CREDIT, SUCH AS ALOAN FOR THE CULTIVATION, PROCESS-ING AND SALE OF SEAWEED IN ZANZIBAR,MAKES POOR FAMILIES LESS DEPENDANTON A SINGLE SOURCE OF INCOME.In <strong>2005</strong>, AKAM commenced microcredit operations in mainlandTanzania in the Mtwara and Lindi regions, which are among themost marginalised areas of the country. Mtwara is one of themost poverty-stricken of the 20 regions on mainland Tanzaniaand borders the even poorer Mozambique province of CaboDelgado, where AKAM also operates microcredit activities. Thisprogramme offers working capital loans <strong>for</strong> the establishment andexpansion of micro and small retail and commercial enterprises inthe urban centres and agriculture loans in the rural areas. Withintwo months of its operations, the programme had disbursed 16group loans with 50 beneficiaries in Masasi District amountingto US$ 15,223.A significant scaling up of the programme activities is envisagedin 2006 with special emphasis placed on achieving managementsynergies and operational efficiencies through linkages with theother AKAM programmes in East Africa.37

THE MICROINSURANCE INITIATIVEMicrocredit is widely known <strong>for</strong> its power to assist people breakout of poverty. However, it is not uncommon <strong>for</strong> families justbeginning to work themselves out of poverty to remain highlyvulnerable to catastrophic events such as the death of a familybreadwinner or an emergency need <strong>for</strong> expensive major surgeryand a long hospital stay. As a result of such a catastrophe, familiesthat had just begun to see the prospect of a better life can often– <strong>for</strong> reasons beyond their control – be driven back into extreme,debilitating poverty, possibly <strong>for</strong> decades.<strong>The</strong> Microinsurance Initiative, funded by a grant of $5.5 million fromthe Bill & Melinda Gates Foundation to <strong>Aga</strong> <strong>Khan</strong> Foundation USA, isbeing implemented by AKAM with the hope of safeguarding thepoor against loss of savings and income as a result of catastrophicevents such as death of a household breadwinner, long-termhospitalisation and business or crop loss. Bringing together internationalexpertise and modern technology, the five-year initiativewill strive to develop a replicable model <strong>for</strong> microinsurance thatwill be viable and financially sustainable in multiple socio-economicand cultural contexts.Beginning in Pakistan, where AKDN has a strong institutionalpresence and long history of innovation and success, FMFB-Pwill work as a plat<strong>for</strong>m <strong>for</strong> launching the insurance products. Inensuring success and innovation, AKAM will leverage the technicalexpertise of the New Jubilee Insurance Companies, also part ofthe AKDN, in developing the most appropriate, accessible andviable microinsurance products. In subsequent years, a similarexercise in Tanzania will adapt the model to the different socioeconomic,political and cultural context.LEFT: IN HALTHAGHARI VILLAGE, INNORTHERN PAKISTAN, MICROFINANCEOFFICERS ARE HELPING WOMEN MAN-AGE AND INVEST EARNINGS FROM LANDDESIGNATED FOR THEIR USE.39

FINANCIAL SUMMARYInvestments <strong>2005</strong>UNAUDITED CONSOLIDATION IN US$ MILLIONEquity participationsFirst MicroFinanceBank - Afghanistan 3.1First MicroFinanceBank - Pakistan 3.3First MicroFinanceBank - Tajikistan 2.0Fanasoavana SA (Madagascar) 0.1Sub-total 8.5Loans and advances to microcredit programmesAfghanistan 5.8Burkina Faso 0.2Egypt 1.0Kenya 0.4Kyrgyz Republic 2.0Madagascar 0.4Mali 0.1Mozambique 0.8Syria 5.5Tajikistan 0.2Tanzania 0.4Sub-total 16.8Total 25.340

