5 Monopoly and Regulation - Luiscabral.net

5 Monopoly and Regulation - Luiscabral.net

5 Monopoly and Regulation - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

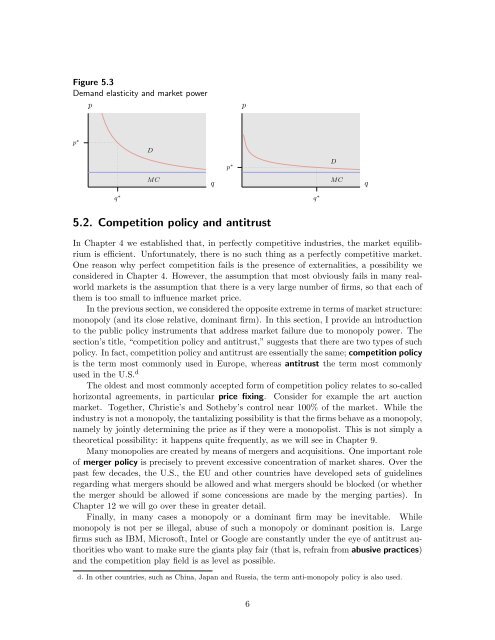

Figure 5.3Dem<strong>and</strong> elasticity <strong>and</strong> market powerppp ∗Dp ∗D... ... .... ... ... .... ... ... ... ................. ... .... ... ... ... ... ... ... ... ... .... ... .... ... ... ... ... ... ... .... ... .... . .......MCqMCqq ∗q ∗5.2. Competition policy <strong>and</strong> antitrustIn Chapter 4 we established that, in perfectly competitive industries, the market equilibriumis efficient. Unfortunately, there is no such thing as a perfectly competitive market.One reason why perfect competition fails is the presence of externalities, a possibility weconsidered in Chapter 4. However, the assumption that most obviously fails in many realworldmarkets is the assumption that there is a very large number of firms, so that each ofthem is too small to influence market price.In the previous section, we considered the opposite extreme in terms of market structure:monopoly (<strong>and</strong> its close relative, dominant firm). In this section, I provide an introductionto the public policy instruments that address market failure due to monopoly power. Thesection’s title, “competition policy <strong>and</strong> antitrust,” suggests that there are two types of suchpolicy. In fact, competition policy <strong>and</strong> antitrust are essentially the same; competition policyis the term most commonly used in Europe, whereas antitrust the term most commonlyused in the U.S. dThe oldest <strong>and</strong> most commonly accepted form of competition policy relates to so-calledhorizontal agreements, in particular price fixing. Consider for example the art auctionmarket. Together, Christie’s <strong>and</strong> Sotheby’s control near 100% of the market. While theindustry is not a monopoly, the tantalizing possibility is that the firms behave as a monopoly,namely by jointly determining the price as if they were a monopolist. This is not simply atheoretical possibility: it happens quite frequently, as we will see in Chapter 9.Many monopolies are created by means of mergers <strong>and</strong> acquisitions. One important roleof merger policy is precisely to prevent excessive concentration of market shares. Over thepast few decades, the U.S., the EU <strong>and</strong> other countries have developed sets of guidelinesregarding what mergers should be allowed <strong>and</strong> what mergers should be blocked (or whetherthe merger should be allowed if some concessions are made by the merging parties). InChapter 12 we will go over these in greater detail.Finally, in many cases a monopoly or a dominant firm may be inevitable. Whilemonopoly is not per se illegal, abuse of such a monopoly or dominant position is. Largefirms such as IBM, Microsoft, Intel or Google are constantly under the eye of antitrust authoritieswho want to make sure the giants play fair (that is, refrain from abusive practices)<strong>and</strong> the competition play field is as level as possible.d. In other countries, such as China, Japan <strong>and</strong> Russia, the term anti-monopoly policy is also used.6