FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

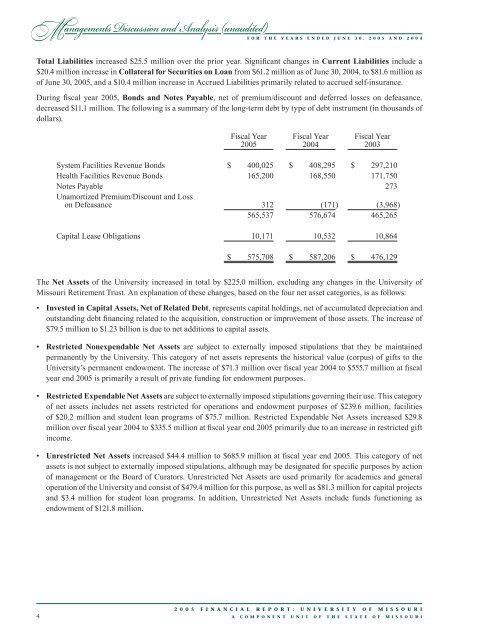

Management’s Discussion and Analysis (unaudited)F o r t h e y e a r s e n d e d J u n e 3 0 , 2 0 0 5 a n d 2 0 0 4Total Liabilities increased $25.5 million over the prior year. Significant changes in Current Liabilities include a$20.4 million increase in Collateral for Securities on Loan from $61.2 million as <strong>of</strong> June 30, 2004, to $81.6 million as<strong>of</strong> June 30, <strong>2005</strong>, and a $10.4 million increase in Accrued Liabilities primarily related to accrued self-insurance.During fiscal year <strong>2005</strong>, Bonds and Notes Payable, net <strong>of</strong> premium/discount and deferred losses on defeasance,decreased $11.1 million. The following is a summary <strong>of</strong> the long-term debt by type <strong>of</strong> debt instrument (in thousands <strong>of</strong>dollars).Fiscal Year<strong>2005</strong>Fiscal Year2004Fiscal Year2003<strong>System</strong> Facilities Revenue Bonds $ 400,025 $ 408,295 $ 297,210Health Facilities Revenue Bonds 165,200 168,550 171,750Notes Payable 273Unamortized Premium/Discount and Losson Defeasance 312 (171) (3,968)565,537 576,674 465,265Capital Lease Obligations 10,171 10,532 10,864$ 575,708 $ 587,206 $ 476,129The Net Assets <strong>of</strong> the <strong>University</strong> increased in total by $225.0 million, excluding any changes in the <strong>University</strong> <strong>of</strong><strong>Missouri</strong> Retirement Trust. An explanation <strong>of</strong> these changes, based on the four net asset categories, is as follows:• Invested in Capital Assets, Net <strong>of</strong> Related Debt, represents capital holdings, net <strong>of</strong> accumulated depreciation andoutstanding debt financing related to the acquisition, construction or improvement <strong>of</strong> those assets. The increase <strong>of</strong>$79.5 million to $1.23 billion is due to net additions to capital assets.• Restricted Nonexpendable Net Assets are subject to externally imposed stipulations that they be maintainedpermanently by the <strong>University</strong>. This category <strong>of</strong> net assets represents the historical value (corpus) <strong>of</strong> gifts to the<strong>University</strong>’s permanent endowment. The increase <strong>of</strong> $71.3 million over fiscal year 2004 to $555.7 million at fiscalyear end <strong>2005</strong> is primarily a result <strong>of</strong> private funding for endowment purposes.• Restricted Expendable Net Assets are subject to externally imposed stipulations governing their use. This category<strong>of</strong> net assets includes net assets restricted for operations and endowment purposes <strong>of</strong> $239.6 million, facilities<strong>of</strong> $20.2 million and student loan programs <strong>of</strong> $75.7 million. Restricted Expendable Net Assets increased $29.8million over fiscal year 2004 to $335.5 million at fiscal year end <strong>2005</strong> primarily due to an increase in restricted giftincome.• Unrestricted Net Assets increased $44.4 million to $685.9 million at fiscal year end <strong>2005</strong>. This category <strong>of</strong> netassets is not subject to externally imposed stipulations, although may be designated for specific purposes by action<strong>of</strong> management or the Board <strong>of</strong> Curators. Unrestricted Net Assets are used primarily for academics and generaloperation <strong>of</strong> the <strong>University</strong> and consist <strong>of</strong> $479.4 million for this purpose, as well as $81.3 million for capital projectsand $3.4 million for student loan programs. In addition, Unrestricted Net Assets include funds functioning asendowment <strong>of</strong> $121.8 million.2 0 0 5 F i n a n c i a l R e p o r t : U n i v e r s i t y o f M i s s o u r ia c o m p o n e n t u n i t o f t h e S t a t e o f M i s s o u r i