Balance Sheet <strong>2005</strong>UNAUDITED CONSOLIDATION IN US$ MILLIONAssetsCash and Short Term Securities 37.6Gross Loans Outstanding 35.5Loan Loss Reserve (0.8)Other Current Assets 2.6Total Current Assets 74.9Fixed Assets (Gross) 3.9Accumulated Depreciation (1.4)Net Fixed Assets 2.5Total Assets 77.4LiabilitiesCustomer Deposits 30.8Other Current Liabilities 8.2Deferred Liabilities 0.2Total Liabilities 39.2Capital 38.0Accumulated Earnings 0.2Total Equity 38.2Total Liabilities and Equity 77.441

FINANCIAL SUMMARYFigures <strong>for</strong> the Year <strong>2005</strong>AfghanistanAfghanistanEgyptKenyaARMP FMFB-A FMF FMFAPorfolio QualityLoan Loss Provision Ratio 2.0% 1.5% 2.0% 6.0%Recovery as a Percent of Falling Due 99.0% 121.0%* 99.0% 86.0%Outreach IndicatorsNumber of Loans Disbursed 18,290 8,333 3,218 1,238Total Value of Loans Disbursed US$ '000 3,139 11,978 1,287 188Number of Loans Disbursed Since Inception 26,474 10,413 3,643 1,238Total Value of Loans Disbursed Since Inception US$ '000 19,272 15,044 1,441 188Number of Loans Outstanding 13,586 8,302 2,371 1,092Number of Deposits Outstanding 423Average Loan Size in US$ 717 1,437 400 152Average Deposit Size in US$ 38,266Number of Female Loans Disbursed 1,853 1,108 1,240 687Percent of Female Borrowers 10% 13% 39% 55%Number of Staff 193 113 32 17Number of Branches 28 5 3 2Number of Credit Officers 87 56 22 9Credit Officers as a Percent of Staff 45% 50% 69% 53%ProductivityNumber of Outstanding Loans per Credit Officer 156 148 108 121Average Loan Portfolio per Credit Officer in US$ '000 97 146 27 1542

Kyrgyz RepublicMozambiquePakistanSyriaTajikistanTajikistanTanzaniaOwnership of the FirstMicroFinanceBanksFirst <strong>Microfinance</strong>Bank - PakistanMCP MCP FMFB-P SMP MLF FMFB-T MCP TOTAL2.0% 13.3% 2.8% 2.3% 3.4% 2.0% 2.0% 2.2%<strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong> <strong>for</strong> <strong>Microfinance</strong><strong>Aga</strong> <strong>Khan</strong> Rural Support ProgrammeInternational Finance Corporation99.0% 65.0% 98.0% 99.0% 99.0% 99.0% 90.0% 103.6%24%46%3,114 2,160 18,627 7,810 701 3,594 50 67,1353,092 587 9,407 9,718 450 6,679 15 56,53930%6,192 3,490 39,622 13,370 7,820 4,054 50 116,3664,480 923 20,338 15,966 6,869 7,413 15 91,9492,181 1,076 17,088 7,228 390 2,740 50 56,10427,937 2,791 31,151993 272 505 1,244 641 1,858 304 842376 1,461 9881,281 502 2,815 1,755 69 1,349 28 12,687First <strong>Microfinance</strong>Bank - Afghanistan<strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong> <strong>for</strong> <strong>Microfinance</strong>International Finance CorporationKfW Banking Group41% 23% 15% 22% 10% 38% 56% 19%64 26 260 53 10 115 5 8886 4 25 7 3 19 1 10329 12 99 26 5 50 3 39845% 46% 38% 49% 50% 43% 60% 45%32%17%51%75 90 173 278 78 55 17 7966 16 59 238 42 81 5 141* Indicates early repayments and other adjustmentsFirst <strong>Microfinance</strong>Bank - Tajikistan<strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong> <strong>for</strong> <strong>Microfinance</strong><strong>Aga</strong> <strong>Khan</strong> FoundationInternational Finance CorporationKfW Banking Group23%37%16%24%43

