The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

The 2005 Aga Khan Agency for Microfinance Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

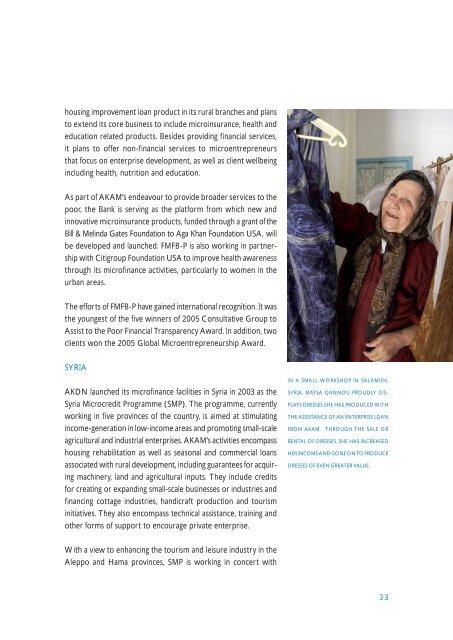

housing improvement loan product in its rural branches and plansto extend its core business to include microinsurance, health andeducation related products. Besides providing financial services,it plans to offer non-financial services to microentrepreneursthat focus on enterprise development, as well as client wellbeingincluding health, nutrition and education.As part of AKAM’s endeavour to provide broader services to thepoor, the Bank is serving as the plat<strong>for</strong>m from which new andinnovative microinsurance products, funded through a grant of theBill & Melinda Gates Foundation to <strong>Aga</strong> <strong>Khan</strong> Foundation USA, willbe developed and launched. FMFB-P is also working in partnershipwith Citigroup Foundation USA to improve health awarenessthrough its microfinance activities, particularly to women in theurban areas.<strong>The</strong> ef<strong>for</strong>ts of FMFB-P have gained international recognition. It wasthe youngest of the five winners of <strong>2005</strong> Consultative Group toAssist to the Poor Financial Transparency Award. In addition, twoclients won the <strong>2005</strong> Global Microentrepreneurship Award.SYRIAAKDN launched its microfinance facilities in Syria in 2003 as theSyria Microcredit Programme (SMP). <strong>The</strong> programme, currentlyworking in five provinces of the country, is aimed at stimulatingincome-generation in low-income areas and promoting small-scaleagricultural and industrial enterprises. AKAM’s activities encompasshousing rehabilitation as well as seasonal and commercial loansassociated with rural development, including guarantees <strong>for</strong> acquiringmachinery, land and agricultural inputs. <strong>The</strong>y include credits<strong>for</strong> creating or expanding small-scale businesses or industries andfinancing cottage industries, handicraft production and tourisminitiatives. <strong>The</strong>y also encompass technical assistance, training andother <strong>for</strong>ms of support to encourage private enterprise.IN A SMALL WORKSHOP IN SALAMIEH,SYRIA, MAYSA QANNOU PROUDLY DIS-PLAYS DRESSES SHE HAS PRODUCED WITHTHE ASSISTANCE OF AN ENTERPRISE LOANFROM AKAM. THROUGH THE SALE ORRENTAL OF DRESSES, SHE HAS INCREASEDHER INCOME AND GONE ON TO PRODUCEDRESSES OF EVEN GREATER VALUE.With a view to enhancing the tourism and leisure industry in theAleppo and Hama provinces, SMP is working in concert with33