Annual Report 10/11 - ACL Cables PLC

Annual Report 10/11 - ACL Cables PLC

Annual Report 10/11 - ACL Cables PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

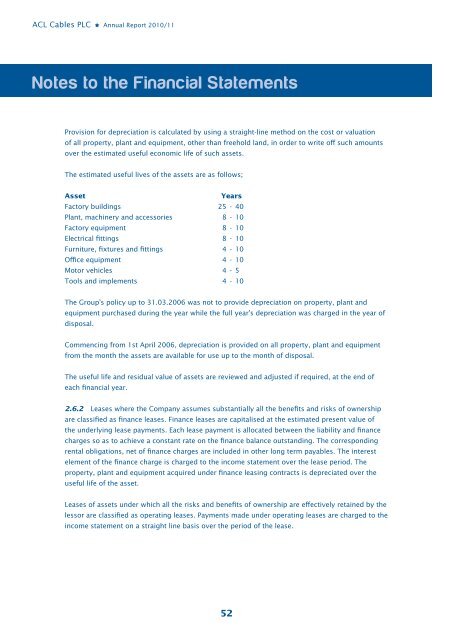

<strong>ACL</strong> <strong>Cables</strong> <strong>PLC</strong> <strong>Annual</strong> <strong>Report</strong> 20<strong>10</strong>/<strong>11</strong>Notes to the Financial StatementsProvision for depreciation is calculated by using a straight-line method on the cost or valuationof all property, plant and equipment, other than freehold land, in order to write off such amountsover the estimated useful economic life of such assets.The estimated useful lives of the assets are as follows;AssetYearsFactory buildings 25 - 40Plant, machinery and accessories 8 - <strong>10</strong>Factory equipment 8 - <strong>10</strong>Electrical fittings 8 - <strong>10</strong>Furniture, fixtures and fittings 4 - <strong>10</strong>Office equipment 4 - <strong>10</strong>Motor vehicles 4 - 5Tools and implements 4 - <strong>10</strong>The Group’s policy up to 31.03.2006 was not to provide depreciation on property, plant andequipment purchased during the year while the full year’s depreciation was charged in the year ofdisposal.Commencing from 1st April 2006, depreciation is provided on all property, plant and equipmentfrom the month the assets are available for use up to the month of disposal.The useful life and residual value of assets are reviewed and adjusted if required, at the end ofeach financial year.2.6.2 Leases where the Company assumes substantially all the benefits and risks of ownershipare classified as finance leases. Finance leases are capitalised at the estimated present value ofthe underlying lease payments. Each lease payment is allocated between the liability and financecharges so as to achieve a constant rate on the finance balance outstanding. The correspondingrental obligations, net of finance charges are included in other long term payables. The interestelement of the finance charge is charged to the income statement over the lease period. Theproperty, plant and equipment acquired under finance leasing contracts is depreciated over theuseful life of the asset.Leases of assets under which all the risks and benefits of ownership are effectively retained by thelessor are classified as operating leases. Payments made under operating leases are charged to theincome statement on a straight line basis over the period of the lease.52