PROGRAMME PARTNERSAKAM is supported by many institutional, government and local partners across the world.Asian Development BankBanking With <strong>The</strong> Poor Network AsiaCanadian International Development <strong>Agency</strong>Citigroup FoundationConsultative Group to Assist the PoorDepartment <strong>for</strong> International DevelopmentDeutsche Entwicklung Gesellschaft (DEG)Egyptian Social Development FundEuropean UnionGesellschaft für Technische Zusammenarbeit (GTZ)International Finance CorporationJapanese Social Development FundKreditanstalt für Wiederaufbau (KfW)<strong>Microfinance</strong> Investment Support Facility of AfghanistanNorwegian <strong>Agency</strong> <strong>for</strong> Development CooperationGovernments of:AfghanistanBurkina FasoEgyptKazakhstanKenyaKyrgyz RepublicMadagascarMaliMozambiquePakistanSyriaTajikistanTanzaniaZanzibarNorwegian FundPakistan MicroFinance Network<strong>The</strong> MicroFinance Network<strong>The</strong> World BankUnited Nations Development ProgrammeUnited States <strong>Agency</strong> <strong>for</strong> International DevelopmentUnited States Department of Agriculture44

FACTS AT A GLANCEFounder and Chairman:His Highness the <strong>Aga</strong> <strong>Khan</strong>,spiritual leader of the ShiaIsmaili Muslims and Chairmanof the <strong>Aga</strong> <strong>Khan</strong> DevelopmentNetworkSources of funding:His Highness the <strong>Aga</strong> <strong>Khan</strong>,grants, loans and contributionsfrom developmentagencies, private foundations,corporations and individuals.Board of Directors:His Highness the <strong>Aga</strong> <strong>Khan</strong>,Prince Amyn <strong>Aga</strong> <strong>Khan</strong>,Prince Rahim <strong>Aga</strong> <strong>Khan</strong>,Princess Zahra <strong>Aga</strong> <strong>Khan</strong>, IainCheyne, Thomas Kessinger,Luis Monreal, Shafik SachedinaOrganisation: Established inNovember 2004 in Geneva,Switzerland. Under Swiss law,AKAM is a private, not-<strong>for</strong>profit,non-denominationalinternational developmentagency. It is part of the <strong>Aga</strong> <strong>Khan</strong>Development Network, agroup of nine institutionsworking in health, education,culture, and rural and economicdevelopment, primarily in sub-Saharan Africa, South and CentralAsia and the Middle East.Staff: 888 worldwide. AKAMdevelops local human resourcesand capacity; the majority ofemployees are nationals oftheir countries.Mandate and goals:AKAM’s mandate is to alleviatepoverty, diminish the vulnerabilityof poor populations andreduce economic and socialexclusion. It aims to:• Help people become selfreliant and eventually gainthe skills needed tograduate into the mainstream financial markets;• Realize long-term sustainabilitythat covers costsand contributes toexpansion;• Reach out as broadly aspossible, in terms of bothgeographical coverage andrange of services offered;• Maximise impact onintended beneficiaries byensuring that resourcesflow primarily to the poorand the excluded.External Auditor:KPMG Switzerland45

