Annual Report 10/11 - ACL Cables PLC

Annual Report 10/11 - ACL Cables PLC

Annual Report 10/11 - ACL Cables PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

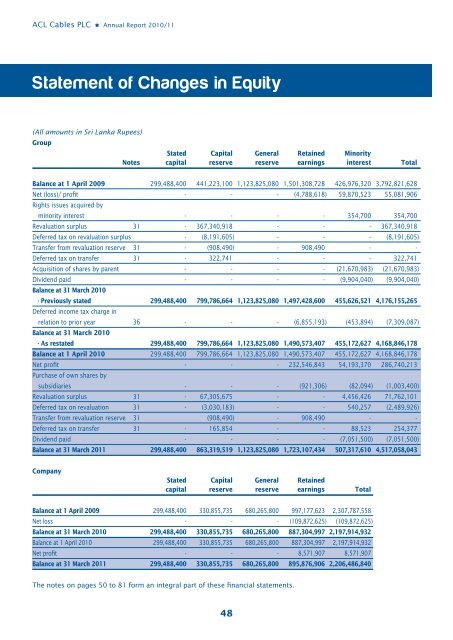

<strong>ACL</strong> <strong>Cables</strong> <strong>PLC</strong> <strong>Annual</strong> <strong>Report</strong> 20<strong>10</strong>/<strong>11</strong>Statement of Changes in Equity(All amounts in Sri Lanka Rupees)GroupStated Capital General Retained MinorityNotes capital reserve reserve earnings interest TotalBalance at 1 April 2009 299,488,400 441,223,<strong>10</strong>0 1,123,825,080 1,501,308,728 426,976,320 3,792,821,628Net (loss)/ profit - - - (4,788,618) 59,870,523 55,081,906Rights issues acquired byminority interest - - - - 354,700 354,700Revaluation surplus 31 - 367,340,918 - - - 367,340,918Deferred tax on revaluation surplus - (8,191,605) - - - (8,191,605)Transfer from revaluation reserve 31 - (908,490) - 908,490 - -Deferred tax on transfer 31 - 322,741 - - - 322,741Acquisition of shares by parent - - - - (21,670,983) (21,670,983)Dividend paid - - - - (9,904,040) (9,904,040)Balance at 31 March 20<strong>10</strong>- Previously stated 299,488,400 799,786,664 1,123,825,080 1,497,428,600 455,626,521 4,176,155,265Deferred income tax charge inrelation to prior year 36 - - - (6,855,193) (453,894) (7,309,087)Balance at 31 March 20<strong>10</strong>- As restated 299,488,400 799,786,664 1,123,825,080 1,490,573,407 455,172,627 4,168,846,178Balance at 1 April 20<strong>10</strong> 299,488,400 799,786,664 1,123,825,080 1,490,573,407 455,172,627 4,168,846,178Net profit - - - 232,546,843 54,193,370 286,740,213Purchase of own shares bysubsidiaries - - - (921,306) (82,094) (1,003,400)Revaluation surplus 31 - 67,305,675 - - 4,456,426 71,762,<strong>10</strong>1Deferred tax on revaluation 31 - (3,030,183) - - 540,257 (2,489,926)Transfer from revaluation reserve 31 (908,490) - 908,490 - -Deferred tax on transfer 31 - 165,854 - - 88,523 254,377Dividend paid - - - - (7,051,500) (7,051,500)Balance at 31 March 20<strong>11</strong> 299,488,400 863,319,519 1,123,825,080 1,723,<strong>10</strong>7,434 507,317,6<strong>10</strong> 4,517,058,043CompanyStated Capital General Retainedcapital reserve reserve earnings TotalBalance at 1 April 2009 299,488,400 330,855,735 680,265,800 997,177,623 2,307,787,558Net loss - - - (<strong>10</strong>9,872,625) (<strong>10</strong>9,872,625)Balance at 31 March 20<strong>10</strong> 299,488,400 330,855,735 680,265,800 887,304,997 2,197,914,932Balance at 1 April 20<strong>10</strong> 299,488,400 330,855,735 680,265,800 887,304,997 2,197,914,932Net profit - - - 8,571,907 8,571,907Balance at 31 March 20<strong>11</strong> 299,488,400 330,855,735 680,265,800 895,876,906 2,206,486,840The notes on pages 50 to 81 form an integral part of these financial statements.48