Annual Report 2000 in PDF - Antofagasta plc

Annual Report 2000 in PDF - Antofagasta plc

Annual Report 2000 in PDF - Antofagasta plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

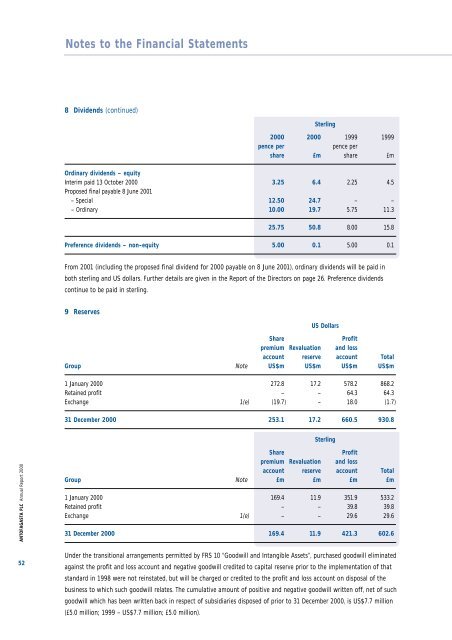

Notes to the F<strong>in</strong>ancial Statements8 Dividends (cont<strong>in</strong>ued)Sterl<strong>in</strong>g<strong>2000</strong> <strong>2000</strong> 1999 1999pence perpence pershare £m share £mOrd<strong>in</strong>ary dividends – equityInterim paid 13 October <strong>2000</strong> 3.25 6.4 2.25 4.5Proposed f<strong>in</strong>al payable 8 June 2001– Special 12.50 24.7 – –– Ord<strong>in</strong>ary 10.00 19.7 5.75 11.325.75 50.8 8.00 15.8Preference dividends – non-equity 5.00 0.1 5.00 0.1From 2001 (<strong>in</strong>clud<strong>in</strong>g the proposed f<strong>in</strong>al dividend for <strong>2000</strong> payable on 8 June 2001), ord<strong>in</strong>ary dividends will be paid <strong>in</strong>both sterl<strong>in</strong>g and US dollars. Further details are given <strong>in</strong> the <strong>Report</strong> of the Directors on page 26. Preference dividendscont<strong>in</strong>ue to be paid <strong>in</strong> sterl<strong>in</strong>g.9 ReservesUS DollarsShareProfitpremium Revaluation and lossaccount reserve account TotalGroup Note US$m US$m US$m US$m1 January <strong>2000</strong> 272.8 17.2 578.2 868.2Reta<strong>in</strong>ed profit – – 64.3 64.3Exchange 1(e) (19.7) – 18.0 (1.7)31 December <strong>2000</strong> 253.1 17.2 660.5 930.8Sterl<strong>in</strong>gANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> <strong>2000</strong>ShareProfitpremium Revaluation and lossaccount reserve account TotalGroup Note £m £m £m £m1 January <strong>2000</strong> 169.4 11.9 351.9 533.2Reta<strong>in</strong>ed profit – – 39.8 39.8Exchange 1(e) – – 29.6 29.631 December <strong>2000</strong> 169.4 11.9 421.3 602.652Under the transitional arrangements permitted by FRS 10 “Goodwill and Intangible Assets”, purchased goodwill elim<strong>in</strong>atedaga<strong>in</strong>st the profit and loss account and negative goodwill credited to capital reserve prior to the implementation of thatstandard <strong>in</strong> 1998 were not re<strong>in</strong>stated, but will be charged or credited to the profit and loss account on disposal of thebus<strong>in</strong>ess to which such goodwill relates. The cumulative amount of positive and negative goodwill written off, net of suchgoodwill which has been written back <strong>in</strong> respect of subsidiaries disposed of prior to 31 December <strong>2000</strong>, is US$7.7 million(£5.0 million; 1999 – US$7.7 million; £5.0 million).