Online Form System - Chhattisgarh Commercial Tax

Online Form System - Chhattisgarh Commercial Tax

Online Form System - Chhattisgarh Commercial Tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

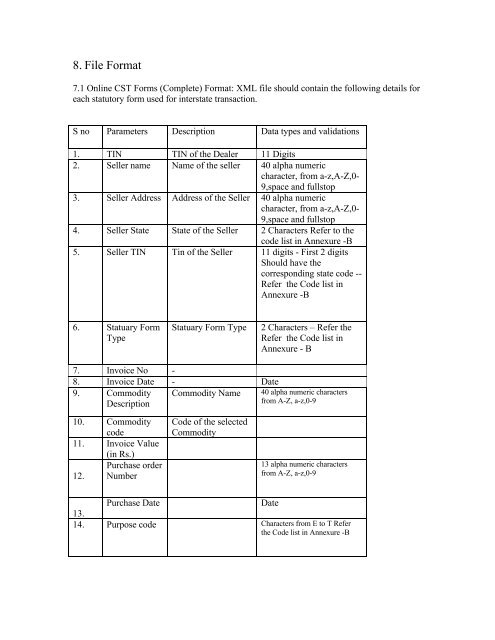

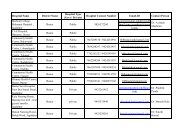

8. File <strong>Form</strong>at7.1 <strong>Online</strong> CST <strong>Form</strong>s (Complete) <strong>Form</strong>at: XML file should contain the following details foreach statutory form used for interstate transaction.S no Parameters Description Data types and validations1. TIN TIN of the Dealer 11 Digits2. Seller name Name of the seller 40 alpha numericcharacter, from a-z,A-Z,0-9,space and fullstop3. Seller Address Address of the Seller 40 alpha numericcharacter, from a-z,A-Z,0-9,space and fullstop4. Seller State State of the Seller 2 Characters Refer to thecode list in Annexure -B5. Seller TIN Tin of the Seller 11 digits - First 2 digitsShould have thecorresponding state code --Refer the Code list inAnnexure -B6. Statuary <strong>Form</strong>TypeStatuary <strong>Form</strong> Type2 Characters – Refer theRefer the Code list inAnnexure - B7. Invoice No -8. Invoice Date - Date9. Commodity Commodity Name 40 alpha numeric charactersDescriptionfrom A-Z, a-z,0-910. Commoditycode11. Invoice Value(in Rs.)Purchase order12. NumberCode of the selectedCommodity13 alpha numeric charactersfrom A-Z, a-z,0-9Purchase DateDate13.14. Purpose code Characters from E to T Referthe Code list in Annexure -B