Trust - TMLT

Trust - TMLT

Trust - TMLT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

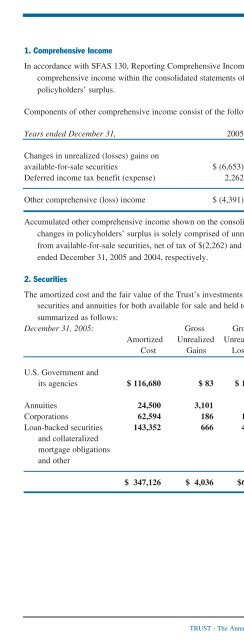

1. Comprehensive IncomeIn accordance with SFAS 130, Reporting Comprehensive Income, the <strong>Trust</strong> presentscomprehensive income within the consolidated statements of changes inpolicyholders’ surplus.Notes to ConsolidatedFinancial StatementsComponents of other comprehensive income consist of the following:Years ended December 31, 2005 2004(in thousands)Changes in unrealized (losses) gains onavailable-for-sale securities $ (6,653) $ 1,238Deferred income tax benefit (expense) 2,262 (420)Other comprehensive (loss) income $ (4,391) $ 818Accumulated other comprehensive income shown on the consolidated statements ofchanges in policyholders’ surplus is solely comprised of unrealized gains (losses)from available-for-sale securities, net of tax of $(2,262) and $420 for the yearsended December 31, 2005 and 2004, respectively.2. SecuritiesThe amortized cost and the fair value of the <strong>Trust</strong>’s investments in fixed maturitysecurities and annuities for both available for sale and held to maturity aresummarized as follows:December 31, 2005: Gross Gross EstimatedAmortized Unrealized Unrealized FairCost Gains Losses Value(in thousands)U.S. Government andits agencies $ 116,680 $ 83 $ 1,347 $115,416Annuities 24,500 3,101 - 27,601Corporations 62,594 186 1,444 61,336Loan-backed securities 143,352 666 4,006 140,012and collateralizedmortgage obligationsand other$ 347,126 $ 4,036 $6,797 $ 344,365TRUST - The Annual Report Magazine33