Annual Report 2000 in PDF - Antofagasta plc

Annual Report 2000 in PDF - Antofagasta plc

Annual Report 2000 in PDF - Antofagasta plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

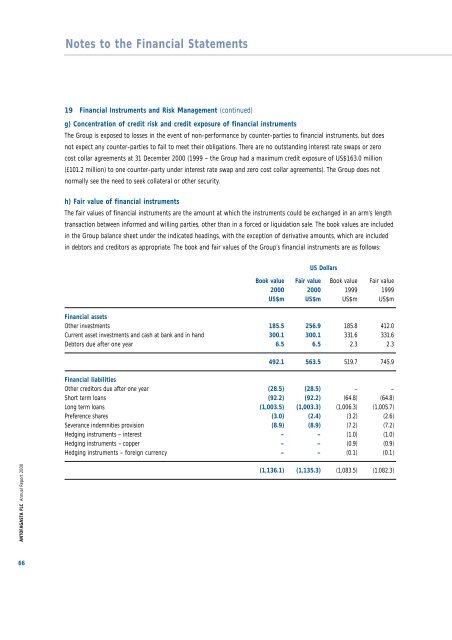

Notes to the F<strong>in</strong>ancial Statements19 F<strong>in</strong>ancial Instruments and Risk Management (cont<strong>in</strong>ued)g) Concentration of credit risk and credit exposure of f<strong>in</strong>ancial <strong>in</strong>strumentsThe Group is exposed to losses <strong>in</strong> the event of non-performance by counter-parties to f<strong>in</strong>ancial <strong>in</strong>struments, but doesnot expect any counter-parties to fail to meet their obligations. There are no outstand<strong>in</strong>g <strong>in</strong>terest rate swaps or zerocost collar agreements at 31 December <strong>2000</strong> (1999 – the Group had a maximum credit exposure of US$163.0 million(£101.2 million) to one counter-party under <strong>in</strong>terest rate swap and zero cost collar agreements). The Group does notnormally see the need to seek collateral or other security.h) Fair value of f<strong>in</strong>ancial <strong>in</strong>strumentsThe fair values of f<strong>in</strong>ancial <strong>in</strong>struments are the amount at which the <strong>in</strong>struments could be exchanged <strong>in</strong> an arm’s lengthtransaction between <strong>in</strong>formed and will<strong>in</strong>g parties, other than <strong>in</strong> a forced or liquidation sale. The book values are <strong>in</strong>cluded<strong>in</strong> the Group balance sheet under the <strong>in</strong>dicated head<strong>in</strong>gs, with the exception of derivative amounts, which are <strong>in</strong>cluded<strong>in</strong> debtors and creditors as appropriate. The book and fair values of the Group’s f<strong>in</strong>ancial <strong>in</strong>struments are as follows:US DollarsBook value Fair value Book value Fair value<strong>2000</strong> <strong>2000</strong> 1999 1999US$m US$m US$m US$mF<strong>in</strong>ancial assetsOther <strong>in</strong>vestments 185.5 256.9 185.8 412.0Current asset <strong>in</strong>vestments and cash at bank and <strong>in</strong> hand 300.1 300.1 331.6 331.6Debtors due after one year 6.5 6.5 2.3 2.3492.1 563.5 519.7 745.9F<strong>in</strong>ancial liabilitiesOther creditors due after one year (28.5) (28.5) – –Short term loans (92.2) (92.2) (64.8) (64.8)Long term loans (1,003.5) (1,003.3) (1,006.3) (1,005.7)Preference shares (3.0) (2.4) (3.2) (2.6)Severance <strong>in</strong>demnities provision (8.9) (8.9) (7.2) (7.2)Hedg<strong>in</strong>g <strong>in</strong>struments – <strong>in</strong>terest – – (1.0) (1.0)Hedg<strong>in</strong>g <strong>in</strong>struments – copper – – (0.9) (0.9)Hedg<strong>in</strong>g <strong>in</strong>struments – foreign currency – – (0.1) (0.1)ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> <strong>2000</strong>(1,136.1) (1,135.3) (1,083.5) (1,082.3)66