Download PDF - Kinross Gold

Download PDF - Kinross Gold

Download PDF - Kinross Gold

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

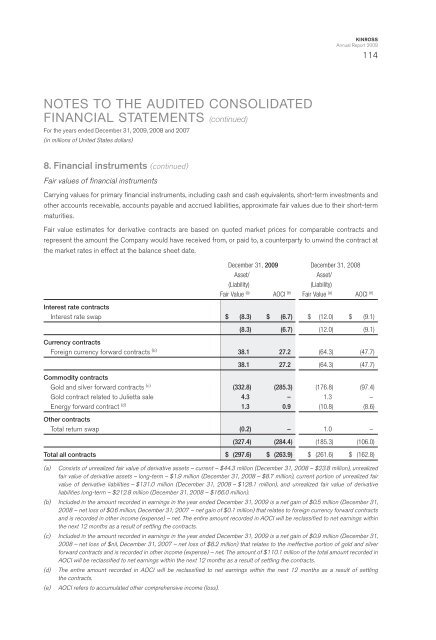

KINROSSAnnual Report 2009114NOTES TO THE AUDITED CONSOLIDATEDFINANCIAL STATEMENTS (continued)For the years ended December 31, 2009, 2008 and 2007(in millions of United States dollars)8. Financial instruments (continued)Fair values of financial instrumentsCarrying values for primary financial instruments, including cash and cash equivalents, short-term investments andother accounts receivable, accounts payable and accrued liabilities, approximate fair values due to their short-termmaturities.Fair value estimates for derivative contracts are based on quoted market prices for comparable contracts andrepresent the amount the Company would have received from, or paid to, a counterparty to unwind the contract atthe market rates in effect at the balance sheet date.December 31, 2009 December 31, 2008Asset/Asset/(Liability)(Liability)Fair Value (a) AOCI (e) Fair Value (a) AOCI (e)Interest rate contractsInterest rate swap $ (8.3) $ (6.7) $ (12.0) $ (9.1)(8.3) (6.7) (12.0) (9.1)Currency contractsForeign currency forward contracts (b) 38.1 27.2 (64.3) (47.7)38.1 27.2 (64.3) (47.7)Commodity contracts<strong>Gold</strong> and silver forward contracts (c) (332.8) (285.3) (176.8) (97.4)<strong>Gold</strong> contract related to Julietta sale 4.3 – 1.3 –Energy forward contract (d) 1.3 0.9 (10.8) (8.6)Other contractsTotal return swap (0.2) – 1.0 –(327.4) (284.4) (185.3) (106.0)Total all contracts $ (297.6) $ (263.9) $ (261.6) $ (162.8)(a) Consists of unrealized fair value of derivative assets – current – $44.3 million (December 31, 2008 – $23.8 million), unrealizedfair value of derivative assets – long-term – $1.9 million (December 31, 2008 – $8.7 million), current portion of unrealized fairvalue of derivative liabilities – $131.0 million (December 31, 2008 – $128.1 million), and unrealized fair value of derivativeliabilities long-term – $212.8 million (December 31, 2008 – $166.0 million).(b) Included in the amount recorded in earnings in the year ended December 31, 2009 is a net gain of $0.5 million (December 31,2008 – net loss of $0.6 million, December 31, 2007 – net gain of $0.1 million) that relates to foreign currency forward contractsand is recorded in other income (expense) – net. The entire amount recorded in AOCI will be reclassified to net earnings withinthe next 12 months as a result of settling the contracts.(c) Included in the amount recorded in earnings in the year ended December 31, 2009 is a net gain of $0.9 million (December 31,2008 – net loss of $nil, December 31, 2007 – net loss of $8.2 million) that relates to the ineffective portion of gold and silverforward contracts and is recorded in other income (expense) – net. The amount of $110.1 million of the total amount recorded inAOCI will be reclassified to net earnings within the next 12 months as a result of settling the contracts.(d) The entire amount recorded in AOCI will be reclassified to net earnings within the next 12 months as a result of settlingthe contracts.(e) AOCI refers to accumulated other comprehensive income (loss).