Annual Report 2006 - JAL | JAPAN AIRLINES

Annual Report 2006 - JAL | JAPAN AIRLINES

Annual Report 2006 - JAL | JAPAN AIRLINES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

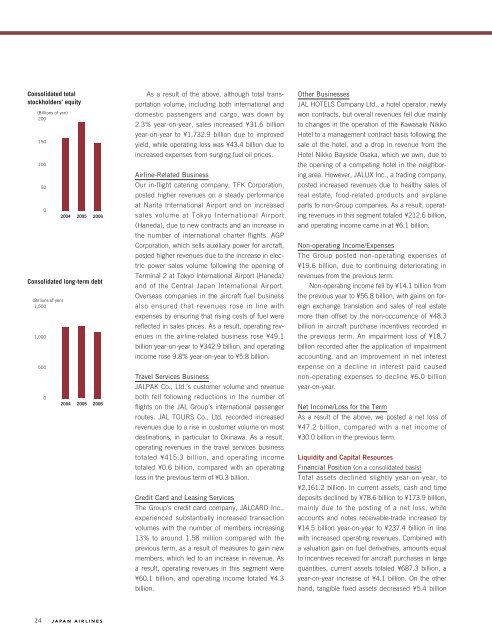

Consolidated totalstockholders’ equity(Billions of yen)2001501005002004 2005 <strong>2006</strong>Consolidated long-term debt(Billions of yen)1,5001,00050002004 2005 <strong>2006</strong>As a result of the above, although total transportationvolume, including both international anddomestic passengers and cargo, was down by2.3% year-on-year, sales increased ¥31.6 billionyear-on-year to ¥1,732.9 billion due to improvedyield, while operating loss was ¥43.4 billion due toincreased expenses from surging fuel oil prices.Airline-Related BusinessOur in-flight catering company, TFK Corporation,posted higher revenues on a steady performanceat Narita International Airport and on increasedsales volume at Tokyo International Airport(Haneda), due to new contracts and an increase inthe number of international charter flights. AGPCorporation, which sells auxiliary power for aircraft,posted higher revenues due to the increase in electricpower sales volume following the opening ofTerminal 2 at Tokyo International Airport (Haneda)and of the Central Japan International Airport.Overseas companies in the aircraft fuel businessalso ensured that revenues rose in line withexpenses by ensuring that rising costs of fuel werereflected in sales prices. As a result, operating revenuesin the airline-related business rose ¥49.1billion year-on-year to ¥342.9 billion, and operatingincome rose 9.8% year-on-year to ¥5.8 billion.Travel Services Business<strong>JAL</strong>PAK Co., Ltd.’s customer volume and revenueboth fell following reductions in the number offlights on the <strong>JAL</strong> Group’s international passengerroutes. <strong>JAL</strong> TOURS Co., Ltd. recorded increasedrevenues due to a rise in customer volume on mostdestinations, in particular to Okinawa. As a result,operating revenues in the travel services businesstotaled ¥415.3 billion, and operating incometotaled ¥0.6 billion, compared with an operatingloss in the previous term of ¥0.3 billion.Credit Card and Leasing ServicesThe Group’s credit card company, <strong>JAL</strong>CARD Inc.,experienced substantially increased transactionvolumes with the number of members increasing13% to around 1.58 million compared with theprevious term, as a result of measures to gain newmembers, which led to an increase in revenue. Asa result, operating revenues in this segment were¥60.1 billion, and operating income totaled ¥4.3billion.Other Businesses<strong>JAL</strong> HOTELS Company Ltd., a hotel operator, newlywon contracts, but overall revenues fell due mainlyto changes in the operation of the Kawasaki NikkoHotel to a management contract basis following thesale of the hotel, and a drop in revenue from theHotel Nikko Bayside Osaka, which we own, due tothe opening of a competing hotel in the neighboringarea. However, <strong>JAL</strong>UX Inc., a trading company,posted increased revenues due to healthy sales ofreal estate, food-related products and airplaneparts to non-Group companies. As a result, operatingrevenues in this segment totaled ¥212.6 billion,and operating income came in at ¥6.1 billion.Non-operating Income/ExpensesThe Group posted non-operating expenses of¥19.6 billion, due to continuing deteriorating inrevenues from the previous term.Non-operating income fell by ¥14.1 billion fromthe previous year to ¥56.8 billion, with gains on foreignexchange translation and sales of real estatemore than offset by the non-occurrence of ¥48.3billion in aircraft purchase incentives recorded inthe previous term. An impairment loss of ¥18.7billion recorded after the application of impairmentaccounting, and an improvement in net interestexpense on a decline in interest paid causednon-operating expenses to decline ¥6.0 billionyear-on-year.Net Income/Loss for the TermAs a result of the above, we posted a net loss of¥47.2 billion, compared with a net income of¥30.0 billion in the previous term.Liquidity and Capital ResourcesFinancial Position (on a consolidated basis)Total assets declined slightly year-on-year, to¥2,161.2 billion. In current assets, cash and timedeposits declined by ¥78.6 billion to ¥173.9 billion,mainly due to the posting of a net loss, whileaccounts and notes receivable-trade increased by¥14.5 billion year-on-year to ¥237.4 billion in linewith increased operating revenues. Combined witha valuation gain on fuel derivatives, amounts equalto incentives received for aircraft purchases in largequantities, current assets totaled ¥687.3 billion, ayear-on-year increase of ¥4.1 billion. On the otherhand, tangible fixed assets decreased ¥5.4 billion24