Student Aid Form ⢠2010 - Lycée Français de New York

Student Aid Form ⢠2010 - Lycée Français de New York

Student Aid Form ⢠2010 - Lycée Français de New York

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

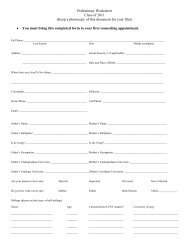

FTAXABLE INCOMEThe 2009 fe<strong>de</strong>ral tax return for stu<strong>de</strong>nt’s household was:o Filedo Not filed yet (See Required Documentation section)o I/we do not file. I/we only receive non-taxable income1. Total number of exemptions claimedon Fe<strong>de</strong>ral Income Tax form:2. Parent/Guardian A total taxableincome from W-2 wages.(List total income for Parent A only)3. Parent/Guardian B total taxableincome from W-2 wages.(List total income for Parent B only)Actual 2009 Estimate <strong>2010</strong>$ ______________ $ _____________$ ______________ $ _____________4. Net business income* from self-employment,farm, rentals, and other businesses.(*Go to Section K)(Attach Schedule C, E, and/or F from your IRS 1040) $ ______________ $ _____________See 2009 1040 lines 12, 17 and 185. Other non-work taxable income from interest,divi<strong>de</strong>nds, alimony, unemployment, and nonbusinessincome.See 2009 1040 lines 8a, 9a-11, 13, 14, 15b, 16b, 19-21See 2009 1040A lines 8a-14b6 Allowable “Adjustments to Income” as reportedon your IRS 1040, 1040A or 1040EZ.See 2009 1040 line 36 or 1040A line 207. Total “Adjusted Gross Income” as reportedon your IRS 1040, 1040A or 1040EZ.See 2009 1040 line 37 or 1040A line 218. Total Tax Paid as reported on yourIRS 1040, 1040A or 1040EZ.See 2009 1040 line 60 or 1040A line 379. Medical/<strong>de</strong>ntal expenses as reported onSchedule A line 1 of your IRS 1040 <strong>Form</strong>.GNON-TAXABLE INCOME$ ______________ $ _____________$ ______________ $ _____________$ ______________ $ _____________$ ______________ $ _____________$ ______________ $ _____________List the total amount received from 1/1/09-12/31/09 for all recipients in household.DO NOT list monthly amounts.HIHOUSING INFORMATION (DO NOT LEAVE BLANK)20. Do you rent or own your resi<strong>de</strong>nce? o Rent o Own (go to line 22)21. If renting, what is the monthly rental payment? $ _________________________________________________________a. Amount paid by household $ ______________________________________ per monthb. Amount paid by other source(s) $ ______________________________________ per month22. If you own your resi<strong>de</strong>nce:a. What is the current market value? $ ______________________________________________b. What is the amount still owed,including home equity loans?ASSETS & INVESTMENTS (AS OF 12/31/09)23. Total amount in cash, checking, and savings accounts $ __________________________________24. Total value of money market funds, mutual funds,stocks, bonds, CDs, or other securities25. Total value of IRA, Keogh, 401K, SEP or otherretirement accounts26. If you own real estate other than your primary resi<strong>de</strong>nce,$ ______________________________________________c. What is the monthly mortgage payment? $ ______________________________________ per month$ __________________________________$ __________________________________a. What is the fair market value? $ _______________b. What is the amount still owed? $ __________________________________27. Do you own a business? o Yes o NoIf Yes, please go to Section K.a. What is the fair market value of your business? $ __________________________________b. What is the amount still owed? $ __________________________________28. Do you own a farm? o Yes o NoIf Yes, please go to Section K.a. What is the fair market value of your farm? $ __________________________________10. Child support $ ______________________________ per year11. Cash Assistance (TANF) $ ______________________________ per year*12. Food Stamps $ ______________________________ per year*a. Medicaid received in 2009? o Yes o No13. Social Security income (SSA/SSD, etc.)(Provi<strong>de</strong> documentation for all recipients in household.)a. Social Securtiy income (SSI ONLY)(Provi<strong>de</strong> documentation for all recipients in household.)14. <strong>Stu<strong>de</strong>nt</strong> loans and/or grants received for PARENT’s education.(Not college attending <strong>de</strong>pen<strong>de</strong>nts or stu<strong>de</strong>nts listed in Section C.)a. total received in 2009 $$ ______________________________ per year*$ ______________________________ per year*b. total used for household expenses $ ______________________________ per year*15. Housing Assistance (Sec. 8, HUD, etc.) $ ______________________________ per year*a. Religious Housing Assistance(parsonage, manse, etc.)$ ______________________________ per year*16. Other non-taxable income (Workers’ Comp., Disability,Pension/Retirement, etc. I<strong>de</strong>ntify source(s) in Section L) $ ______________________________ per year*17. Loans/Gifts from friends or relatives $ ______________________________ per year18. Personal Savings/Investment Accounts usedfor household expenses(Do not inclu<strong>de</strong> totals listed in Section I)$ ______________________________ per year19. Total non-taxable income for 2009 $____________________________ per year*You must provi<strong>de</strong> 2009 YEAR-END documentation for items 11-16; either a Year-EndStatement from the appropriate Public Agency, or documentation showing totals from1/1/09 - 12/31/09.JGo to next page _b. What is the amount still owed? $ __________________________________UNUSUAL CIRCUMSTANCESCheck all that apply to your situation within the past 12 months:a. o Loss of job i. o Death in the familyb. o Recent separation/divorce j. o Shared custodyc. o Change in family living status k. o High <strong>de</strong>btd. o Change in work status l. o Child support reductione. o Bankruptcy m. o Medical/Dental expensesf. o College expenses n. o Shared tuitiong. o Income reduction o. o Other (Explain in Section L)h. o Illness or injury