PDF - 359KB - Truworths

PDF - 359KB - Truworths

PDF - 359KB - Truworths

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

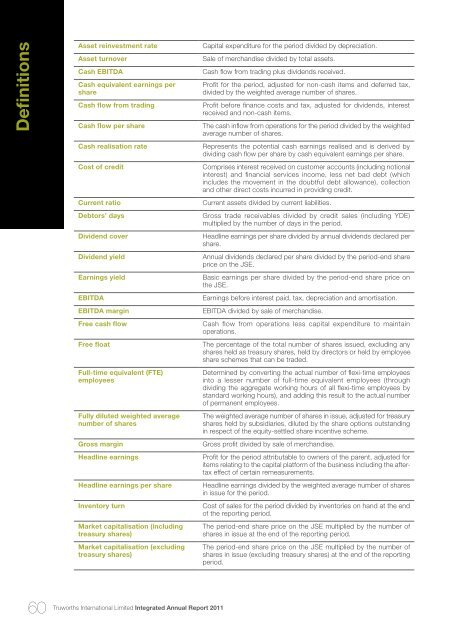

DefinitionsAsset reinvestment rateAsset turnoverCash EBITDACash equivalent earnings pershareCash flow from tradingCash flow per shareCash realisation rateCost of creditCurrent ratioDebtors’ daysDividend coverDividend yieldEarnings yieldEBITDAEBITDA marginFree cash flowFree floatFull-time equivalent (FTE)employeesFully diluted weighted averagenumber of sharesGross marginHeadline earningsHeadline earnings per shareInventory turnMarket capitalisation (includingtreasury shares)Market capitalisation (excludingtreasury shares)Capital expenditure for the period divided by depreciation.Sale of merchandise divided by total assets.Cash flow from trading plus dividends received.Profit for the period, adjusted for non-cash items and deferred tax,divided by the weighted average number of shares.Profit before finance costs and tax, adjusted for dividends, interestreceived and non-cash items.The cash inflow from operations for the period divided by the weightedaverage number of shares.Represents the potential cash earnings realised and is derived bydividing cash flow per share by cash equivalent earnings per share.Comprises interest received on customer accounts (including notionalinterest) and financial services income, less net bad debt (whichincludes the movement in the doubtful debt allowance), collectionand other direct costs incurred in providing credit.Current assets divided by current liabilities.Gross trade receivables divided by credit sales (including YDE)multiplied by the number of days in the period.Headline earnings per share divided by annual dividends declared pershare.Annual dividends declared per share divided by the period-end shareprice on the JSE.Basic earnings per share divided by the period-end share price onthe JSE.Earnings before interest paid, tax, depreciation and amortisation.EBITDA divided by sale of merchandise.Cash flow from operations less capital expenditure to maintainoperations.The percentage of the total number of shares issued, excluding anyshares held as treasury shares, held by directors or held by employeeshare schemes that can be traded.Determined by converting the actual number of flexi-time employeesinto a lesser number of full-time equivalent employees (throughdividing the aggregate working hours of all flexi-time employees bystandard working hours), and adding this result to the actual numberof permanent employees.The weighted average number of shares in issue, adjusted for treasuryshares held by subsidiaries, diluted by the share options outstandingin respect of the equity-settled share incentive scheme.Gross profit divided by sale of merchandise.Profit for the period attributable to owners of the parent, adjusted foritems relating to the capital platform of the business including the aftertaxeffect of certain remeasurements.Headline earnings divided by the weighted average number of sharesin issue for the period.Cost of sales for the period divided by inventories on hand at the endof the reporting period.The period-end share price on the JSE multiplied by the number ofshares in issue at the end of the reporting period.The period-end share price on the JSE multiplied by the number ofshares in issue (excluding treasury shares) at the end of the reportingperiod.60<strong>Truworths</strong> International Limited Integrated Annual Report 2011