Equity Income Fund Annual Report - Putnam Investments

Equity Income Fund Annual Report - Putnam Investments

Equity Income Fund Annual Report - Putnam Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

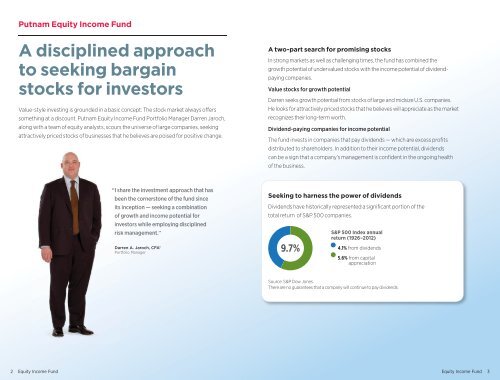

<strong>Putnam</strong> <strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong>A disciplined approachto seeking bargainstocks for investorsValue-style investing is grounded in a basic concept: The stock market always offerssomething at a discount. <strong>Putnam</strong> <strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong> Portfolio Manager Darren Jaroch,along with a team of equity analysts, scours the universe of large com panies, seekingattractively priced stocks of businesses that he believes are poised for positive change.A two-part search for promising stocksIn strong markets as well as challenging times, the fund has combined thegrowth potential of undervalued stocks with the income potential of dividendpayingcompanies.Value stocks for growth potentialDarren seeks growth potential from stocks of large and midsize U.S. companies.He looks for attractively priced stocks that he believes will appreciate as the marketrecognizes their long-term worth.Dividend-paying companies for income potentialThe fund invests in companies that pay dividends — which are excess profitsdistributed to shareholders. In addition to their income potential, dividendscan be a sign that a company’s management is confident in the ongoing healthof the business.“ I share the investment approach that hasbeen the cornerstone of the fund sinceitsinception — seeking a combinationof growth and income potential forinvestors while employing disciplinedrisk management.”Darren A. Jaroch, CFA®Portfolio ManagerSeeking to harness the power of dividendsDividends have historically represented a significant portion of thetotal return of S&P 500 companies.9.7%S&P 500 Index annualreturn (1926–2012)4.1% from dividends5.6% from capitalappreciationSource: S&P Dow Jones.There are no guarantees that a company will continue to pay dividends.2 <strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong><strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong> 3