FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

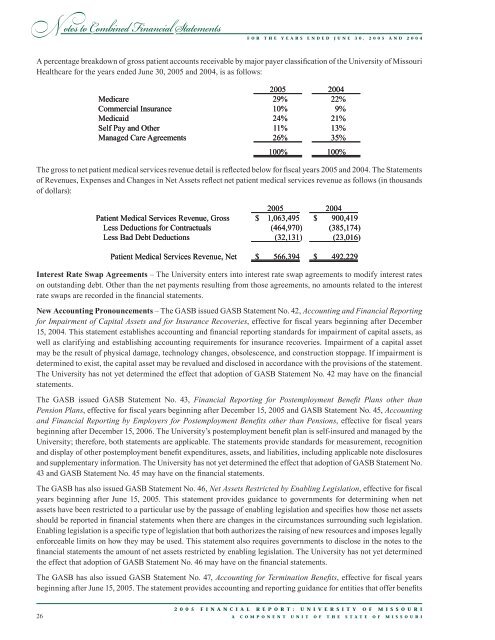

N otes to Combined Financial StatementsF o r t h e y e a r s e n d e d J u n e 3 0 , 2 0 0 5 a n d 2 0 0 4A percentage breakdown <strong>of</strong> gross patient accounts receivable by major payer classification <strong>of</strong> the <strong>University</strong> <strong>of</strong> <strong>Missouri</strong>Healthcare for the years ended June 30, <strong>2005</strong> and 2004, is as follows:<strong>2005</strong> 2004Medicare 29% 22%Commercial Insurance 10% 9%Medicaid 24% 21%Self Pay and Other 11% 13%Managed Care Agreements 26% 35%100% 100%The gross to net patient medical services revenue detail is reflected below for fiscal years <strong>2005</strong> and 2004. The Statements<strong>of</strong> Revenues, Expenses and Changes in Net Assets reflect net patient medical services revenue as follows (in thousands<strong>of</strong> dollars):<strong>2005</strong> 2004Patient Medical Services Revenue, Gross $ 1,063,495 $ 900,419Less Deductions for Contractuals (464,970) (385,174)Less Bad Debt Deductions (32,131) (23,016)Patient Medical Services Revenue, Net $ 566,394 $ 492,229Interest Rate Swap Agreements – The <strong>University</strong> enters into interest rate swap agreements to modify interest rateson outstanding debt. Other than the net payments resulting from those agreements, no amounts related to the interestrate swaps are recorded in the financial statements.New Accounting Pronouncements – The GASB issued GASB Statement No. 42, Accounting and Financial Reportingfor Impairment <strong>of</strong> Capital Assets and for Insurance Recoveries, effective for fiscal years beginning after December15, 2004. This statement establishes accounting and financial reporting standards for impairment <strong>of</strong> capital assets, aswell as clarifying and establishing accounting requirements for insurance recoveries. Impairment <strong>of</strong> a capital assetmay be the result <strong>of</strong> physical damage, technology changes, obsolescence, and construction stoppage. If impairment isdetermined to exist, the capital asset may be revalued and disclosed in accordance with the provisions <strong>of</strong> the statement.The <strong>University</strong> has not yet determined the effect that adoption <strong>of</strong> GASB Statement No. 42 may have on the financialstatements.The GASB issued GASB Statement No. 43, Financial Reporting for Postemployment Benefit Plans other thanPension Plans, effective for fiscal years beginning after December 15, <strong>2005</strong> and GASB Statement No. 45, Accountingand Financial Reporting by Employers for Postemployment Benefits other than Pensions, effective for fiscal yearsbeginning after December 15, 2006. The <strong>University</strong>’s postemployment benefit plan is self-insured and managed by the<strong>University</strong>; therefore, both statements are applicable. The statements provide standards for measurement, recognitionand display <strong>of</strong> other postemployment benefit expenditures, assets, and liabilities, including applicable note disclosuresand supplementary information. The <strong>University</strong> has not yet determined the effect that adoption <strong>of</strong> GASB Statement No.43 and GASB Statement No. 45 may have on the financial statements.The GASB has also issued GASB Statement No. 46, Net Assets Restricted by Enabling Legislation, effective for fiscalyears beginning after June 15, <strong>2005</strong>. This statement provides guidance to governments for determining when netassets have been restricted to a particular use by the passage <strong>of</strong> enabling legislation and specifies how those net assetsshould be reported in financial statements when there are changes in the circumstances surrounding such legislation.Enabling legislation is a specific type <strong>of</strong> legislation that both authorizes the raising <strong>of</strong> new resources and imposes legallyenforceable limits on how they may be used. This statement also requires governments to disclose in the notes to thefinancial statements the amount <strong>of</strong> net assets restricted by enabling legislation. The <strong>University</strong> has not yet determinedthe effect that adoption <strong>of</strong> GASB Statement No. 46 may have on the financial statements.The GASB has also issued GASB Statement No. 47, Accounting for Termination Benefits, effective for fiscal yearsbeginning after June 15, <strong>2005</strong>. The statement provides accounting and reporting guidance for entities that <strong>of</strong>fer benefits262 0 0 5 F i n a n c i a l R e p o r t : U n i v e r s i t y o f M i s s o u r ia c o m p o n e n t u n i t o f t h e S t a t e o f M i s s o u r i