Astral Foods Annual Report 2008

Astral Foods Annual Report 2008

Astral Foods Annual Report 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

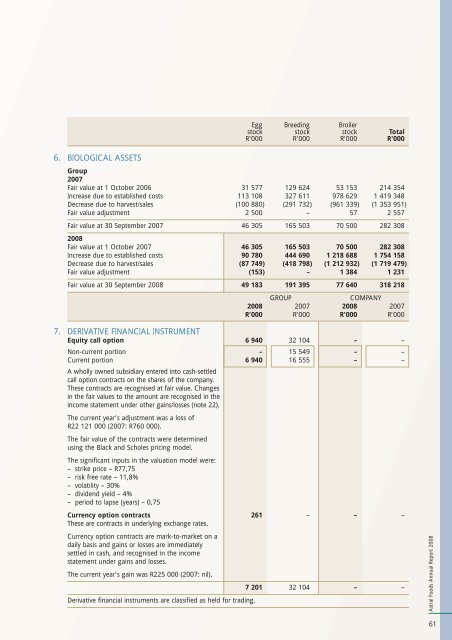

6. BIOLOGICAL ASSETSEgg Breeding Broilerstock stock stock TotalR'000 R'000 R'000 R'000Group2007Fair value at 1 October 2006 31 577 129 624 53 153 214 354Increase due to established costs 113 108 327 611 978 629 1 419 348Decrease due to harvest/sales (100 880) (291 732) (961 339) (1 353 951)Fair value adjustment 2 500 – 57 2 557Fair value at 30 September 2007 46 305 165 503 70 500 282 308<strong>2008</strong>Fair value at 1 October 2007 46 305 165 503 70 500 282 308Increase due to established costs 90 780 444 690 1 218 688 1 754 158Decrease due to harvest/sales (87 749) (418 798) (1 212 932) (1 719 479)Fair value adjustment (153) – 1 384 1 231Fair value at 30 September <strong>2008</strong> 49 183 191 395 77 640 318 218GROUPCOMPANY<strong>2008</strong> 2007 <strong>2008</strong> 2007R’000 R’000 R’000 R’0007. DERIVATIVE FINANCIAL INSTRUMENTEquity call option 6 940 32 104 – –Non-current portion – 15 549 – –Current portion 6 940 16 555 – –A wholly owned subsidiary entered into cash-settledcall option contracts on the shares of the company.These contracts are recognised at fair value. Changesin the fair values to the amount are recognised in theincome statement under other gains/losses (note 22).The current year's adjustment was a loss ofR22 121 000 (2007: R760 000).The fair value of the contracts were determinedusing the Black and Scholes pricing model.The significant inputs in the valuation model were:– strike price – R77,75– risk free rate – 11,8%– volatility – 30%– dividend yield – 4%– period to lapse (years) – 0,75Currency option contracts 261 – – –These are contracts in underlying exchange rates.Currency option contracts are mark-to-market on adaily basis and gains or losses are immediatelysettled in cash, and recognised in the incomestatement under gains and losses.The current year's gain was R225 000 (2007: nil).Derivative financial instruments are classified as held for trading.7 201 32 104 – –<strong>Astral</strong> <strong>Foods</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>61