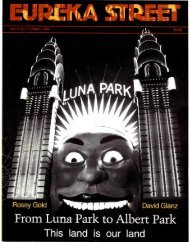

n - Eureka Street

n - Eureka Street

n - Eureka Street

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BooKs: 4BRIAN TOOHEYThe superannuation highwayAAgeing an d Money, Dian a Olsberg, Allen and Unwin, Sydney, 1997 ISBN 1 86448 047 5 RRP $24.95geing and Money has the great giving me any money nowadays. He says managers who handle the contributions onvirtue that its author is an 'insider' in the it's his super and he's going to spend it behalf of the members of various supersuperannuation business who doesn't insist himself. He goes out a lot, plays golf and sch emes and their trustees. Compulsorythat the Labor Government's decision to has lunch with his friends. He's cut my contributions mean that the funds managersprivatise the age pension is an unqualified housekeeping money right back, and I don't now have access to a guaranteed flood ofsuccess. even have money to buy myself lipstick money from people who would not normallyAs a former Executive Director of the any more. go anywhere near the share or bond markets.Australian Institute of Superannuation One intriguing aspect of the new super Olsberg argues that leaving investmentTrustees,DianaOlsbergisoptimisticabout scheme is that- d espite b eing so allocation entirelyinthehandsofthemajorthe new system. If all goes well, it should, regressive-it was introduced at the behest funds managers can lead to contributors'she believes, deliver greater financial of the union movement. Low income 'assets being sold backwards and forwards,freedom for retirees as well as fund the sort earners who could previously expect to get inflating the market and transaction costsof investment needed to make allwithout the benefits of productiveAustralians better off. Over time, itinvestment. These powerful institucouldeven lead to a new era oftions have an adverse effect on oureconomic democracy in which ordinaryemployees have a much largergovernment to slow down theOne super schem e reportedly hired several national economy, pressuring thefunds managers only to discover that theysay in the business decisions whicheconomy at the slightest hint ofhelp shape our society.had been selling the same parcel of BHP higher inflation'.But Olsberg is also well placed to shares to each other ... m embers had paid out Although Olsberg did not givesee some of the shortcomings thatbrokerage and m anagem ent fees for thespecific examples, one super schemelook like becoming en trenched underreportedly hired several funds managersonly to discover that they hadthe Howard Government. From her privilege of owning the same number of BHPperspective, trustees surrender too shares. No new productive investm ent been selling the same parcel of BHPmuch control over investment eventuated but the funds managers and the shares to each other. At the end of thedecisions to professional funds managerswho concentrate excessively onday, m embers had paid out brokeragebrokers went away happy.and management fees for the privilegeshort-term speculative share trading.of owning the same number of BHPOlsberg also recognises thatprivatisation shifts the burden of fundingretirement incomes onto people who canleast afford it. Unless there is a continuingtop-up from the social security system, shewarns that many people will face a roughtime in their old age. She also sees a largegap between the reality facing most peopleand the message conveyed by an advertisingcampaign from one funds manager which'shows a greying, but still youthful looking,60-year-old man walking along a sundrenchedbeach,arm-in-arm and lookingadoringly at a glamorous young woman inher mid-thirties'.The more likely outcome is that anolder woman will be stuck at homestruggling to get a fair share of her partner'ssuperannuation. As Olsberg points out,spouses with no income of their own haveno legal entitlement to their partner's superwhereas they would have had access to thejoint pension. She quotes a 67-year-oldwoman who says:I can't get the pension because Jim has gotvery good superannuation. But he begrudgesan age pension funded from a moderatelyprogressive tax system are now expected toprovide for their own pension via super. Asa result, money which could have gone intotake-home pay now goes into super contributions.Not only are the contributionsequivalent to a flat rate tax, the tax concessionsoverwhelmingly benefit the well-offeven after the Howard Government'ssurcharge.For traditional equity considerations toprevail, the system needs to be turned on itshead so that any tax subsidies go only tothose at the bottom of the scale. The levelof contributions also need to be cappedbelow the proposed 12 percent of income sothat ordinary employees don't find it evenharder to make ends meet during theirworking lives. ( Olsberg focuses on the difficultiesfor part-time employees, but six percent should be more than ample to replacethe age pension for someone in continuousfull-time employment.)Although the poor do badly, the newsystem has created a bonanza for the fundsshares. No new productive investmenteventuated but the funds managers and thebrokers went away happy.Olsberg's other complaint is typified bythe intense pressure exerted by the financialmarkets a couple of years ago for a threepercentage point rise in interest rates inorder to throttle a non-existent threat ofinflation. Fortunately, the then Reserve BankGovernor, Bernie Fraser, refused to bow tothis pressure. Otherwise the economy wouldalmost certainly have been plunged backinto recession and hundreds of thousands ofcontributors would have lost their jobs.Olsberg looks forward to the day whencontributors take a much keener interest inhow the super money is invested. As shewrites, 'What happens to the money in oursuper funds may well be the key to oursuccessful ageing in the 21st century andthe health of our nation as a whole'.The hope is for far more attention to bepaid to ensuring that the money is investedin a manner which takes account on ethicaland environmental considerations as wellas the nation's long-term prosperity. But42 EUREKA STREET • M AY 1997