Trust - TMLT

Trust - TMLT

Trust - TMLT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

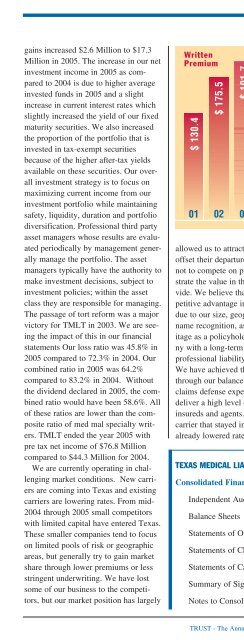

gains increased $2.6 Million to $17.3Million in 2005. The increase in our netinvestment income in 2005 as comparedto 2004 is due to higher averageinvested funds in 2005 and a slightincrease in current interest rates whichslightly increased the yield of our fixedmaturity securities. We also increasedthe proportion of the portfolio that isinvested in tax-exempt securitiesbecause of the higher after-tax yieldsavailable on these securities. Our overallinvestment strategy is to focus onmaximizing current income from ourinvestment portfolio while maintainingsafety, liquidity, duration and portfoliodiversification. Professional third partyasset managers whose results are evaluatedperiodically by management generallymanage the portfolio. The assetmanagers typically have the authority tomake investment decisions, subject toinvestment policies; within the assetclass they are responsible for managing.The passage of tort reform was a majorvictory for <strong>TMLT</strong> in 2003. We are seeingthe impact of this in our financialstatements Our loss ratio was 45.8% in2005 compared to 72.3% in 2004. Ourcombined ratio in 2005 was 64.2%compared to 83.2% in 2004. Withoutthe dividend declared in 2005, the combinedratio would have been 58.6%. Allof these ratios are lower than the compositeratio of med mal specialty writers.<strong>TMLT</strong> ended the year 2005 withpre tax net income of $76.8 Millioncompared to $44.3 Million for 2004.We are currently operating in challengingmarket conditions. New carriersare coming into Texas and existingcarriers are lowering rates. From mid-2004 through 2005 small competitorswith limited capital have entered Texas.These smaller companies tend to focuson limited pools of risk or geographicareas, but generally try to gain marketshare through lower premiums or lessstringent underwriting. We have lostsome of our business to the competitors,but our market position has largelyallowed us to attract new customers tooffset their departure. Our strategy isnot to compete on price, but to demonstratethe value in the coverage we provide.We believe that we have a competitiveadvantage in the current marketdue to our size, geographic scope andname recognition, as well as our heritageas a policyholder-founded companywith a long-term commitment to theprofessional liability insurance industry.We have achieved these advantagesthrough our balance sheet strength,claims defense expertise and ability todeliver a high level of service to ourinsureds and agents. At <strong>TMLT</strong> – thecarrier that stayed in Texas and hasalready lowered rates and initiated aTEXAS MEDICAL LIABILITY TRUST AND SUBSIDIARYdividend program that we hope to continueas long as financial results willsupport it — we have continued tostrengthen our balance sheet to providethe financial stability our policyholdersdeserve. Our premiums are set toprovide insurance coverage at a fairprice — not to maximize profits. <strong>TMLT</strong>is doctor owned and <strong>TMLT</strong>’s responsibilityis to provide its policyholderswith a financially sound carrier andinsurance coverage at a fair price.Ray DemelSenior Vice President and CFOConsolidated Financial Statements • Years Ended December 31, 2005 and 2004Independent Auditors’ Report 24Balance Sheets 25-26Statements of Operations 27Statements of Changes in Policyholders’ Surplus 28Statements of Cash Flows 29Summary of Significant Accounting Policies 30-32Notes to Consolidated Financial Statements 33-39TRUST - The Annual Report Magazine23