Equity Income Fund Annual Report - Putnam Investments

Equity Income Fund Annual Report - Putnam Investments

Equity Income Fund Annual Report - Putnam Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

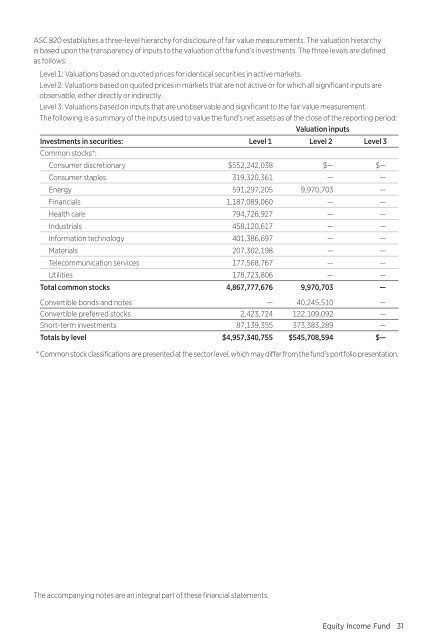

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchyis based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are definedas follows:Level 1: Valuations based on quoted prices for identical securities in active markets.Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs areobservable, either directly or indirectly.Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:Valuation inputs<strong>Investments</strong> in securities: Level 1 Level 2 Level 3Common stocks*:Consumer discretionary $552,242,038 $— $—Consumer staples 319,320,361 — —Energy 591,297,205 9,970,703 —Financials 1,187,089,060 — —Health care 794,726,927 — —Industrials 458,120,617 — —Information technology 401,386,697 — —Materials 207,302,198 — —Telecommunication services 177,568,767 — —Utilities 178,723,806 — —Total common stocks 4,867,777,676 9,970,703 —Convertible bonds and notes — 40,245,510 —Convertible preferred stocks 2,423,724 122,109,092 —Short-term investments 87,139,355 373,383,289 —Totals by level $4,957,340,755 $545,708,594 $—* Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.The accompanying notes are an integral part of these financial statements.<strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong> 31