CONTACTSTHE AGA KHAN AGENCYFOR MICROFINANCE1-3, Avenue de la Paix1202 GenevaSwitzerlandTel: + 41 22 909 72 00Fax: + 41 22 909 72 90E-mail: akam@akdn.orgAFGHANISTANTHE FIRST MICROFINANCEBANK LTDHouse 297, St 17Wazir Akber <strong>Khan</strong>Kabul, AfghanistanTel: + 93 (0) 79 32 1001AFGHANISTAN RURALMICROCREDIT PROGRAMHouse No 616Street No 6Qala-e-FateullahKabul, AfghanistanTel: + 93 (0) 79 33 56 00BURKINA FASOPREMIÈRE AGENCEDE MICROFINANCE29 Ave de la NationImmeuble Air Burkina01 BP 1459, Ouagadougou 01EGYPTFIRST MICROFINANCE FOUNDATION28 Haret El-MadrasaEl-BatniaDarb Al-AhmarCairo, EgyptTel/Fax: +2-02-5147 049KENYAC/O AGA KHAN FOUNDATIONFIRST MICROFINANCEAGENCY, KENYA3rd Floor, Mpaka PlazaPO Box 13149 - 00100Nairobi, KenyaTel: 254 20 227369/ 223951-2KYRGYZ REPUBLICMICROCREDIT PROGRAMME36, Lenin StreetGulcha vlg.Alai DistrictOsh Province, Kyrgyz RepublicTel: + 996 3234 26260MADAGASCARPREMIÈRE AGENCEDE MICROFINANCE1, Lalana Solombavamhoaka Frantsay 77Antsahavola, Antananarivo 101MadagascarTel: +261 (0)32 02 44 646MALIPREMIÈRE AGENCEDE MICROFINANCEImmeuble UattQuartier du FleuveRoute de l’ ArchevêchéBP 2998Bamako, MaliMOZAMBIQUEMICROCREDIT PROGRAMME986, Bairro CimentoAv. 25 de SetembroPemba, MozambiqueTel: + 2587 220795PAKISTANTHE FIRST MICROFINANCEBANK LTD62/C, Tauheed Commercial Area25th Commercial Street, D.H.A.Phase-V 75600Karachi, PakistanTel: + 92 21 582 2433Fax: + 92 21 582 2434PORTUGALC/O AGA KHAN FOUNDATIONIsmaili Center1, Avenida Lusiada1600-001 Lisbon, PortugalTel: +351 21 722 9001SYRIAMICROCREDIT FACILITYFayez Alshaar StreetAlmaham AlleySalamiehHama, SyriaTel: + 963 33 828 350Fax: + 963 33 828 351TAJIKISTANTHE FIRST MICROFINANCEBANK105, Rudaki AvenueDushanbe, TajikistanTel: + 992 372 24 93 10 /14/15Fax: + 992 372 24 93 12EMERGENCY SUPPORT FACILITY137, Rudaki AvenueDushanbe, TajikistanTel: +992 372 247650TANZANIAMICROCREDIT PROGRAMMEPlot No. 78 Haile Silassie Rd. - OysterbayP.O. Box 3105Dar es Salaam, TanzaniaTel: +255 232 33 934ZANZIBARMICROCREDIT PROGRAMMEGround FloorZakaria BuildingVuga StreetStone Town, ZanzibarTel : + 255 748 25 7158CREDITS:Photography:Alain Lits, Gary Otte,Anne-Helen Decaux, Jean-Luc Ray,Naoura Al-Azmeh, Olivier Massart,Qahir Dhanani, Robin Reed,Thomas KellyDesign and Layout:Robin ReedPrinting:Imprimeries Réunies Lausanne s.a.,August, 2006LEFT: WOMEN'S GROUPS IN TANZANIABENEFIT FROM BOTH MICROCREDIT ANDTECHNICAL ASSISTANCE THROUGHAKDN'S MULTI-SECTOR APPROACH.47

THE IMAMATAGA KHAN DEVELOPMENT NETWORKEconomicDevelopmentSocialDevelopmentCulture<strong>Aga</strong> <strong>Khan</strong> Fund <strong>for</strong>Economic Development<strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong><strong>for</strong> Microfi nance<strong>Aga</strong> <strong>Khan</strong>Foundation<strong>Aga</strong> <strong>Khan</strong>UniversityUniversity ofCentral Asia<strong>Aga</strong> <strong>Khan</strong> Trust<strong>for</strong> CultureTourism PromotionServicesIndustrial PromotionServices<strong>Aga</strong> <strong>Khan</strong> Education Services<strong>Aga</strong> <strong>Khan</strong> Award<strong>for</strong> ArchitectureHistoric CitiesSupport ProgrammeFinancial ServicesAviation ServicesMedia Services<strong>Aga</strong> <strong>Khan</strong> Health Services<strong>Aga</strong> <strong>Khan</strong> Planning andBuilding ServicesEducation andCulture Programme48

<strong>Aga</strong> <strong>Khan</strong> <strong>Agency</strong> <strong>for</strong> Microfi nance1-3, Avenue de la Paix1202 Geneva, SwitzerlandTel : + 41 22 909 72 00 Fax : + 41 22 909 72 90www.akdn.org