Equity Income Fund Annual Report - Putnam Investments

Equity Income Fund Annual Report - Putnam Investments

Equity Income Fund Annual Report - Putnam Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

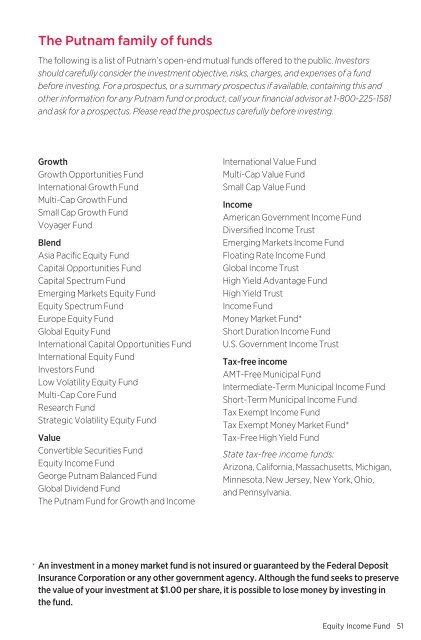

The <strong>Putnam</strong> family of fundsThe following is a list of <strong>Putnam</strong>’s open-end mutual funds offered to the public. Investorsshould carefully consider the investment objective, risks, charges, and expenses of a fundbefore investing. For a prospectus, or a summary prospectus if available, containing this andother information for any <strong>Putnam</strong> fund or product, call your financial advisor at 1-800-225-1581and ask for a prospectus. Please read the prospectus carefully before investing.GrowthGrowth Opportunities <strong>Fund</strong>International Growth <strong>Fund</strong>Multi-Cap Growth <strong>Fund</strong>Small Cap Growth <strong>Fund</strong>Voyager <strong>Fund</strong>BlendAsia Pacific <strong>Equity</strong> <strong>Fund</strong>Capital Opportunities <strong>Fund</strong>Capital Spectrum <strong>Fund</strong>Emerging Markets <strong>Equity</strong> <strong>Fund</strong><strong>Equity</strong> Spectrum <strong>Fund</strong>Europe <strong>Equity</strong> <strong>Fund</strong>Global <strong>Equity</strong> <strong>Fund</strong>International Capital Opportunities <strong>Fund</strong>International <strong>Equity</strong> <strong>Fund</strong>Investors <strong>Fund</strong>Low Volatility <strong>Equity</strong> <strong>Fund</strong>Multi-Cap Core <strong>Fund</strong>Research <strong>Fund</strong>Strategic Volatility <strong>Equity</strong> <strong>Fund</strong>ValueConvertible Securities <strong>Fund</strong><strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong>George <strong>Putnam</strong> Balanced <strong>Fund</strong>Global Dividend <strong>Fund</strong>The <strong>Putnam</strong> <strong>Fund</strong> for Growth and <strong>Income</strong>International Value <strong>Fund</strong>Multi-Cap Value <strong>Fund</strong>Small Cap Value <strong>Fund</strong><strong>Income</strong>American Government <strong>Income</strong> <strong>Fund</strong>Diversified <strong>Income</strong> TrustEmerging Markets <strong>Income</strong> <strong>Fund</strong>Floating Rate <strong>Income</strong> <strong>Fund</strong>Global <strong>Income</strong> TrustHigh Yield Advantage <strong>Fund</strong>High Yield Trust<strong>Income</strong> <strong>Fund</strong>Money Market <strong>Fund</strong>*Short Duration <strong>Income</strong> <strong>Fund</strong>U.S. Government <strong>Income</strong> TrustTax-free incomeAMT-Free Municipal <strong>Fund</strong>Intermediate-Term Municipal <strong>Income</strong> <strong>Fund</strong>Short-Term Municipal <strong>Income</strong> <strong>Fund</strong>Tax Exempt <strong>Income</strong> <strong>Fund</strong>Tax Exempt Money Market <strong>Fund</strong>*Tax-Free High Yield <strong>Fund</strong>State tax-free income funds:Arizona, California, Massachusetts, Michigan,Minnesota, New Jersey, New York, Ohio,and Pennsylvania.* An investment in a money market fund is not insured or guaranteed by the Federal DepositInsurance Corporation or any other government agency. Although the fund seeks to preservethe value of your investment at $1.00 per share, it is possible to lose money by investing inthe fund.<strong>Equity</strong> <strong>Income</strong> <strong>Fund</strong> 51