Astral Foods Annual Report 2008

Astral Foods Annual Report 2008

Astral Foods Annual Report 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

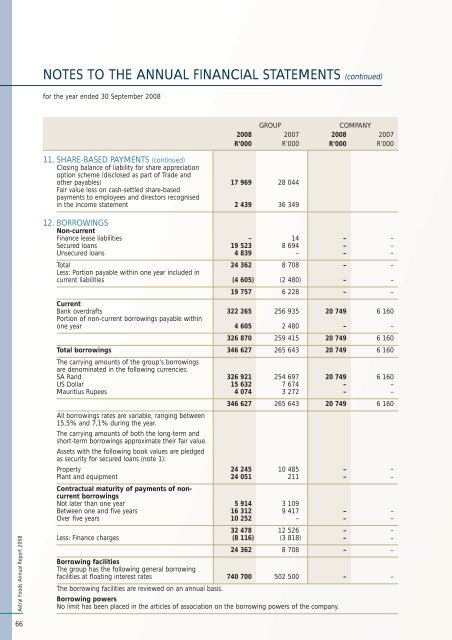

NOTES TO THE ANNUAL FINANCIAL STATEMENTS (continued)for the year ended 30 September <strong>2008</strong>11. SHARE-BASED PAYMENTS (continued)Closing balance of liability for share appreciationoption scheme (disclosed as part of Trade andother payables) 17 969 28 044Fair value loss on cash-settled share-basedpayments to employees and directors recognisedin the income statement 2 439 36 349GROUPCOMPANY<strong>2008</strong> 2007 <strong>2008</strong> 2007R’000 R’000 R’000 R’000<strong>Astral</strong> <strong>Foods</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>12. BORROWINGSNon-currentFinance lease liabilities – 14 – –Secured loans 19 523 8 694 – –Unsecured loans 4 839 – – –Total 24 362 8 708 – –Less: Portion payable within one year included incurrent liabilities (4 605) (2 480) – –19 757 6 228 – –CurrentBank overdrafts 322 265 256 935 20 749 6 160Portion of non-current borrowings payable withinone year 4 605 2 480 – –326 870 259 415 20 749 6 160Total borrowings 346 627 265 643 20 749 6 160The carrying amounts of the group's borrowingsare denominated in the following currencies:SA Rand 326 921 254 697 20 749 6 160US Dollar 15 632 7 674 – –Mauritius Rupees 4 074 3 272 – –346 627 265 643 20 749 6 160All borrowings rates are variable, ranging between15,5% and 7,1% during the year.The carrying amounts of both the long-term andshort-term borrowings approximate their fair value.Assets with the following book values are pledgedas security for secured loans (note 1):Property 24 245 10 485 – –Plant and equipment 24 051 211 – –Contractual maturity of payments of noncurrentborrowingsNot later than one year 5 914 3 109Between one and five years 16 312 9 417 – –Over five years 10 252 – – –32 478 12 526 – –Less: Finance charges (8 116) (3 818) – –24 362 8 708 – –Borrowing facilitiesThe group has the following general borrowingfacilities at floating interest rates 740 700 502 500 – –The borrowing facilities are reviewed on an annual basis.Borrowing powersNo limit has been placed in the articles of association on the borrowing powers of the company.66