FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

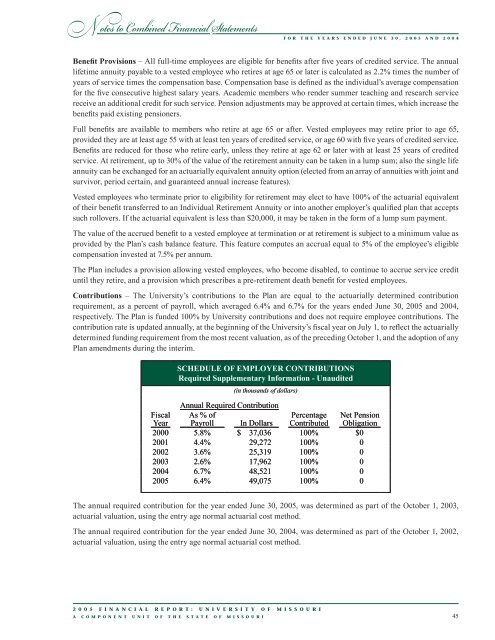

N otes to Combined Financial StatementsF o r t h e y e a r s e n d e d J u n e 3 0 , 2 0 0 5 a n d 2 0 0 4Benefit Provisions – All full-time employees are eligible for benefits after five years <strong>of</strong> credited service. The annuallifetime annuity payable to a vested employee who retires at age 65 or later is calculated as 2.2% times the number <strong>of</strong>years <strong>of</strong> service times the compensation base. Compensation base is defined as the individual’s average compensationfor the five consecutive highest salary years. Academic members who render summer teaching and research servicereceive an additional credit for such service. Pension adjustments may be approved at certain times, which increase thebenefits paid existing pensioners.Full benefits are available to members who retire at age 65 or after. Vested employees may retire prior to age 65,provided they are at least age 55 with at least ten years <strong>of</strong> credited service, or age 60 with five years <strong>of</strong> credited service.Benefits are reduced for those who retire early, unless they retire at age 62 or later with at least 25 years <strong>of</strong> creditedservice. At retirement, up to 30% <strong>of</strong> the value <strong>of</strong> the retirement annuity can be taken in a lump sum; also the single lifeannuity can be exchanged for an actuarially equivalent annuity option (elected from an array <strong>of</strong> annuities with joint andsurvivor, period certain, and guaranteed annual increase features).Vested employees who terminate prior to eligibility for retirement may elect to have 100% <strong>of</strong> the actuarial equivalent<strong>of</strong> their benefit transferred to an Individual Retirement Annuity or into another employer’s qualified plan that acceptssuch rollovers. If the actuarial equivalent is less than $20,000, it may be taken in the form <strong>of</strong> a lump sum payment.The value <strong>of</strong> the accrued benefit to a vested employee at termination or at retirement is subject to a minimum value asprovided by the Plan’s cash balance feature. This feature computes an accrual equal to 5% <strong>of</strong> the employee’s eligiblecompensation invested at 7.5% per annum.The Plan includes a provision allowing vested employees, who become disabled, to continue to accrue service credituntil they retire, and a provision which prescribes a pre-retirement death benefit for vested employees.Contributions – The <strong>University</strong>’s contributions to the Plan are equal to the actuarially determined contributionrequirement, as a percent <strong>of</strong> payroll, which averaged 6.4% and 6.7% for the years ended June 30, <strong>2005</strong> and 2004,respectively. The Plan is funded 100% by <strong>University</strong> contributions and does not require employee contributions. Thecontribution rate is updated annually, at the beginning <strong>of</strong> the <strong>University</strong>’s fiscal year on July 1, to reflect the actuariallydetermined funding requirement from the most recent valuation, as <strong>of</strong> the preceding October 1, and the adoption <strong>of</strong> anyPlan amendments during the interim.SCHEDULE OF EMPLOYER CONTRIBUTIONSRequired Supplementary Information - Unaudited(in thousands <strong>of</strong> dollars)Annual Required ContributionFiscalAs % <strong>of</strong>PercentageNet PensionYearPayrollIn DollarsContributedObligation2000 5.8% $ 37,036 100% $02001 4.4% 29,272 100% 02002 3.6% 25,319 100% 02003 2.6% 17,962 100% 02004 6.7% 48,521 100% 0<strong>2005</strong> 6.4% 49,075 100% 0The annual required contribution for the year ended June 30, <strong>2005</strong>, was determined as part <strong>of</strong> the October 1, 2003,actuarial valuation, using the entry age normal actuarial cost method.The annual required contribution for the year ended June 30, 2004, was determined as part <strong>of</strong> the October 1, 2002,actuarial valuation, using the entry age normal actuarial cost method.2 0 0 5 F i n a n c i a l R e p o r t : U n i v e r s i t y o f M i s s o u r ia c o m p o n e n t u n i t o f t h e S t a t e o f M i s s o u r i 45