Ecowise Annual Report 2007 - ecoWise Holdings Limited

Ecowise Annual Report 2007 - ecoWise Holdings Limited

Ecowise Annual Report 2007 - ecoWise Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

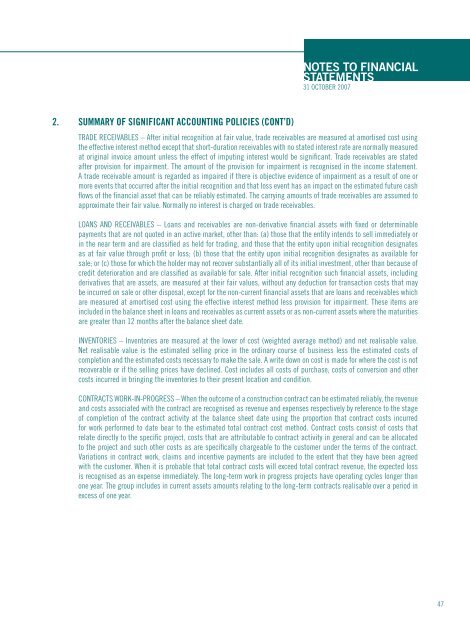

Notes to FinancialStatements31 October <strong>2007</strong>2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Cont’d)TRADE RECEIVABLES – After initial recognition at fair value, trade receivables are measured at amortised cost usingthe effective interest method except that short-duration receivables with no stated interest rate are normally measuredat original invoice amount unless the effect of imputing interest would be significant. Trade receivables are statedafter provision for impairment. The amount of the provision for impairment is recognised in the income statement.A trade receivable amount is regarded as impaired if there is objective evidence of impairment as a result of one ormore events that occurred after the initial recognition and that loss event has an impact on the estimated future cashflows of the financial asset that can be reliably estimated. The carrying amounts of trade receivables are assumed toapproximate their fair value. Normally no interest is charged on trade receivables.LOANS AND RECEIVABLES – Loans and receivables are non-derivative financial assets with fixed or determinablepayments that are not quoted in an active market, other than: (a) those that the entity intends to sell immediately orin the near term and are classified as held for trading, and those that the entity upon initial recognition designatesas at fair value through profit or loss; (b) those that the entity upon initial recognition designates as available forsale; or (c) those for which the holder may not recover substantially all of its initial investment, other than because ofcredit deterioration and are classified as available for sale. After initial recognition such financial assets, includingderivatives that are assets, are measured at their fair values, without any deduction for transaction costs that maybe incurred on sale or other disposal, except for the non-current financial assets that are loans and receivables whichare measured at amortised cost using the effective interest method less provision for impairment. These items areincluded in the balance sheet in loans and receivables as current assets or as non-current assets where the maturitiesare greater than 12 months after the balance sheet date.INVENTORIES – Inventories are measured at the lower of cost (weighted average method) and net realisable value.Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs ofcompletion and the estimated costs necessary to make the sale. A write down on cost is made for where the cost is notrecoverable or if the selling prices have declined. Cost includes all costs of purchase, costs of conversion and othercosts incurred in bringing the inventories to their present location and condition.CONTRACTS WORK-IN-PROGRESS – When the outcome of a construction contract can be estimated reliably, the revenueand costs associated with the contract are recognised as revenue and expenses respectively by reference to the stageof completion of the contract activity at the balance sheet date using the proportion that contract costs incurredfor work performed to date bear to the estimated total contract cost method. Contract costs consist of costs thatrelate directly to the specific project, costs that are attributable to contract activity in general and can be allocatedto the project and such other costs as are specifically chargeable to the customer under the terms of the contract.Variations in contract work, claims and incentive payments are included to the extent that they have been agreedwith the customer. When it is probable that total contract costs will exceed total contract revenue, the expected lossis recognised as an expense immediately. The long-term work in progress projects have operating cycles longer thanone year. The group includes in current assets amounts relating to the long-term contracts realisable over a period inexcess of one year.47