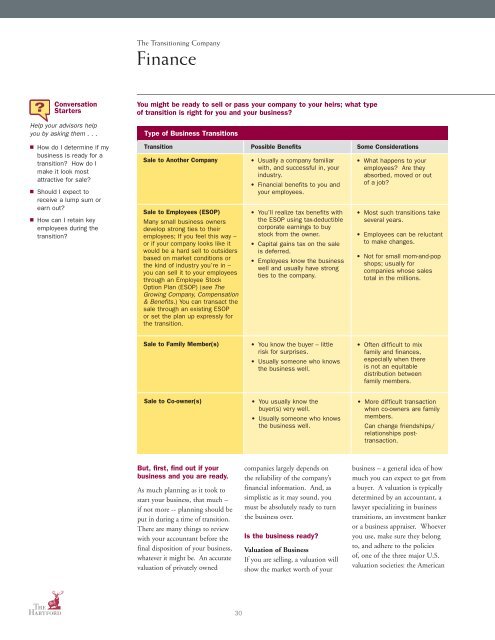

<strong>The</strong> Transitioning CompanyFinanceConversationStartersHelp your advisors helpyou by asking them . . .■ How do I determine if mybusiness is ready for atransition? How do Imake it look mostattractive for sale?■ Should I expect toreceive a lump sum orearn out?■ How can I retain keyemployees during thetransition?You might be ready to sell or pass your company to your heirs; what typeof transition is right for you and your business?Type of <strong>Business</strong> TransitionsTransition Possible Benefits Some ConsiderationsSale to Another CompanySale to Employees (ESOP)Many small business ownersdevelop strong ties to theiremployees; If you feel this way –or if your company looks like itwould be a hard sell to outsidersbased on market conditions orthe kind of industry you’re in –you can sell it to your employeesthrough an Employee StockOption Plan (ESOP) (see <strong>The</strong>Growing Company, Compensation& Benefits.) You can transact thesale through an existing ESOPor set the plan up expressly forthe transition.• Usually a company familiarwith, and successful in, yourindustry.• Financial benefits to you andyour employees.• You’ll realize tax benefits withthe ESOP using tax-deductiblecorporate earnings to buystock from the owner.• Capital gains tax on the saleis deferred.• Employees know the businesswell and usually have strongties to the company.• What happens to youremployees? Are theyabsorbed, moved or outof a job?• Most such transitions takeseveral years.• Employees can be reluctantto make changes.• Not for small mom-and-popshops; usually forcompanies whose salestotal in the millions.Sale to Family Member(s)• You know the buyer – littlerisk for surprises.• Usually someone who knowsthe business well.• Often difficult to mixfamily and finances,especially when thereis not an equitabledistribution betweenfamily members.Sale to Co-owner(s)• You usually know thebuyer(s) very well.• Usually someone who knowsthe business well.• More difficult transactionwhen co-owners are familymembers.Can change friendships/relationships posttransaction.But, first, find out if yourbusiness and you are ready.As much planning as it took tostart your business, that much –if not more -- planning should beput in during a time of transition.<strong>The</strong>re are many things to reviewwith your accountant before thefinal disposition of your business,whatever it might be. An accuratevaluation of privately ownedcompanies largely depends onthe reliability of the company’sfinancial information. And, assimplistic as it may sound, youmust be absolutely ready to turnthe business over.Is the business ready?Valuation of <strong>Business</strong>If you are selling, a valuation willshow the market worth of yourbusiness – a general idea of howmuch you can expect to get froma buyer. A valuation is typicallydetermined by an accountant, alawyer specializing in businesstransitions, an investment bankeror a business appraiser. Whoeveryou use, make sure they belongto, and adhere to the policiesof, one of the three major U.S.valuation societies: the American30

TransitioningSociety of Appraisers (ASA), theInstitute of <strong>Business</strong> Appraisers(IBA) and the NationalAssociation of Certified ValuationAnalysts (NACVA).<strong>The</strong>re are several methods todetermine the accurate valuationof your business – your accountantor a valuation specialist will knowthe best way for your specificsituation and goals. Factors thatplay into these formulas includethe state of the economy, growthprospects of the industry, thecompany’s outstanding obligationsand/or its need for capital expendituresto stay competitive or, ifapplicable, a pressing need to sell.When you have precise valuation,work with your accountant orfinancial planner to compare it toyour total annual compensationand what you determine you’llneed after your transition. If yourprobable sale price won’t meetyour needs, it’s time to work onimproving performance beforeselling. If you’re determined tocut back on your own involvementwith the business rightaway, a good manager might beable to achieve the needed growthspurt before a sale.Tie up all the loose endsto make your businessattractive to buyers. Achecklist should includethe following elements:Loose End ChecklistAll company financials areready to be auditedAudits and other recordsshould be ready forinspection by prospectivebuyersAll taxes are paidVerbal contracts withvendors and key employeeshave been put in writing(non-compete or “retention”agreements for employeesare key in some fields)Leases and other contractsthat are due to expirehave been renegotiated(although the buyer mightwant otherwise). Ensurethat all contracts will behonored, no matter whoowns the businessYou have developed aselling memorandumdetailing the business’sfinancials, its assetsand its potential; thememorandum summarizeswhat it is you are offeringto prospective buyersAre you ready?What do you want/needfrom the transition?After determining that the company’svaluation supports thetransition and that the businessis ready to sell, you’ll need tocalculate your personal financialneeds. First, consider what it coststo support your lifestyle (now andin the future) and what obligationsyou have (or will) have (help foran aging parent or subsidy of achild in college, for example).<strong>The</strong>n ask yourself one of thehardest questions you’ll ever face:what do you want to do now?And be honest with yourself:■ Will you retire?■ Start a new business (whichwill require capital)?■ Get another job?■ Stay on as a consultant tothe business you are selling?Each option will come with adifferent expense and incomeprofile.Once you’ve figured out yourlife’s next chapter, consider yourincome needs. You’ll need to factorin the long-term income you cancount on from the proceeds fromthe transition, your savings andany future income. <strong>The</strong>n you canwork with your accountant orlawyer to structure your transition– and payout – in a way that suitsyour needs.If you sell to an individual,chances are you’ll get cash, eitherin a lump sum or in installments.But you might also negotiate aplan to lease some of your assetsto the buyer, so you’ll haveongoing income. (This couldease the upfront burden on thebuyer, as well.) If you sell to youremployees or to a corporation,you might receive cash plus stockor options. Whether you sell toan outside party or an employee,you might negotiate a contract tostay on as consultant for a set feefor a period of time. Work withyour advisors to structure a dealthat will meet your future needs.Focus on Debt, Notthe Big ProjectsDon’t assume that you need toundertake major capital projectsto correct all the business’sflaws. Buyers want to see highprofits, not debt, and they mighthave the resources, such asunderused real estate, forexample, that will enable themto correct your company’sflaws on their own. Speak toyour accountant or lawyerabout the best course of action.Don’t be tempted to changeaccounting practices to makethe business look more attractive.Professionals are trained to easilyspot such actions, which canseriously derail your transitionplans.31