5 Monopoly and Regulation - Luiscabral.net

5 Monopoly and Regulation - Luiscabral.net

5 Monopoly and Regulation - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

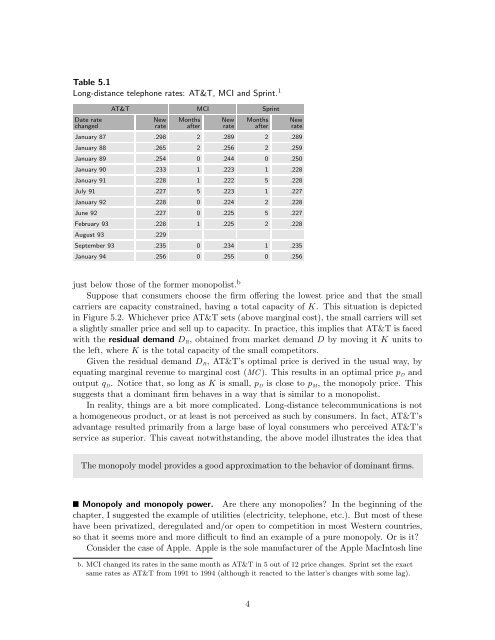

Table 5.1Long-distance telephone rates: AT&T, MCI <strong>and</strong> Sprint. 1Date ratechangedAT&T MCI SprintNewrateMonthsafterNewrateMonthsafterNewrateJanuary 87 .298 2 .289 2 .289January 88 .265 2 .256 2 .259January 89 .254 0 .244 0 .250January 90 .233 1 .223 1 .228January 91 .228 1 .222 5 .228July 91 .227 5 .223 1 .227January 92 .228 0 .224 2 .228June 92 .227 0 .225 5 .227February 93 .228 1 .225 2 .228August 93 .229September 93 .235 0 .234 1 .235January 94 .256 0 .255 0 .256just below those of the former monopolist. bSuppose that consumers choose the firm offering the lowest price <strong>and</strong> that the smallcarriers are capacity constrained, having a total capacity of K. This situation is depictedin Figure 5.2. Whichever price AT&T sets (above marginal cost), the small carriers will seta slightly smaller price <strong>and</strong> sell up to capacity. In practice, this implies that AT&T is facedwith the residual dem<strong>and</strong> D R , obtained from market dem<strong>and</strong> D by moving it K units tothe left, where K is the total capacity of the small competitors.Given the residual dem<strong>and</strong> D R , AT&T’s optimal price is derived in the usual way, byequating marginal revenue to marginal cost (MC ). This results in an optimal price p D <strong>and</strong>output q D . Notice that, so long as K is small, p D is close to p M , the monopoly price. Thissuggests that a dominant firm behaves in a way that is similar to a monopolist.In reality, things are a bit more complicated. Long-distance telecommunications is nota homogeneous product, or at least is not perceived as such by consumers. In fact, AT&T’sadvantage resulted primarily from a large base of loyal consumers who perceived AT&T’sservice as superior. This caveat notwithst<strong>and</strong>ing, the above model illustrates the idea thatThe monopoly model provides a good approximation to the behavior of dominant firms.<strong>Monopoly</strong> <strong>and</strong> monopoly power. Are there any monopolies? In the beginning of thechapter, I suggested the example of utilities (electricity, telephone, etc.). But most of thesehave been privatized, deregulated <strong>and</strong>/or open to competition in most Western countries,so that it seems more <strong>and</strong> more difficult to find an example of a pure monopoly. Or is it?Consider the case of Apple. Apple is the sole manufacturer of the Apple MacIntosh lineb. MCI changed its rates in the same month as AT&T in 5 out of 12 price changes. Sprint set the exactsame rates as AT&T from 1991 to 1994 (although it reacted to the latter’s changes with some lag).4