Annual Report 1999 - Fiskarsgroup.com

Annual Report 1999 - Fiskarsgroup.com

Annual Report 1999 - Fiskarsgroup.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

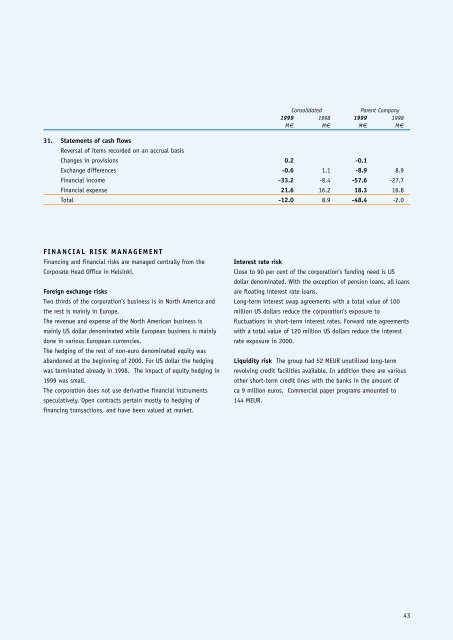

ConsolidatedParent Company<strong>1999</strong> 1998 <strong>1999</strong> 1998M€ M€ M€ M€31. Statements of cash flowsReversal of items recorded on an accrual basisChanges in provisions 0.2 -0.1Exchange differences -0.6 1.1 -8.9 8.9Financial in<strong>com</strong>e -33.2 -8.4 -57.6 -27.7Financial expense 21.6 16.2 18.3 16.8Total -12.0 8.9 -48.4 -2.0FINANCIAL RISK MANAGEMENTFinancing and financial risks are managed centrally from theCorporate Head Office in Helsinki.Foreign exchange risksTwo thirds of the corporation’s business is in North America andthe rest is mainly in Europe.The revenue and expense of the North American business ismainly US dollar denominated while European business is mainlydone in various European currencies.The hedging of the rest of non-euro denominated equity wasabandoned at the beginning of 2000. For US dollar the hedgingwas terminated already in 1998. The impact of equity hedging in<strong>1999</strong> was small.The corporation does not use derivative financial instrumentsspeculatively. Open contracts pertain mostly to hedging offinancing transactions, and have been valued at market.Interest rate riskClose to 90 per cent of the corporation’s funding need is USdollar denominated. With the exception of pension loans, all loansare floating interest rate loans.Long-term interest swap agreements with a total value of 100million US dollars reduce the corporation’s exposure tofluctuations in short-term interest rates. Forward rate agreementswith a total value of 120 million US dollars reduce the interestrate exposure in 2000.Liquidity risk The group had 52 MEUR unutilized long-termrevolving credit facilities available. In addition there are variousother short-term credit lines with the banks in the amount ofca 9 million euros. Commercial paper programs amounted to144 MEUR.43