FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

FY 2005 - University of Missouri System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

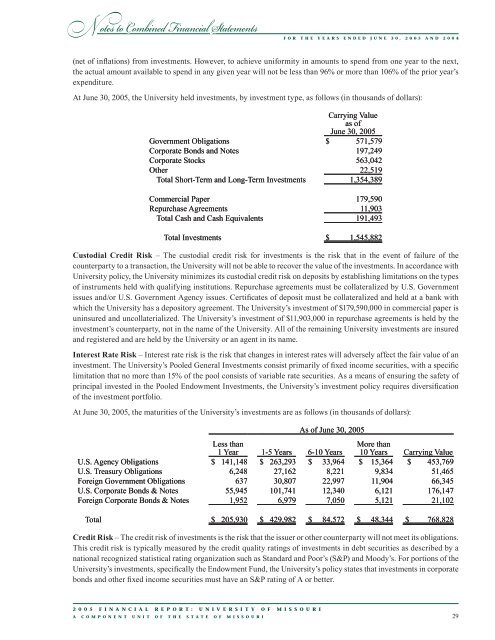

N otes to Combined Financial StatementsF o r t h e y e a r s e n d e d J u n e 3 0 , 2 0 0 5 a n d 2 0 0 4(net <strong>of</strong> inflations) from investments. However, to achieve uniformity in amounts to spend from one year to the next,the actual amount available to spend in any given year will not be less than 96% or more than 106% <strong>of</strong> the prior year’sexpenditure.At June 30, <strong>2005</strong>, the <strong>University</strong> held investments, by investment type, as follows (in thousands <strong>of</strong> dollars):Carrying Valueas <strong>of</strong>June 30, <strong>2005</strong>Government Obligations $ 571,579Corporate Bonds and Notes 197,249Corporate Stocks 563,042Other 22,519Total Short-Term and Long-Term Investments 1,354,389Commercial Paper 179,590Repurchase Agreements 11,903Total Cash and Cash Equivalents 191,493Total Investments $ 1,545,882Custodial Credit Risk – The custodial credit risk for investments is the risk that in the event <strong>of</strong> failure <strong>of</strong> thecounterparty to a transaction, the <strong>University</strong> will not be able to recover the value <strong>of</strong> the investments. In accordance with<strong>University</strong> policy, the <strong>University</strong> minimizes its custodial credit risk on deposits by establishing limitations on the types<strong>of</strong> instruments held with qualifying institutions. Repurchase agreements must be collateralized by U.S. Governmentissues and/or U.S. Government Agency issues. Certificates <strong>of</strong> deposit must be collateralized and held at a bank withwhich the <strong>University</strong> has a depository agreement. The <strong>University</strong>’s investment <strong>of</strong> $179,590,000 in commercial paper isuninsured and uncollaterialized. The <strong>University</strong>’s investment <strong>of</strong> $11,903,000 in repurchase agreements is held by theinvestment’s counterparty, not in the name <strong>of</strong> the <strong>University</strong>. All <strong>of</strong> the remaining <strong>University</strong> investments are insuredand registered and are held by the <strong>University</strong> or an agent in its name.Interest Rate Risk – Interest rate risk is the risk that changes in interest rates will adversely affect the fair value <strong>of</strong> aninvestment. The <strong>University</strong>’s Pooled General Investments consist primarily <strong>of</strong> fixed income securities, with a specificlimitation that no more than 15% <strong>of</strong> the pool consists <strong>of</strong> variable rate securities. As a means <strong>of</strong> ensuring the safety <strong>of</strong>principal invested in the Pooled Endowment Investments, the <strong>University</strong>’s investment policy requires diversification<strong>of</strong> the investment portfolio.At June 30, <strong>2005</strong>, the maturities <strong>of</strong> the <strong>University</strong>’s investments are as follows (in thousands <strong>of</strong> dollars):As <strong>of</strong> June 30, <strong>2005</strong>Less than1 Year 1-5 Years 6-10 YearsMore than10 Years Carrying ValueU.S. Agency Obligations $ 141,148 $ 263,293 $ 33,964 $ 15,364 $ 453,769U.S. Treasury Obligations 6,248 27,162 8,221 9,834 51,465Foreign Government Obligations 637 30,807 22,997 11,904 66,345U.S. Corporate Bonds & Notes 55,945 101,741 12,340 6,121 176,147Foreign Corporate Bonds & Notes 1,952 6,979 7,050 5,121 21,102Total $ 205,930 $ 429,982 $ 84,572 $ 48,344 $ 768,828Credit Risk – The credit risk <strong>of</strong> investments is the risk that the issuer or other counterparty will not meet its obligations.This credit risk is typically measured by the credit quality ratings <strong>of</strong> investments in debt securities as described by anational recognized statistical rating organization such as Standard and Poor’s (S&P) and Moody’s. For portions <strong>of</strong> the<strong>University</strong>’s investments, specifically the Endowment Fund, the <strong>University</strong>’s policy states that investments in corporatebonds and other fixed income securities must have an S&P rating <strong>of</strong> A or better.2 0 0 5 F i n a n c i a l R e p o r t : U n i v e r s i t y o f M i s s o u r ia c o m p o n e n t u n i t o f t h e S t a t e o f M i s s o u r i 29