Annual Report 2000 in PDF - Antofagasta plc

Annual Report 2000 in PDF - Antofagasta plc

Annual Report 2000 in PDF - Antofagasta plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

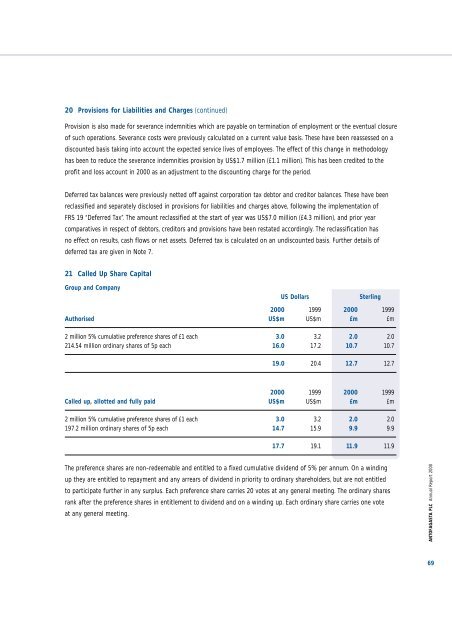

20 Provisions for Liabilities and Charges (cont<strong>in</strong>ued)Provision is also made for severance <strong>in</strong>demnities which are payable on term<strong>in</strong>ation of employment or the eventual closureof such operations. Severance costs were previously calculated on a current value basis. These have been reassessed on adiscounted basis tak<strong>in</strong>g <strong>in</strong>to account the expected service lives of employees. The effect of this change <strong>in</strong> methodologyhas been to reduce the severance <strong>in</strong>demnities provision by US$1.7 million (£1.1 million). This has been credited to theprofit and loss account <strong>in</strong> <strong>2000</strong> as an adjustment to the discount<strong>in</strong>g charge for the period.Deferred tax balances were previously netted off aga<strong>in</strong>st corporation tax debtor and creditor balances. These have beenreclassified and separately disclosed <strong>in</strong> provisions for liabilities and charges above, follow<strong>in</strong>g the implementation ofFRS 19 “Deferred Tax”. The amount reclassified at the start of year was US$7.0 million (£4.3 million), and prior yearcomparatives <strong>in</strong> respect of debtors, creditors and provisions have been restated accord<strong>in</strong>gly. The reclassification hasno effect on results, cash flows or net assets. Deferred tax is calculated on an undiscounted basis. Further details ofdeferred tax are given <strong>in</strong> Note 7.21 Called Up Share CapitalGroup and CompanyUS DollarsSterl<strong>in</strong>g<strong>2000</strong> 1999 <strong>2000</strong> 1999Authorised US$m US$m £m £m2 million 5% cumulative preference shares of £1 each 3.0 3.2 2.0 2.0214.54 million ord<strong>in</strong>ary shares of 5p each 16.0 17.2 10.7 10.719.0 20.4 12.7 12.7<strong>2000</strong> 1999 <strong>2000</strong> 1999Called up, allotted and fully paid US$m US$m £m £m2 million 5% cumulative preference shares of £1 each 3.0 3.2 2.0 2.0197.2 million ord<strong>in</strong>ary shares of 5p each 14.7 15.9 9.9 9.917.7 19.1 11.9 11.9The preference shares are non-redeemable and entitled to a fixed cumulative dividend of 5% per annum. On a w<strong>in</strong>d<strong>in</strong>gup they are entitled to repayment and any arrears of dividend <strong>in</strong> priority to ord<strong>in</strong>ary shareholders, but are not entitledto participate further <strong>in</strong> any surplus. Each preference share carries 20 votes at any general meet<strong>in</strong>g. The ord<strong>in</strong>ary sharesrank after the preference shares <strong>in</strong> entitlement to dividend and on a w<strong>in</strong>d<strong>in</strong>g up. Each ord<strong>in</strong>ary share carries one voteat any general meet<strong>in</strong>g.ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> <strong>2000</strong>69