Download PDF - Kinross Gold

Download PDF - Kinross Gold

Download PDF - Kinross Gold

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

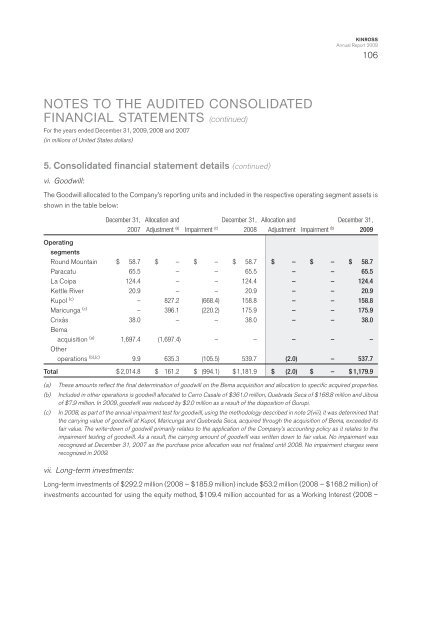

KINROSSAnnual Report 2009106NOTES TO THE AUDITED CONSOLIDATEDFINANCIAL STATEMENTS (continued)For the years ended December 31, 2009, 2008 and 2007(in millions of United States dollars)5. Consolidated financial statement details (continued)vi. Goodwill:The Goodwill allocated to the Company’s reporting units and included in the respective operating segment assets isshown in the table below:December 31, Allocation and December 31, Allocation and December 31,2007 Adjustment (a) Impairment (c) 2008 Adjustment Impairment (b) 2009OperatingsegmentsRound Mountain $ 58.7 $ – $ – $ 58.7 $ – $ – $ 58.7Paracatu 65.5 – – 65.5 – – 65.5La Coipa 124.4 – – 124.4 – – 124.4Kettle River 20.9 – – 20.9 – – 20.9Kupol (c) – 827.2 (668.4) 158.8 – – 158.8Maricunga (c) – 396.1 (220.2) 175.9 – – 175.9Crixás 38.0 – – 38.0 – – 38.0Bemaacquisition (a) 1,697.4 (1,697.4) – – – – –Otheroperations (b),(c) 9.9 635.3 (105.5) 539.7 (2.0) – 537.7Total $ 2,014.8 $ 161.2 $ (994.1) $ 1,181.9 $ (2.0) $ – $ 1,179.9(a)(b)(c)These amounts reflect the final determination of goodwill on the Bema acquisition and allocation to specific acquired properties.Included in other operations is goodwill allocated to Cerro Casale of $361.0 million, Quebrada Seca of $168.8 million and Jiboiaof $7.9 million. In 2009, goodwill was reduced by $2.0 million as a result of the disposition of Gurupi.In 2008, as part of the annual impairment test for goodwill, using the methodology described in note 2(viii), it was determined thatthe carrying value of goodwill at Kupol, Maricunga and Quebrada Seca, acquired through the acquisition of Bema, exceeded itsfair value. The write-down of goodwill primarily relates to the application of the Company’s accounting policy as it relates to theimpairment testing of goodwill. As a result, the carrying amount of goodwill was written down to fair value. No impairment wasrecognized at December 31, 2007 as the purchase price allocation was not finalized until 2008. No impairment charges wererecognized in 2009.vii. Long-term investments:Long-term investments of $292.2 million (2008 – $185.9 million) include $53.2 million (2008 – $168.2 million) ofinvestments accounted for using the equity method, $109.4 million accounted for as a Working Interest (2008 –