Business Owner's Playbook - The Hartford

Business Owner's Playbook - The Hartford

Business Owner's Playbook - The Hartford

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

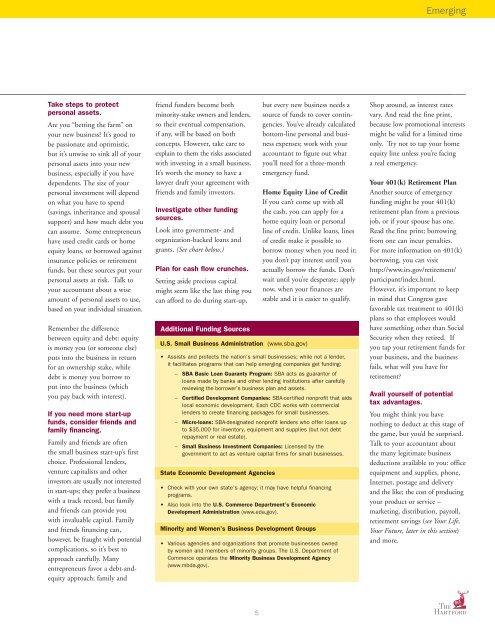

EmergingTake steps to protectpersonal assets.Are you “betting the farm” onyour new business? It’s good tobe passionate and optimistic,but it’s unwise to sink all of yourpersonal assets into your newbusiness, especially if you havedependents. <strong>The</strong> size of yourpersonal investment will dependon what you have to spend(savings, inheritance and spousalsupport) and how much debt youcan assume. Some entrepreneurshave used credit cards or homeequity loans, or borrowed againstinsurance policies or retirementfunds, but these sources put yourpersonal assets at risk. Talk toyour accountant about a wiseamount of personal assets to use,based on your individual situation.Remember the differencebetween equity and debt: equityis money you (or someone else)puts into the business in returnfor an ownership stake, whiledebt is money you borrow toput into the business (whichyou pay back with interest).If you need more start-upfunds, consider friends andfamily financing.Family and friends are oftenthe small business start-up’s firstchoice. Professional lenders,venture capitalists and otherinvestors are usually not interestedin start-ups; they prefer a businesswith a track record, but familyand friends can provide youwith invaluable capital. Familyand friends financing can,however, be fraught with potentialcomplications, so it’s best toapproach carefully. Manyentrepreneurs favor a debt-andequityapproach: family andfriend funders become bothminority-stake owners and lenders,so their eventual compensation,if any, will be based on bothconcepts. However, take care toexplain to them the risks associatedwith investing in a small business.It’s worth the money to have alawyer draft your agreement withfriends and family investors.Investigate other fundingsources.Look into government- andorganization-backed loans andgrants. (See chart below.)Plan for cash flow crunches.Setting aside precious capitalmight seem like the last thing youcan afford to do during start-up,Additional Funding SourcesU.S. Small <strong>Business</strong> Administration (www.sba.gov)but every new business needs asource of funds to cover contingencies.You’ve already calculatedbottom-line personal and businessexpenses; work with youraccountant to figure out whatyou’ll need for a three-monthemergency fund.Home Equity Line of CreditIf you can’t come up with allthe cash, you can apply for ahome equity loan or personalline of credit. Unlike loans, linesof credit make it possible toborrow money when you need it;you don’t pay interest until youactually borrow the funds. Don’twait until you’re desperate; applynow, when your finances arestable and it is easier to qualify.• Assists and protects the nation’s small businesses; while not a lender,it facilitates programs that can help emerging companies get funding:– SBA Basic Loan Guaranty Program: SBA acts as guarantor ofloans made by banks and other lending institutions after carefullyreviewing the borrower’s business plan and assets.– Certified Development Companies: SBA-certified nonprofit that aidslocal economic development. Each CDC works with commerciallenders to create financing packages for small businesses.– Micro-loans: SBA-designated nonprofit lenders who offer loans upto $35,000 for inventory, equipment and supplies (but not debtrepayment or real estate).– Small <strong>Business</strong> Investment Companies: Licensed by thegovernment to act as venture capital firms for small businesses.State Economic Development Agencies• Check with your own state’s agency; it may have helpful financingprograms.• Also look into the U.S. Commerce Department’s EconomicDevelopment Administration (www.eda.gov).Minority and Women’s <strong>Business</strong> Development Groups• Various agencies and organizations that promote businesses ownedby women and members of minority groups. <strong>The</strong> U.S. Department ofCommerce operates the Minority <strong>Business</strong> Development Agency(www.mbda.gov).Shop around, as interest ratesvary. And read the fine print,because low promotional interestsmight be valid for a limited timeonly. Try not to tap your homeequity line unless you’re facinga real emergency.Your 401(k) Retirement PlanAnother source of emergencyfunding might be your 401(k)retirement plan from a previousjob, or if your spouse has one.Read the fine print; borrowingfrom one can incur penalties.For more information on 401(k)borrowing, you can visithttp://www.irs.gov/retirement/participant/index.html.However, it’s important to keepin mind that Congress gavefavorable tax treatment to 401(k)plans so that employees wouldhave something other than SocialSecurity when they retired. Ifyou tap your retirement funds foryour business, and the businessfails, what will you have forretirement?Avail yourself of potentialtax advantages.You might think you havenothing to deduct at this stage ofthe game, but you’d be surprised.Talk to your accountant aboutthe many legitimate businessdeductions available to you: officeequipment and supplies, phone,Internet, postage and deliveryand the like; the cost of producingyour product or service –marketing, distribution, payroll,retirement savings (see Your Life,Your Future, later in this section)and more.5